State Department Official Warns President Xi Will Face “Serious Consequences” If China Helps Moscow Avoid Sanctions

While Russian forces continue to bombard Ukrainian population centers (while an attack on a nuclear power plant last night turned out to be far less destructive than initially reported), American bureaucrats are already looking past the invasion in Ukraine to focus on China and its continuing support for President Vladimir Putin.

To wit, the SCMP reported Friday that State Department counselor Derek Chollet warned that there will be serious consequences for Beijing if it helps Moscow in evading sanctions.

If China tries to help Russia evade sanctions in the wake of Moscow’s invasion of Ukraine, it will face countermeasures, a senior US State Department official said on Thursday, without providing details.

State Department counsellor Derek Chollet said the allied nations that have joined in sanctioning Russia represent a combined 50 per cent of the global economy; China accounts for around 15 per cent.

“China, if it were to seek to evade the sanctions, or somehow dividing the sanctions, they would be vulnerable,” he said. “Any country that tries to evade these sanctions will also face the consequences of its actions. I don’t want to speculate with that would be.”

Beijing has been pretty clear in its support for Russia, going so far as to denounce the western sanctions as “illegal”.

“China firmly opposes all illegal unilateral sanctions, and believes that sanctions are never fundamentally effective means to solve problems,” Liu Pengyu, spokesman in the Chinese embassy in Washington, said on Thursday.

Bloomberg, meanwhile, published a warning in the form of a report about the sanctions afflicting Russian President Vladimir Putin and his allies being a “cautionary tale” for President Xi. Of course, as BBG readily admits, all this purely speculation, as Beijing has – so far, at least – complied with US sanctions on Hong Kong leader Carrie Lam, and others.

While China has declined to slap financial penalties on Russia and will likely help it weather the sanctions storm by buying oil, gas and wheat, limits to the “no limits’’ friendship already appear to be emerging. Political leaders have talked of the need for a quick cease-fire and some big Chinese banks have restricted access to financing purchases of Russian commodities.

That pattern has been apparent in the past: China may disagree with the political goals of Western sanctions, but it has tended to avoid confronting them head on. Even Chinese state-run banks, for example, have complied with past U.S. curbs on Hong Kong. Carrie Lam, the territory’s Beijing-friendly chief executive, said in 2020 that she was collecting “piles of cash” at home because the U.S. measures barred her from basic banking services. “The Chinese banks are actually quite leery of running afoul of the U.S. Treasury,’’ says David Dollar, a senior fellow at Brookings and former Treasury representative in Beijing. “The big Chinese banks are among the largest in the world, they’re deeply integrated with the global system. So they’re going to be careful.’’

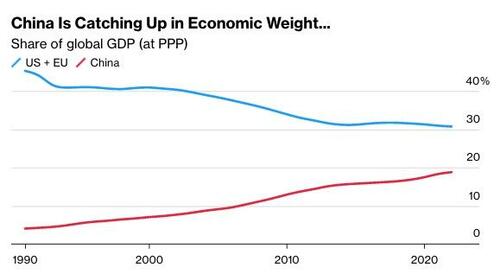

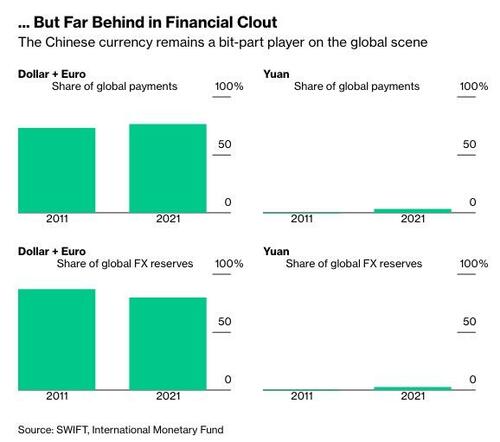

But the BBG report also notes that China’s economic clout has been growing…

…even if its currency, the yuan, remains a “bit player” in global trade.

While Beijing might heed these warnings for now, it’s pretty clear where their sympathies lie.

Foreign Ministery spokesman Wang Wenbin offered some insight this week when he blamed Washington for being the “culprit” of the situation in Ukraine. Washington “claims to be preventing a war in Europe. Did it accomplish that mission? It claims to be committed to peaceful resolution, but what has it done in that regard, except for providing military aid and enhancing military deterrence?”

As for the trend of “de-globalization” and the return of multi-polarity in the international political system, US economists believe it will only continue.

Plenty of economists agree that the polarization is real. Adam Posen, president of the Peterson Institute for International Economics, calls it the “corrosion of globalization.” He says it began with President Donald Trump’s trade war with China, and continued through the pandemic as economies turned inward. Now it’s accelerated.

“Everybody has been talking for a long while about blocs and the global economy splitting up,” says Posen.

The result, they fear, will be a global economy that’s “less productive and innovative as it turns combative”. But while China will likely continue buying Russian oil, gas and wheat, limits to their friendship have already manifested in the near-term. The takeaway is this: while Beijing disagrees with western sanctions, the CCP is still “biding its time”, and as a result has pursued a policy of non-confrontation.

Source link