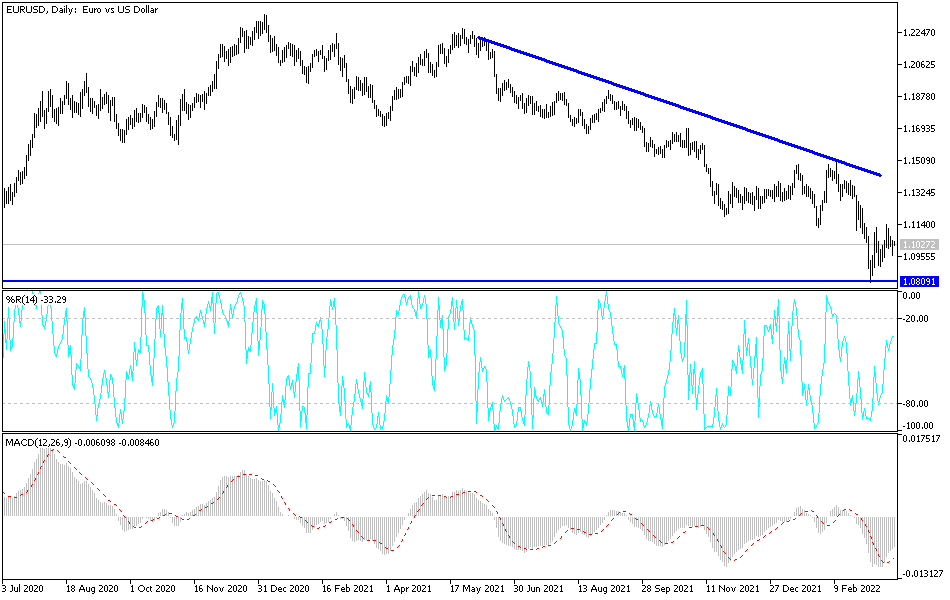

Sell EUR/USD from Bearish Levels

Prospects for a peaceful settlement in Ukraine have declined significantly this week and is likely to keep the euro under pressure in the near term, analysts say. Yesterday, the price of the euro currency pair declined towards the support level 1.0960 and settled around the level of 1.1030 at the time of writing the analysis. Its gains last week did not exceed the 1.1137 resistance level. As mentioned before, any gains in the euro will remain subject to sale as long as the Russian war continues. After two weeks of negotiations and positive signs, Russia appears to be backing away from the prospects of any breakthrough in the talks in the coming days, with Russian Presidential Press Secretary Dmitry Peskov saying the two sides remain far apart.

“The degree of progress in the negotiations may not be what is desirable and not what the development of the situation may require on the Ukrainian side,” Peskov said at a regular briefing to the media.

Following the talks between the two sides, there were hopes that sufficient progress would be made for a meeting between Ukrainian President Volodymyr Zelensky and Russian President Vladimir Putin. Accordingly, Peskov said: “To start talking about a meeting between the two presidents, the homework should be done first, that is, to conduct negotiations and agree on their results.” “No tangible progress has yet been secured,” he added. They (Putin and Zelensky) will have nothing to formalize, no agreements to formalize.”

The Euro recovered against the Dollar and Sterling over the past week along with global stock markets in hopes of a negotiated settlement of the conflict. Therefore, any fading of these hopes will negatively affect the euro exchange rates

News reports suggest that Belarus may be preparing to join the war in Ukraine on Russia’s behalf, a development that would amount to an escalation of geopolitical risks. Moreover, it was reported on Tuesday that US President Joe Biden believes there are “clear indications” that Russia is preparing to use chemical weapons as he has become increasingly frustrated with the inability of Russian forces to hand over territory.

Such an outcome could lead to further tightening of sanctions from Western countries and put pressure on investor sentiment.

Another negative sentiment development will be greater involvement of China on the Russian side. The United States warned China last week against supplying arms to Russia, a development they thought was likely. Accordingly, analysts are of the opinion that if China is more explicitly indicating its support for Russia, as the United States has indicated, it is possible for a wider contagion to spread in market prices. All this combined with hawkish Fed call points to renew the US dollar’s rally.”

“The evolution of the conflict in Ukraine still appears to be the main driver in the FX market as it does now,” says Roberto Mialic, FX analyst at UniCredit in Milan.

According to the technical analysis of the pair: The stronger trajectory of the EUR/USD is still to the downside, and lower energy prices from the recent peak could push the Euro higher above 1.1200 this week if it happens. Much about the outlook for the euro also hinges on whether the market rediscovers its appetite for the dollar after last week’s dips, which continued even after what was widely seen as the “hawkish” policy statement from the US Federal Reserve. On the daily chart, the euro-dollar broke the support level 1.0925, which will support the move towards the next psychological support 1.0800.

I still prefer to sell EURUSD from every bullish level.

Source link