Retail Sales Miss, Q1 GDP May Contract After Unexpected Slide In Control Group

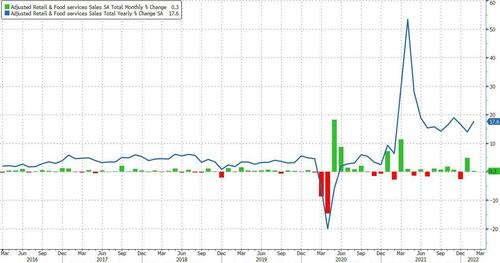

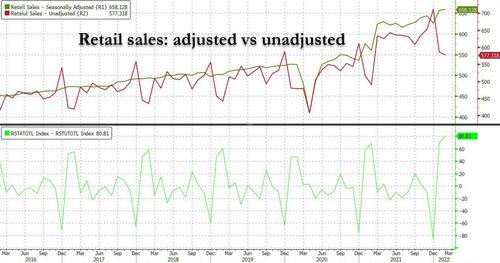

After January’s shockingly strong beat in adjusted retail sales, which however was more than offset by a plunge in unadjusted retail sales, moments ago the dept of commerce reported that February retail sales slowed sharply from the January euphoria, with the headline retail sales rising just 0.3% after January’s 4.9% surge, and missing expectations of a 0.4% print. Core retail sales excluding autos were even uglier, rising just 0.2%, and missing expectations of a 0.9% rise. And while gasoline station sales soared, the disappointment in most other segments suggests that we are starting to get demand destruction across the board.

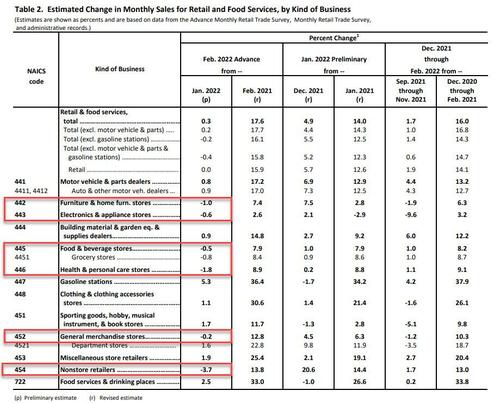

Digging through the components, the report was mixed with modest increases in motor vehicles, building materials, clothing and sporting goods (and of course gasoline stations, driven by soaring gas prices), offset by declines in food and beverage stores, electronics and appliance stores, furniture and general merchandise and finally, nonstore, or internet, retailers.

Ominously, after scoring their biggest (adjusted) increase on record in January largely due to omicron lockdowns, non-store retailers – or internet vendors – saw their third biggest drop in the past year.

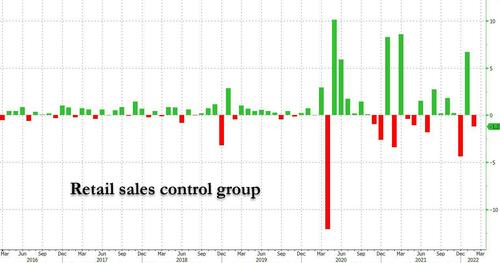

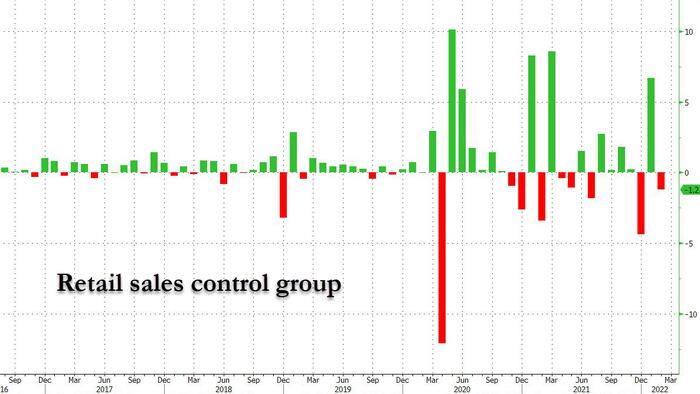

Perhaps most notable, the Control Group which is used to calculate GDP, showed a sharp 1.2% MoM drop after its 6.7% surge in January. And with Q1 GDP already on the verge of contraction, this surprisingly ugly number may be enough to push the US economy into contraction.

Finally, and suggesting that these numbers are all bunk, the unadjusted retail sales continued to slide, and after a record gap in January between the two series, in February the gap got even bigger, suggesting that the only “growth” in US spending is due to some Commerce Department seasonal adjustment calculator.

Source link