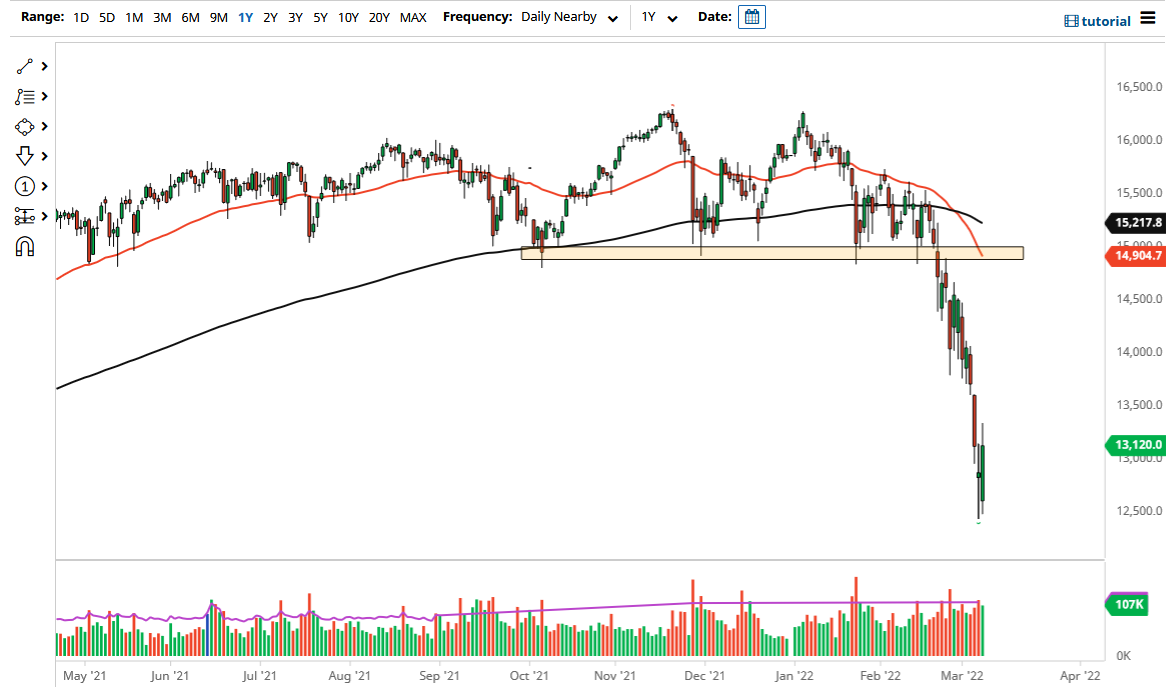

Index Recovers Some Recent Losses

The DAX will be highly influenced by the global markets, as so much of the economic activity by the largest companies in this index has to do with international trade.

The German DAX Index rallied rather significantly on Tuesday to wipe out the losses from Monday. This is a very bullish sign, at least for the short term. That being said, this is a market that is still very negative and there are a lot of things out there that will continue to cause problems. The size of the candlestick is rather impressive, but the fundamental situation has not changed all that much quite yet.

One of the major positive headlines to cross the wires during the trading session on Tuesday was that Ukraine no longer insists on joining NATO, which was one of the major problems stated by the Russians. Whether or not that actually brings anything to fruition is a completely different question, but there was a “knee-jerk reaction” in multiple markets around the world. This is a market that was probably due for some type of bounce, so this is just an oversold balance until proven otherwise. Because of this, I believe that you need to pay close attention to multiple levels above.

The €13,500 level is an area where I think you would see a little bit of resistance, followed by the €14,000 level. Any signs of failure between here and there could be sold into, but I think at the very least you have to look at this as a market in which you need to find value for short positions, and we just do not have that at the moment.

The DAX will be highly influenced by the global markets, as so much of the economic activity by the largest companies in this index has to do with international trade. Germany is a major exporter, so it needs the rest of the world to be healthy in order for it to continue to be healthy. Beyond that, we do have a shooting war on the doorsteps of the European Union itself, so it makes a certain amount of sense that we would see selling pressure in not only the DAX but multiple other indices as well.

I believe that simply sitting still and waving for signs of exhaustion at one of the levels above that I previously mentioned might be the best trade at this point in time. The €12,500 level looks to be very supportive, so a break down below that could open up another €500 drop.

Source link