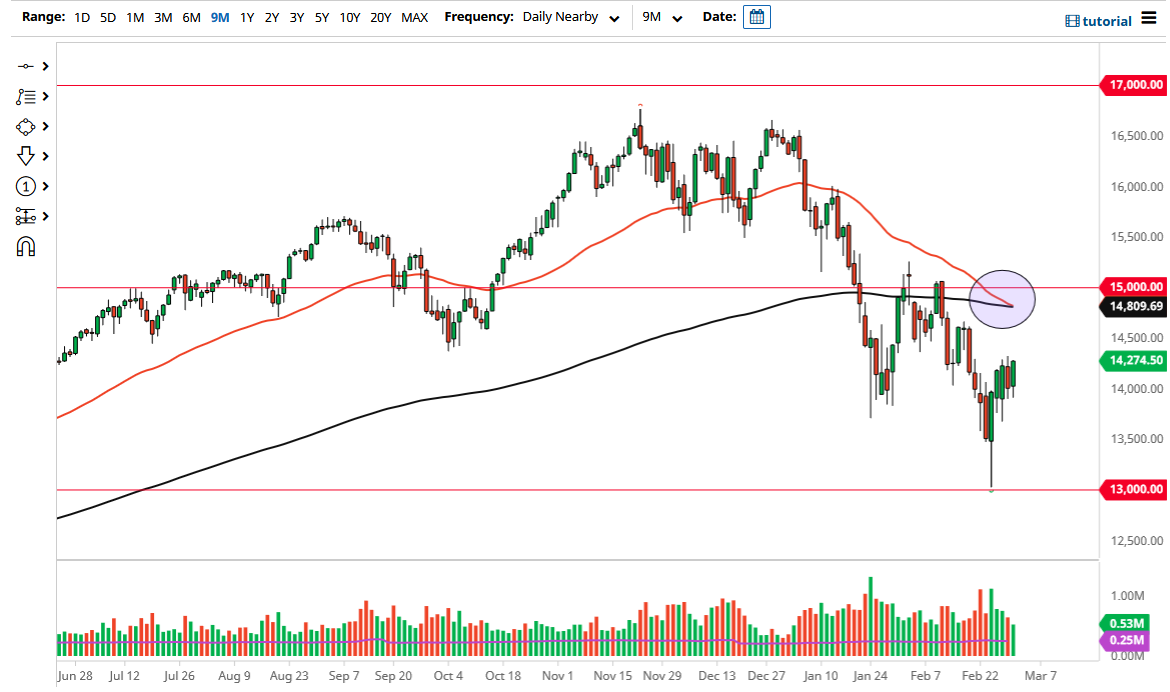

Index Recaptures Losses from Last Day

Ultimately, I am looking for signs of exhaustion in order to start selling, based upon a failure of momentum.

The NASDAQ 100 initially pulled back a bit on Wednesday but turned around to reach towards the top of the previous candlestick. At this point, the market has simply been going back and forth and shopping around, perhaps causing devastation to a lot of accounts. That being said, this is a market that I think will continue to see a lot of noisy behavior, and that makes sense considering that the NASDAQ 100 is highly levered to risk appetite.

It is also worth noting that the 50-day EMA is crossing the 200-day EMA currently, which is the so-called “death cross” and a negative indicator from a longer-term perspective. Because of this, I think that the longer-term traders are looking at this through the prism of shorting, so I think it is probably only a matter of time before we see sellers come back into the market. Interest rates have dropped a bit, and Jerome Powell speaking during the course of the trading session at Congress suggesting that we may not get a 50 basis point rate hike in March has helped, but there have also been statements from other members suggesting that the Federal Reserve simply must hike in order to retain its credibility.

This could be a bit of a “V bottom”, but I think it is short-lived at best. We need to see a complete reversal of the fundamentals in order to see this market take off. The NASDAQ 100 is something that thrives in a high-growth environment, something that we simply do not have at the moment. Bear market rallies can be very vicious, and that might be part of what we are seeing. Ultimately, I am looking for signs of exhaustion in order to start selling, based upon a failure of momentum.

If we do break down below the lows of the last couple of days, we could very well be looking at a move down to the 13,500 level underneath, and then the 13,000 level underneath. The volatility measurements are still pretty high when it comes to most indices in the United States, so it is not an environment in which we should see follow-through for any significant amount of time.

Source link