Gold Technical Analysis: Experiencing Weekly Decline

By the end of last week’s trading, gold futures contracts declined, leading to a noticeable weekly loss for the precious metal. Gold prices were volatile last week, making Friday’s session tepid compared to previous sessions. The recent selling operations pushed the price of gold towards the support level of $ 1895 an ounce and closed the week’s trading stable around the level of $ 1921 an ounce. The gains of the gold market did not exceed the top of the 1950 dollars an ounce.

The price of the yellow metal experienced a weekly decline of about 2.8%, trimming its rise since the start of the year 2022 to date to less than 6%.

In the same way, the price of silver, the sister commodity of gold, is trying to stay above the $ 25 level. Silver futures fell to $25.275 an ounce. The price of the white metal is down 3.6% this week but is still up more than 8% so far this year. Overall, the metals market declined following the Federal Reserve raising US interest rates by 25 basis points for the first time since 2018. The US central bank has forecast six more rate hikes this year, in addition to lower growth and higher inflation.

Precious metals stood out for the rate hike with some expecting 50 basis points, so maybe investors will take profits. The gold market is usually sensitive to a high interest rate environment because it raises the opportunity cost of holding non-return bullion. Meanwhile, market analysts stress that investors remain optimistic about gold due to rampant price inflation and the severity and consequences of the military conflict between Ukraine and Russia.

For factors affecting the price of gold. The strength of the US dollar increased which increased pressure on the price of the yellow metal. The US Dollar Index (DXY) advanced to 98.61, from an opening at 97.97. The DXY Dollar Index, which measures the performance of the US dollar against the other major currencies, is on track for a weekly slide of 0.5%, down less than 3% over the year.

In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

Relative to the prices of other metallic commodities, copper futures contracted to $4.697 a pound. Platinum futures rose to $1036.70 an ounce. Palladium futures rose to $2,538.00 an ounce.

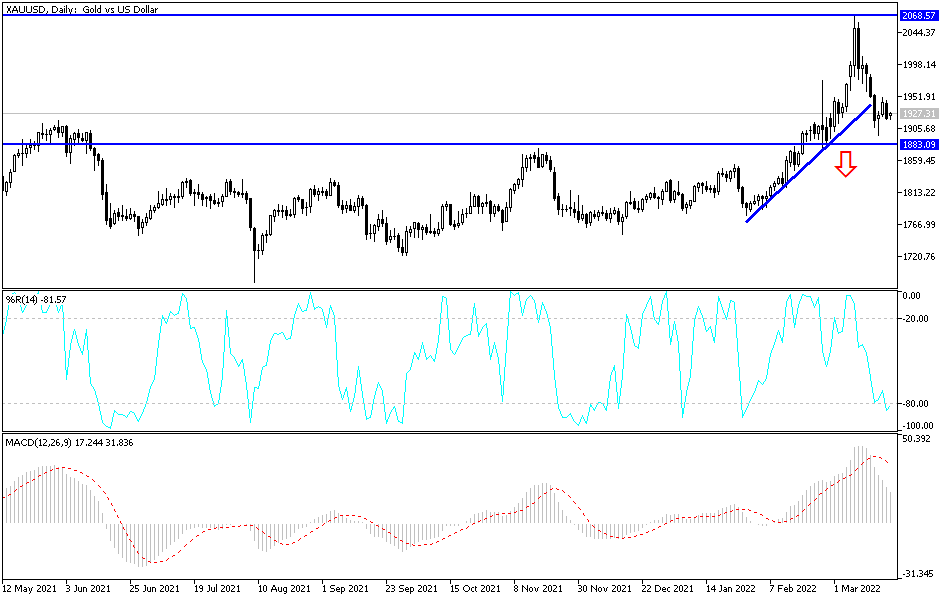

According to the technical analysis of gold: Despite the recent selling operations, I still see that the stability of the gold price is above the resistance of 1900 dollars an ounce. This is in support of the bulls’ control of the trend and supports the continuation of gold purchases. A return to the historical psychological peak of 2000 dollars an ounce requires the bulls to return in the price to the levels of resistance 1955 and 1975 dollars, respectively. On the downside, and according to the performance on the daily chart, a break of the $1880 support level will be important for more bears dominating the performance.

With the continuation of the Russian war and renewed fears of the outbreak of Covid-19, I still prefer buying gold from every bearish level.

Source link