Gold Price Falling from 20-Month Top, Eying $2,020 amid Ukraine Ease-off

- The price of gold is down from an 18-month high for the first time in five days.

- Ukrainian and Venezuelan officials are working to ease market tensions, but fears from Russia remain.

- Gold prices may rise as stagflation fears increase in China despite a rise in CPI/PPI.

The price of gold is taking a break at $2,052, up 0.11% intraday during Wednesday’s Asian session. With that being said, the yellow metal has remained at its highest levels since August 2020 while struggling to continue a four-day uptrend.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Risk sentiment swinging on and off

Ukraine and Venezuela have recently taken steps to ease geopolitical tensions with Russia and the United States. As a result, the demand for the safe-haven metal fell, resulting in the recent drop in XAU/USD.

AFP headlines asserted that Ukraine no longer wanted NATO membership due to deference to Russia the day before. A humanitarian corridor has also been confirmed in Ukraine that may help to combat market pessimism. Venezuela’s release of an American prisoner has a positive impact on willingness to take risks and a negative impact on the attractiveness of gold as a safe haven.

The intention of Kyiv to leave NATO may not be welcomed by Moscow, which fears hostile entry into the European Union (EU), which in turn undermines Putin’s unspoken goal of becoming a Kremlin-controlled leader in Ukraine. Recently, Russia called for nationalizing closed foreign-owned factories, which undermined market optimism.

Key data to support the gold buyers

According to the IBD/TIPP Economic Optimism Indicator for March, the US trade deficit widened to an all-time high, and small business confidence declined to a 13-month low. In addition, China’s consumer price index (CPI) rose above forecast by 0.8%, topping the previous data by 0.9%. In comparison, the producer price index (PPI) beat the market consensus by 8.7% at 8.8% year-over-year, 9.1% above the previous figures.

Bond yields on 10-year US Treasury notes fell two basis points (bps) to 1.85%, while S&P 500 futures dropped about 0.72% on the day. But, again, it reflects a neutral risk sentiment.

Despite mixed geopolitical concerns, a recent stagflation fear stemming from recent commodity price rallies and related economic concerns may give hope to XAU/USD buyers.

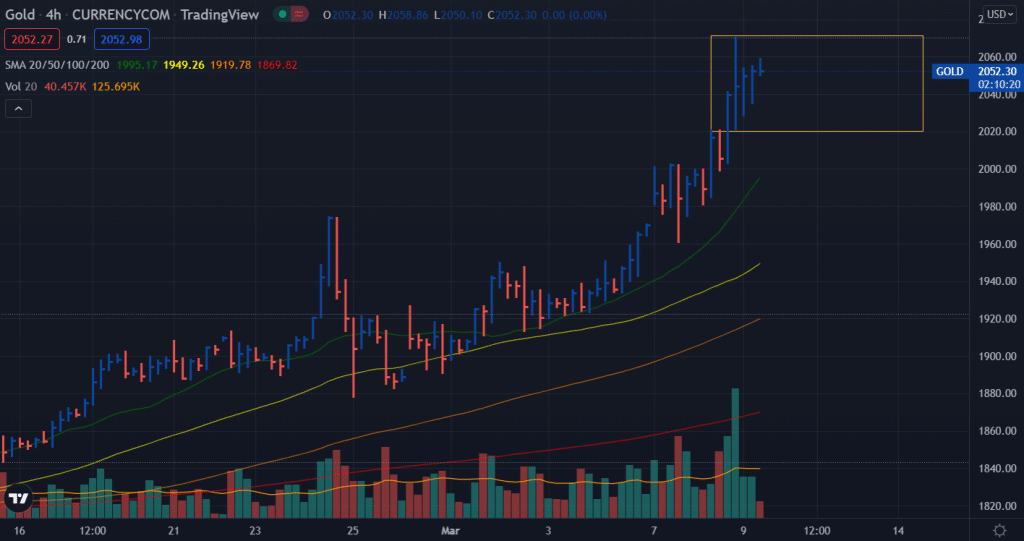

Gold price technical analysis: Bulls to run out of steam

The gold price has formed a potential reversal pattern, commonly called buying climax. We can clearly see an up bar closing in the middle while the volume is ultra-high. The succeeding bars are bullish, but the volume is declining. To confirm the bearish pattern, we need to see a breakout and retest of $2,020 level.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Alternatively, the upside hurdle remains intact at $2,075 ahead of $2,100. However, the upside path looks bumpy, and there’s a due correction for a prolonged uptrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source link