Gold: “A crisis is unfolding. A crisis of commodities”- Zoltan Pozsar

In Zoltan’s latest missive on the events in Ukraine, he describes the situation, mechanism, and likely monetary outcome of these global reaching events. Zerohedge did a thorough rundown of the report earlier in the week. The report ends with: After this war is over, “money” will never be the same again1… He is right. We want to focus on a specific aspect for this write-up; China’s dominance and what that means for Gold and Silver.

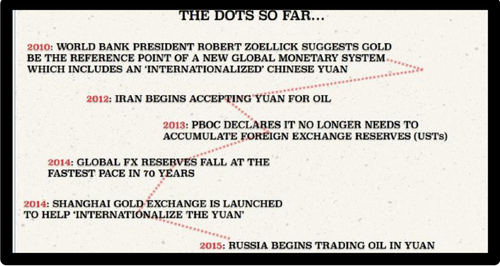

The report, entitled Bretton Woods III lays out in more detail the concept touched on in a Bloomberg Odd Lots interview with Joe Weisenthal and Tracy Alloway. In that interview he explains why Gold is important again and how this recent turn of events can serve as an accelerant towards the demise of US Dollar dominance. The latter, we believe has been ongoing since at least 2017.

From our 2017 post Golden Yuan:Crude Backed By Gold is Here:

China is long gold. Therefore it only makes sense they will use it to make payment for oil from Russia and the Saudis. It will either be gold or yuan with “implicit” gold backing.

Back then we identified the transition from Fiat money to a more physically backed currency as a logical consequence of increased oil trade in the East. But there is much, much, much more to it we are learning.

Commodity Collateral Is Money

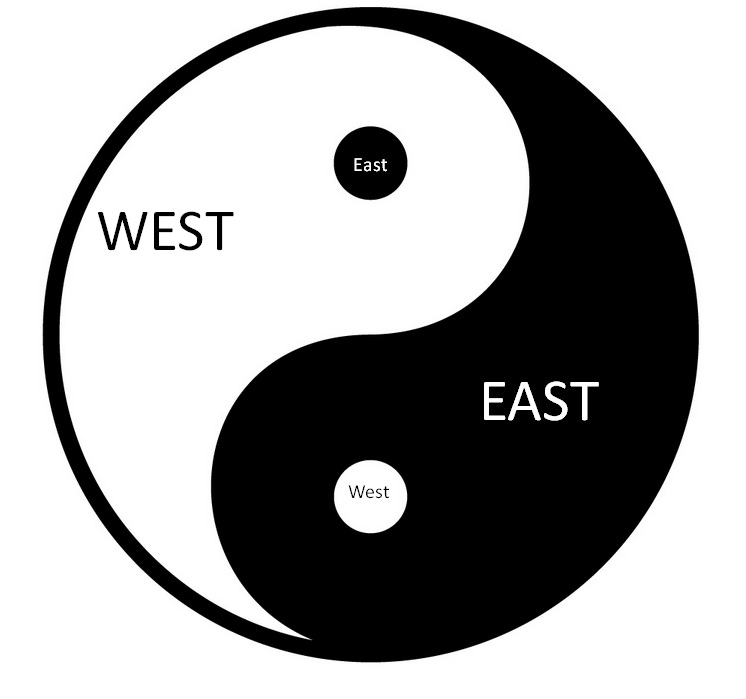

Pozsar’s latest is a report combining secular, geopolitical, and flow analysis diving into many interrelated topics. One topic of direct interest to us was that markets are moving from inside (core) money towards outside (peripheral) money. What we feel he really means is the core is becoming the periphery and vice-versa.

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money.

Collateral is the foundation on which the financial system is based. Collateral equals money in the realest sense. The “outside” collateral is no longer the periphery.

MARKETS ARE OFF THE TILT

That collateral is a large and grossly undervalued part of the current core’s valuations. Put another way, the derivative-tail has been wagging the spot-dog too hard and too long. We used to have a phrase for that in option volatility management. When an option came closer to spot term, we said it came “Off the Tilt” meaning it was not hedgable with options in different expirations anymore. Spot was treated as different from futures. The term structure was breaking for that period. The Ukraine war and sanctions have made markets go way off the tilt on term structure risk now.

FED BACKSTOP NO GOOD HERE

Zoltan goes on to explain how he came to this conclusion paralleling previous crises. These include but are not limited to events like the Southeast Asian crisis of 1997; subprime, Bear Stearns, and Lehman Brothers in 2008; and secured funding against good collateral to RV hedge funds during 2020.

In all instances a backstop was provided. Somebody had to underwrite the “put” that saved the markets from an abyss. Every time in those instances it was the US Fed that did this. Not this time. Why?

The collateral underpinning the system is not financial this time. It is real. War, sanctions, and the ensuing chaos has split markets along spot versus derivative lines. Geographically: East vs West. Collateral: Real vs rehypothecated.

CHINA IS THE COMMODITY BACKSTOP

Guess who owns the collateral that is being used to leverage western finances? Russia and China. Pozsar asks rhetorically:

If we are right, and this is a “crisis of commodities” [EDIT/spot, not futures/Goldfix] – a 2008 of sorts thematically, if not in terms of size or severity – who will provide the backstop?

China of course is his answer. China will backstop the Russian materials that need to find a home. China will provide capital for Russian companies to keep them afloat. The West cannot facilitate this even if it wanted to:

Western central banks cannot close the gaping “commodities basis” because their respective sovereigns are the ones driving the sanctions.

When the stonk mkt in MoCKBA reopens, the top 5 holding of the index will be

1. Sinogazprom

2. Sinosberbank

3. Sinolukoil

4. Sinoyandex

5. Sinosibneft— Barbarian Capital (@BarbarianCap) March 10, 2022

If Russia is this generation’s Iran in terms of a 1970’s style embargo; then the PBoC is this generation’s Marc Rich.

COUNTERPARTY RISK CANNOT BE PRINTED AWAY

The West can provide liquidity and financial backstops. But those do not solve the collateral problem. Our central banks cannot print the oil, copper, and gold (rehypothecation doesn’t count now) that Russia has. And so the periphery must become the core again.

Counterparty risk is now too big in a world where even central bank FX reserves can be sanctioned. US commodity future markets may break. Meanwhile Faith-based “financials” can seem ok. China may be the inevitable backstop this time.

The Credit Suisse contributing economist again:

..if you believe that the West can craft sanctions that maximize pain for Russia while minimizing financial stability risks and price stability risks in the West, you could also believe in unicorns.

Gold and Silver Futures Are Vulnerable (Again)

The Gold EFP (green) has gotten volatile relative to the underlying (yellow) this last move…

Indeed, futures markets are shredding in their relationship to spot markets as participants are growing more fearful of term deals. You either have the collateral or you do not. Catching up with a top-tier Gold trader who routinely carries thousands of future spreads in his market-making operation:

Tough few days. Crazy moves though. Big time spread issues. Got hurt pretty bad on it.

The reason this is an insane statement is this trader’s firm doesn’t directly trade spreads. Spreads make up a very small piece of their risk. This is Gold for crying out loud. Butterflied spreads are not a big deal. Gold is gold on any expiration. The trader and GoldFix agree that banks are not backstopping spread arbitrage like they have in the past. We also acknowledge the last time this happened was when the Metals fabricators “went on Covid strike” in March 2020.

The western successors to Marc Rich are no longer comfortable arbitraging the carry trades available. They don’t have the collateral, and they are wary of counterparty risk now.

CASH AND CARRY TRADES ARE DYING

That could be because they were making more money in flat price. Or, it could be because they are backing away from term risk. And Pozsar notes: We hear two things from funding desks: cash is bid, and term cash is hard to come by. If there is no term cash for funding term risk, then no future’s risk will be taken.

There isn’t enough good collateral out there for the size of potential claims being made on it. The West is now, for reasons that may be the lesser evil, squeezing itself.

COMEX VENUE SQUEEZE MAY BE BACK

We fear a venue squeeze for Gold and Silver can hit Comex in the next year that will make the Covid/ Refinery one in 2020 look like a picnic. It could end with Comex suspending delivery to prevent the physical from migrating to the East more than it already has.

This was subsequently substantiated by George Gero

#Gold

unsubstantiated but logical:

1-someone stood for delivery

2-comex bar specs were not honored

3-scramble by any/all banks with non spec bars in inventory to fix issue-(comex Fu vault raid)

4- LBMA offers its bars in substitute

5- cme may permit temp substitute of lbma— VBL (@VlanciPictures) March 24, 2020

For now, the flow of metal is from west to east. Thus, the traditional spread from spot to futures (Exchange for Physical) reflecting a short squeeze may not backwardate. We may see the Comex deliverable metal explode relative to its London counterpart as the remaining metal supply moves to satisfy eastern demand.

Indeed the contango from spot to Comex futures increased more than what seemed normal this past week in rallies. Usually this is from overzealous speculative funds buying. That may very well be the case again. But 2020 informed us that is no longer the best bet to be made.

Western Gold Goes East Now

Not to be Cassandras on this; but the 2020 form/venue issue (played off as a one-time event 100 vs. 400 ounce bar fungibility), exposed the vulnerable underbelly of it all. We will go into this in more detail in a subsequent piece. We tweeted on this many times when it was going down and had conversations with the late, great George Gero ( one of our futures mentors from floor days) and others on this very topic.

Back to Zoltan’s thesis. He says: This crisis is not like anything we have seen since President Nixon took the U.S. dollar off gold in 1971 – the end of the era of commodity-based money.

Indeed it is not. It is indicative of a changing Zeitgeist. We may be reverting back to a respect for real risk. On the radar now are things increasingly symptomatic of a more mercantilist globe:

- Markets deleveraging due to lack of good collateral despite plenty of cash

- Exchanges increasing margins and haircuts for spread positions

- Physical deliveries throttled or suspended

- More inflation in what you need, deflation in what you don’t

- Calls for austerity and toughening up tied to patriotic appeals

We would not be surprised if China rescues things. Then upon that event, demand a bigger slice of the IMF SDRs, add commodities to the basket, and advances its agenda of moving the pricing mechanisms of global trade to the East in GoldenYuan terms.

Pozsar concludes:

From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities). After this war is over, “money” will never be the same again…

…and Bitcoin (if it still exists then) will probably benefit from all this.

Related Posts

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link