GBP/USD Technical Analysis: Recovery Attempts Weak

For two days in a row, the price of the GBP/USD currency pair is trying to recover and compensate for its recent losses. It reached the 1.3273 support level, amid a sharp aversion to risk among investors with the start of the Russian invasion of Ukraine. Attempts to rebound higher for the sterling dollar pair did not exceed the resistance level 1.3438, and it is settling around the 1.3400 level, waiting for anything new. By the end of last week’s trading, sterling rebounded tepidly against the dollar as global markets rebounded after what at the time was a mild international sanctions reaction to Russia’s attempt to invade Ukraine. It could easily come under pressure again early in the new week.

The GBP/USD pair could be at risk along with some other exchange rates after leaders of the G7 nations announced what could be the “mother of all sanctions packages” last Saturday, which includes a decision to freeze the central bank’s official reserve assets. In this regard, the White House said over the weekend that they plan collectively to impose measures to ensure that Russia cannot use central bank reserves to prop up its currency and thus undermine the impact of our sanctions. This will show that the imposition of sanctions on its economy by Russia is nothing but a myth.

While the expulsion of many Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) amounts to a powerful right-hand blow to the body of the Russian economy, the CBR asset freeze is by far the most significant of its potential fallout. The central bank under Putin will lose the ability to offset the impact of our sanctions. The White House also said: “The ruble will fall further, inflation will rise, and the central bank will be left defenseless.”

Sanctions like the proposed asset freeze will almost certainly require basic legislation in at least some jurisdictions, and this could lead to delays in their implementation as well as create room for some parts of potential price action in the market during the interim.

Nearly two-thirds of Russia’s official reserves in G7 currencies and denominated assets were reported in the latest disclosure, and any potential attempt to sell them before sanctions are implemented is one potential source of downside risk for GBP/USD this week. There are also other risks associated with the threat of a protracted conflict in Ukraine, although this is far from a done deal after fierce resistance by the Ukrainian military and civilian population appears to have left Russia’s invading power falter over the weekend.

To the extent that this remains the case, it may eventually become a source of support for the Pound by nullifying the risk of a prolonged conflict that will darken the European economic outlook for as long as it continues. Developments in and related to Ukraine are likely to be the dominant considerations for financial markets this week, although there are a number of the Bank of England’s Monetary Policy Committee (BoE) set to speak publicly over the coming days.

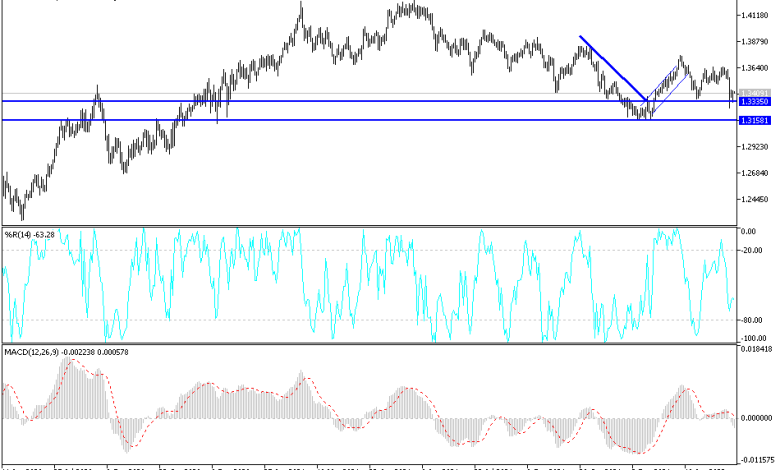

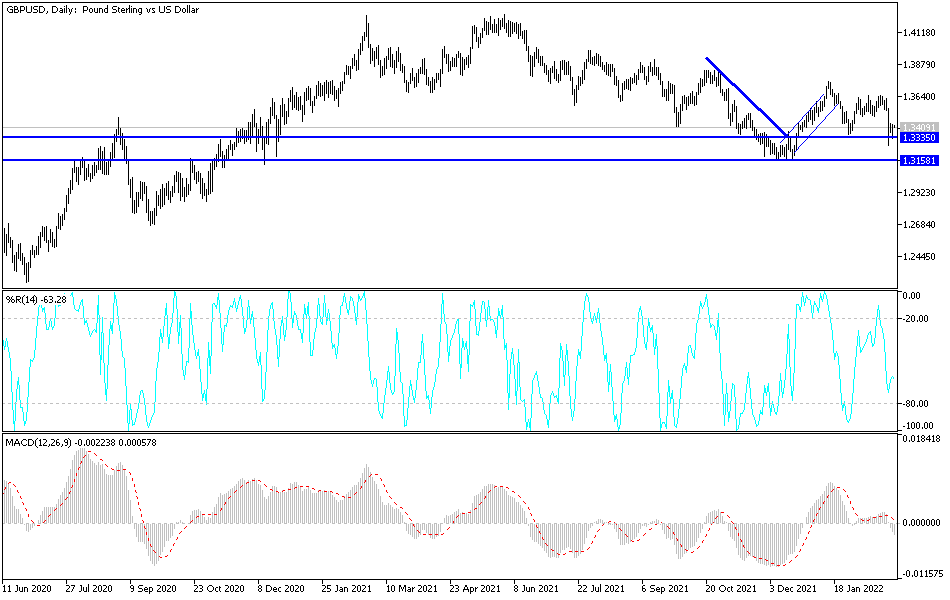

According to the technical analysis of the pair: In the event of calm and the end of the Russian war, the price of the GBP/USD currency pair will be stronger in rebounding upwards and recovering. The factors of its gains before the war are strong and support a stronger control of the bulls. According to the performance on the daily chart, the resistance levels will be 1.3495, 1.3575 and 1.3660, the most important for the currency pair to turn to the upside. On the downside, breaking the support 1.3320 will support the bears strongly to move further down.

Source link