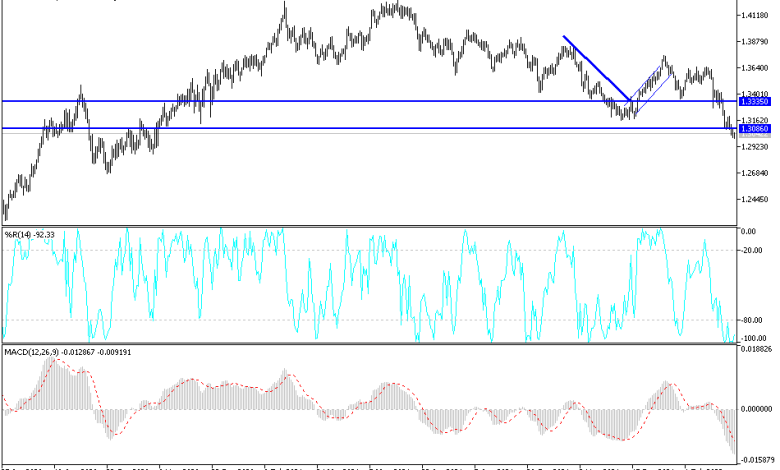

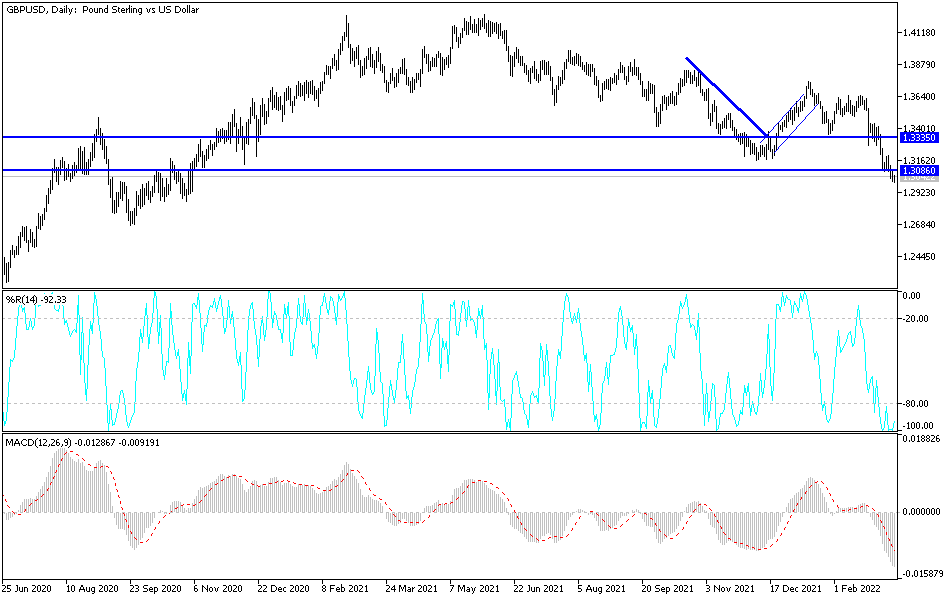

GBP/USD Technical Analysis: Psychological Support 1.3000

The GBP/USD exchange rate gave up key support levels on the charts last week, but looming monetary policy decisions by the Fed and the Bank of England (BoE) could see further pullback towards support 1.2837 or less in the coming days. At the beginning of this important week’s trading, the sterling-dollar pair moved towards the psychological support 1.3000, which we mentioned a lot before that this is possible if the Russian war continues. Overall, the British Pound made gains against the safe-haven Japanese Yen and Swiss Franc only last week, while it fell against other major currencies. This is especially for European currencies which rose strongly on speculative suggestions that negotiations will soon end the ongoing Russian invasion of Ukraine.

Despite the recovery in global markets, the British pound ended the last week down more than 1% after the US dollar strengthened following data from the Bureau of Labor Statistics on Thursday, which showed US inflation rose to 7.9% in February.

This leaves the Fed in a hot seat ahead of Wednesday’s policy decision and does little to support the sterling rate. Accordingly, Joseph Caporso, Head of International Economics at the Commonwealth Bank of Australia says, “GBP/USD faces the FOMC and the Bank of England (BoE) within 24 hours. Both central banks are expected to raise interest rates by 25 basis points. The market’s reaction will depend in large part on the post-meeting data and the US central bank’s press conference. The analyst warned that the British pound could fall to 1.2894 this week.

GBP/USD has already fallen below the 38.2% Fibonacci retracement level of the 2020 recovery trend at 1.3172 and the 200-week moving average at 1.3117 last week, undermining all the way what was the last appearance of meaningful technical support before 50% Fibonacci retracement is down around 1.2837.

Whether or not GBP/USD drops much this week will likely depend on the US dollar’s response to Wednesday’s Fed decision and on how Thursday’s BoE policy decision affects the Pound. Commenting on the milestones, Kevin Cummins, chief economist at Natwest Markets says, “In our view, the 2022 points are likely to essentially cluster around four or five highs for 2022 (with some outliers at both ends), given the stronger pace of inflation. Since the Federal Open Market Committee meeting in January.

According to the technical analysis of the pair: the general trend of the GBP/USD pair is bearish, especially since the move towards the 1.3000 psychological support level currently confirms the bears’ control over the general trend. The path is open for further movement downward and testing stronger support levels, the most important of which are 1.2830 and 1.2700, respectively. This week’s events are important for the currency pair’s forecast. To change the trend to the upside, as I mentioned before, the bulls must break through the resistance 1.3335.

The sterling dollar pair will be affected today by the announcement of jobs and wages figures in Britain and later the announcement of the US producer price index.

Source link