GBP/USD Technical Analysis: Bullish Attempts are Weak

The sudden rise in stock markets points to a sharp reversal in risk sentiment for the better, helping the Euro and the British Pound to rally against the US Dollar. Accordingly, the exchange rate of the GBP/USD currency pair rebounded to the resistance level of 1.3190, a bounce from the support level of 1.3082 affected by the Russian / Ukrainian war, which still exists despite the cautious truce. So far, the war in Ukraine remains the main primary driver of the global foreign exchange forex. The British pound has ceded significant value to the dollar since the war began. On the latest developments front, Newswire said on Wednesday that the Russian Foreign Ministry would better achieve Russia’s goals in Ukraine through talks.

This adds to reports earlier this week that if Ukraine agreed to Russia’s terms it would stop fighting immediately. Among some of the Russian demands that Ukraine recognize the independence of Luhansk and Donetsk while recognizing Russia’s sovereignty over Crimea. They also want Ukraine to commit not to join NATO and other political blocs (ie the European Union).

News of the ceasefire around Kyiv, which is set to last until Wednesday, may be a contributing factor to improving market sentiment

The market also appears to be leaning heavily on Thursday’s meeting between Russian Sergei Lavrov and Ukrainian negotiators in Turkey as a source of hope that the situation in Ukraine can be calmed. Ahead of the meeting, Agence France-Presse reported that Russia says, “some progress is being made in talks with Ukraine”. The improvement in sentiment led to some selling off the Dollar, which remains a beneficiary during times when investors are apprehensive. The rebound in sterling may also be, at least in part, due to technical re-calibrations.

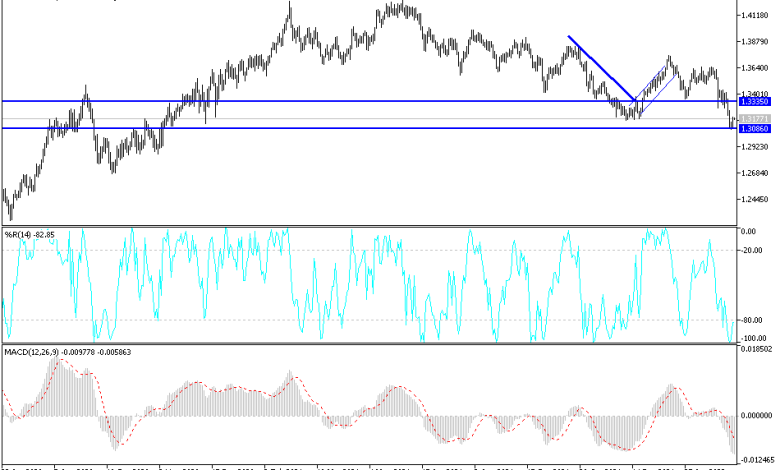

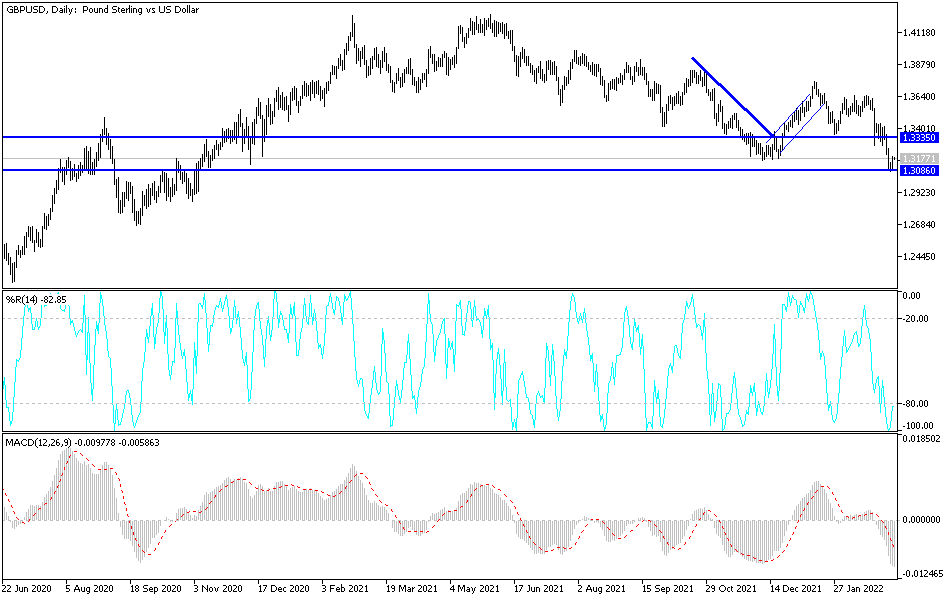

Strategists at JP Morgan’s trading desk in London say they are looking to buy back the dollar but will give sterling some room to bounce higher in the near term. They note that the GBP/USD exchange rate is now heading to oversold, but the retracement buying is not a high convincing position.

The note also says: “Given the dearth of liquidity in the markets at the moment, we may get an opportunity to buy the US dollar at better levels this week, so we are dampening our enthusiasm for the time being.” “I’d have fun fading out would be around 1.3260/70 and 1.3350/60,” he added.

According to the technical analysis of the pair: So far, the general trend of the GBP/USD pair is still bearish, and yesterday’s rebound has not yet exited from the descending channel. Psychological support will be 1.3000. On the other hand, the opportunity to breach the resistance 1.3335 on the daily chart gives some hope that the bulls will return to control.

There is no important and influential British data today, and the focus will be on the announcement of the US consumer price index and the number of weekly jobless claims.

Technical tip: The Relative Strength Index (RSI) is useful because it can indicate when the movement is extending: when the RSI drops below 30 it tells traders that an asset is oversold.

Source link