GBP/USD Technical Analysis: Breaking General Bullish Trend

Despite the continuous selling operations from February 23, which the GBP/USD currency pair experienced, with losses to the 1.3273 support level it settled around the 1.3310 level at the time of writing the analysis.

The British pound and the euro are looking to be oversold relative to the US dollar and could recover if investor concerns about the Russia-Ukraine conflict begin to subside, says a leading British bank and global investment bank.

The British Pound and the Euro joined stock markets in the recovery on February 28 after negotiators from Russia and Ukraine concluded talks in Belarus and committed to further talks. Therefore, any hope that the conflict can be resolved at some point can provide support for the various stocks and currencies associated with risks.

Research by Barclays has found that the Pound has struggled since Russia invaded its neighbor last week but there is a “significant” rebound potential if market fears abate. In this regard, says Marek Rachko, forex strategist at Barclays Bank: “Selling was also greater for the pound, the euro, the Turkish lira, the Indian rupee and the Thai baht, indicating that oil importers were particularly affected.”

Research by Barclays showed that the British pound and the euro are two currencies that are particularly vulnerable to higher oil prices due to supply-side shocks. Oil prices crossed $100 a barrel last week as concerns mount over the continued availability of Russian oil. Meanwhile, prices at UK gas stations hit a record high on Sunday, according to the RAC motoring association.

However, markets are inherently forward looking and tend to rule out worst-case scenarios very early and the “peak anxiety” may pass soon, especially if there is evidence that Russia and Ukraine are negotiating. Accordingly, analyst Rachko says, “Overall, our analyzes indicate that moves in the Central and Eastern European, GBP and EUR markets appear to be overblown.” “Just as sterling has fallen significantly from the Russian-Ukrainian situation, it has a lot of room to appreciate as markets increasingly see this conflict as domestic, and global risks are starting to recover,” he added.

However, he adds that it may take a stabilization in oil prices before a recovery takes shape, and like other investment banks, Barclays does not expect a major reversal in oil prices. Accordingly, RBC Capital Markets says it is very convinced that oil prices are in the midst of a super cycle, backed by strong fundamentals and that more hikes are to come.

“To be clear, geopolitical tensions help fuel the bullish view, but this hypothesis is purely fundamentally driven,” says Michael Tran, global energy strategist at RBC Capital.

As for the GBP, the BoE’s reaction to the recent events will remain a major concern going forward.

“The British pound continues to get primary support from expectations that the Bank of England will raise interest rates for the third meeting in a row on 17 March,” says Joe Manimbo, senior FX analyst at Western Union Business Solutions.

Economists broadly agree that the Russia-Ukraine crisis poses upward risks to inflation, which central banks usually react to by raising interest rates. The prospect of higher inflation will fuel MPC concerns that a wage-price spiral will develop, says Andrew Goodwin, chief UK economist at Oxford Economics. The main impact of the Russian invasion of Ukraine on the UK economy is likely to be a sustained increase in energy prices.

But Oxford Economics also warns that ongoing developments may in fact cause the BoE to moderate their approach to rate hikes later in 2022. They are now seeing rate increases of only 25 basis points this year, in March and May, rather than The three hikes they were expecting to head towards the Russian-Ukrainian crisis.

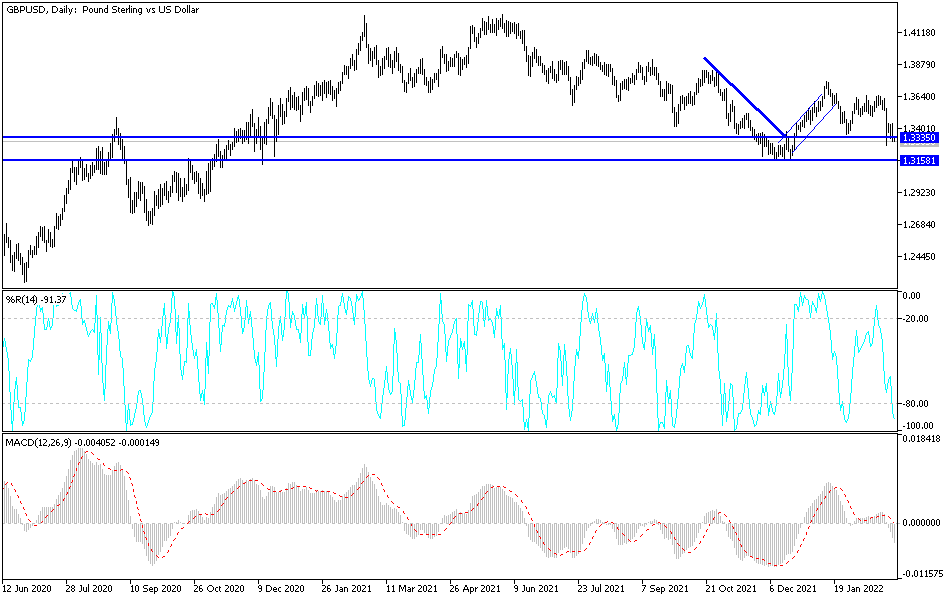

According to the technical analysis of the pair: On the daily chart, the bears’ trend is still going to break the general bullish trend of the GBP/USD currency pair and moving below the 1.3300 support. This trend supports the continuation of the bears’ control that may move the pair towards the 1.3150 support level over the same period of time. There will be no return to the bulls’ domination of the trend without moving towards the resistance level 1.3660, otherwise the stronger bears will remain in control.

The currency pair is not awaiting any important and influential British data today, and it will interact with the announcement of the ADP survey reading to measure the change in the number of US non-farm payrolls and the reaction from Jerome Powell’s testimony.

Source link