EUR/USD Technical Analysis: Waiting for Central Bank

The price of the EUR/USD currency pair may continue to move in narrow ranges until the US Federal Reserve announces the update of its monetary policy decisions. Today is the most important date for global markets in general and the forex market. Markets are on a date to raise US interest rates for the first time since 2018. Ahead of the official announcement, the price of the euro-dollar is moving in a range between the level of 1.0900 and 1.1020, and it is settling around the level of 1.0945 at the time of writing the analysis.

In addition to expectations of a US interest rate hike., renewed coronavirus fears are at the top of a long list of concerns for markets, which have caused extreme hour-to-hour volatility in recent weeks. The war in Ukraine pushed up the prices of oil, wheat, and other goods produced in the region. This increases the threat that already high inflation will persist and combine with a potentially stagnant economy.

Meanwhile, global central banks are preparing to withdraw the support they provided to the global economy after the outbreak of the pandemic. The Federal Reserve begins its two-day meeting on interest rates, and broad expectations are that today it will announce a 0.25 percentage point increase over the key short-term interest rate. This would be the first increase since 2018, taking it above a record low of nearly zero, and likely the first in a series of price increases. The Fed is trying to slow the economy down enough to stem the high inflation sweeping the country, but not so much that it leads to a recession.

Inflation is already at its highest level in generations, and the latest figures do not include the oil price hike that occurred after Russia’s invasion of Ukraine.

Recent data showed that inflation was still very high at the wholesale level last month, but at least it was not accelerating. Producer prices rose 10% in February from a year earlier, the same rate as in January. On a monthly basis, inflation rose 0.8% in February compared to January, against expectations of 0.9%. This represents a slowdown from January’s inflation rate of 1.2% m/m.

So, economists said the numbers are still too high and will keep the Fed on track to raise rates today, but at least they weren’t worse than expected. A separate survey by the Federal Reserve Bank of New York showed that manufacturing in the state fell for the first time since early in the pandemic. A weak economy could make the Fed less aggressive about raising interest rates.

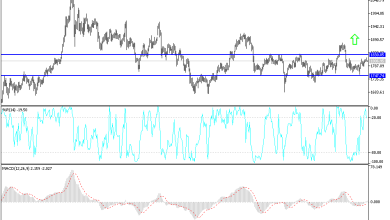

According to the technical analysis of the pair: There is no change in my technical view, as the price of the EUR/USD currency pair will remain stable in narrow ranges until the US Federal Reserve announces its monetary policy decisions today. The general trend of the euro-dollar is still bearish, and the return of the move towards the psychological support 1.0800 is possible if the Russian-Ukrainian war continues. Investors do not care about the arrival of technical indicators towards oversold levels as much as they follow the effects of the war on the future economic recovery of the euro zone.

On the upside, and according to the performance on the daily chart, the breach of the resistance levels 1.1125 and 1.1260 will be important to start breaking the sharp bearish channel for the currency pair. The currency pair will be affected today by a bundle of US economic data, led by the US central bank announcements and US retail sales figures.

Source link