EUR/USD Technical Analysis: Selling Operations Continue

In light of the constant anxiety in the financial markets, the selling operations of the euro against the dollar EUR/USD are still going on. The bears’ control of the trend since the invasion reached the 1.1090 support level yesterday, before the currency pair settled around the 1.1111 level at the time of writing.

For their part, analysts believe that the war in Ukraine, rising energy prices, and reducing the expectations of the European Central Bank to raise interest rates are all factors that negatively affect the euro.

The euro was one of the top performers in the forex market until geopolitical tensions exploded when Russia invaded Ukraine on February 24, and analysts are now looking to extend the weakness to new multi-year lows. As of March 1, the market was expecting a 27 basis point ECB rate hike to be delivered by the end of the year, down from 55 basis point hikes priced in February 7 when markets digested the ECB’s policy shift on February 3.

The European Central Bank said on February 3 that inflation was a concern for all members of the Governing Council, and therefore they could no longer rule out a rate hike in 2022, and the euro rose sharply in response.

The drop in pricing expectations for a rate hike from the European Central Bank is directly related to Russia’s invasion of Ukraine, which has led to massive policy shifts in the European Union and raised energy costs. Commenting on this, Ayla Mir, Senior Eurozone Analyst at Danske Bank, “If oil and gas prices remain at elevated levels throughout the remainder of the year, inflation rates of more than 6% may be expected in the second half of 22.” Danske now also has downside risks to his Eurozone GDP forecast for 2022 of 4.0% from 0.4-0.5, mainly due to downside damage to consumers from persistently high inflation. For their part, currency analysts at Swedbank said in a recent report: “The decline in stock prices and the rise in commodity prices will have real economic impacts. Economies may also suffer from reduced trade as well as increased uncertainty that can discourage households and businesses from consuming and investing.”

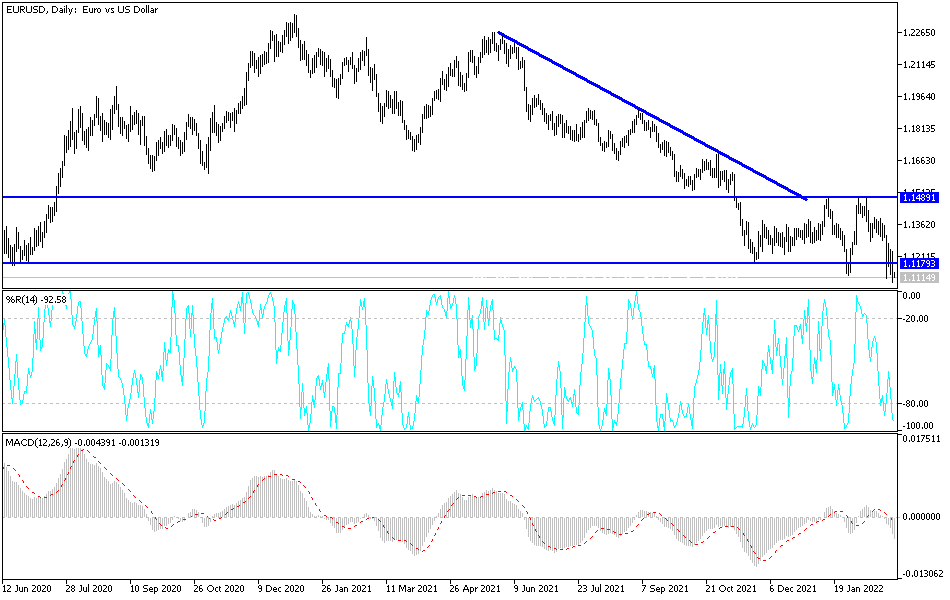

According to the technical analysis of the pair: The general trend of the EUR/USD currency pair is still bearish, and it is currently the closest to moving towards the 1.1000 psychological support level. As mentioned before, it crossed the 1.1180 support that supports it according to the performance on the daily chart below. Any gains in the euro will remain a target for sale as long as the Russian war continues. The closest resistance levels for the pair are currently 1.1195 and 1.1265, respectively.

The currency pair will be affected today by the developments of the Russian war and the announcement of inflation figures in the euro zone, then to the most important, the ADP reading to measure the change in US non-farm jobs and the testimony of US Federal Reserve Governor Jerome Powell.

Source link