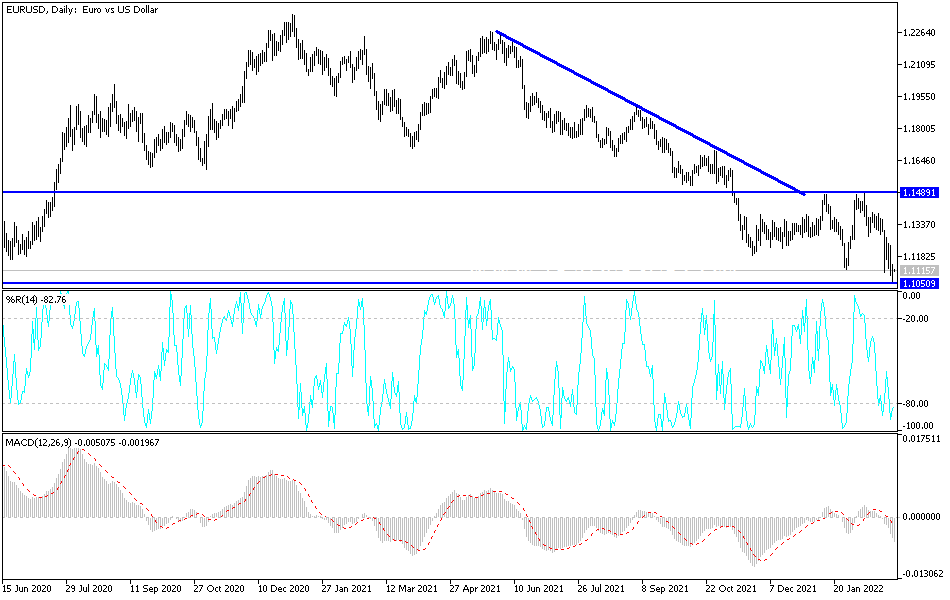

EUR/USD Technical Analysis: Ignoring Oversold Indicators

The pace of losses for the EUR/USD currency pair continued more towards a noticeable support level on the charts in the middle of this week’s trading. The losses reached the support level 1.1057, the closest to breaching the strong psychological support for the currency pair. Its sharp losses came as other regional currencies incurred more crushing losses that are likely to lead to further losses of the Euro-dollar, although the European Central Bank’s decision next Thursday may be an important event for the euro’s path.

Eurodollar losses are on track to 1.1002 and the 78.6% Fibonacci retracement of the 2020 recovery trend even after Eurostat figures showed eurozone inflation rose further in February. According to official figures, inflation in the euro area rose from 5.1% to 5.8% last month, making it even higher than the 5.4% seen in the United Kingdom, while the most important core measure of inflation rose from 2.3% to 2.7% in another indication that Price pressures continued to build up early in the new year.

But with the market unsure whether it will get a response from the European Central Bank, the data did little to help the euro, which has remained under almost relentless pressure along with the Central and Eastern European (CEE) currencies.

The Polish zloty fell more than 2 percent during European trading on Wednesday, taking a one-week loss to nearly seven percent as European currencies continued to be penalized for being too close to the conflict in Ukraine; especially those in Central and Eastern Europe. In general, the depreciation of the zloty observed in recent days does not correspond to the fundamentals of the Polish economy, nor to the direction of the monetary policy of the Dutch National Bank. The National Bank of Poland (NBP) said on Tuesday that the Dutch National Bank has an adequate level of foreign exchange reserves.

So the possibility, if not likely that the euro would sink, is that Tuesday’s intervention could have led to NBP selling the euro for the dollar and then the dollar for the zloty because this was the most effective way to combat the inflationary impact of the decline in Polish exchange rates .

The Polish Central Bank maintains the euro and the dollar in its basket of foreign exchange reserves of approximately $161 billion, although the bulk of goods imported into Poland come from euro-denominated economies, and it is likely that NBP has sought to push the euro/zloty exchange rate up. However, these transactions will be just a growing headwind among several stressors on the euro, which has also been saddled with a host of side effects from the conflict in Ukraine including higher oil prices and a waning European Central Bank confidence in the eurozone economic outlook.

According to the technical analysis of the pair: On the daily chart below, investors ignore the arrival of technical indicators to oversold levels as the EUR/USD pair met only weakness and pressure factors. Psychological support 1.1000 is important and a sure symbol of the bears’ control of the trend and may support the move towards severe descending levels. The Russian war may be prolonged and thus the damage to the euro continues. As mentioned before, any gains in the euro will remain a target for selling again, and the closest resistance levels for the currency pair are currently 1.1185, 1.1255 and 1.1320, respectively.

Source link