Bulls Hold on to Recent Gains

Sharp expectations for the future of the US Federal Reserve’s tightening policy this year, as well as investors abandoning the Japanese yen despite fears of the prolonged Russian war, contributed to the bulls maintaining their gains in the USD/JPY currency pair. It reached the highest resistance level of 121.42 for the pair. It is stable around the level of 121.10 at the time of writing the analysis. Despite the currency pair’s gains, there has been growing concern on Wall Street that inflation will continue to rise since the Russian invasion of Ukraine, which has pushed up energy and other commodity prices. Crude oil prices have been volatile due to fears that the conflict will exacerbate an already tight market. The volatility in prices was driving and dragging the stock market in general.

Energy prices are likely to remain volatile as the conflict continues. US President Joe Biden heads to Europe for an emergency NATO summit on Thursday when sanctions and a Russian oil embargo are likely to top the agenda. Many of the higher costs incurred by companies have been passed on to consumers, and higher prices for food, clothing and other goods may reduce spending, slowing economic growth. The reaction of global central banks has been to raise interest rates to try to counter the impact of inflation.

The Fed has already announced a 0.25% increase in the benchmark interest rate and is ready to act more aggressively if necessary.

On the economic data front: US new home sales fell in February for a second month, indicating that higher prices and higher mortgage rates could keep potential buyers on the sidelines. Government data showed that purchases of new single-family homes fell 2% to a 772,000 annual pace after a downward adjustment of 788,000 in January.

The drop in sales indicates that buyers are turning away from the market amid rising home prices and rising mortgage rates as the Federal Reserve tightens its policy. A recent report showed that a gauge of homebuilders’ sales expectations for the next six months fell in March to the lowest level since June 2020 amid growing concerns about a combination of rising construction costs and higher interest rates.

The New Home Sales report, released by the Bureau of Statistics and the Department of Housing and Urban Development, showed that the median sales price for a new home jumped 10.7% in February from a year earlier, to $400,600. Yesterday’s report showed that the number of homes sold during the month and waiting to start construction – a measure of the backlog – rose from January to 209,000. As of the end of February, there were 407,000 new homes for sale, the most since August 2008, although nearly 91% were either under construction or not yet started. At the current sales pace, it will take 6.3 months to exhaust the supply of new homes, compared to 4.5 months one year ago.

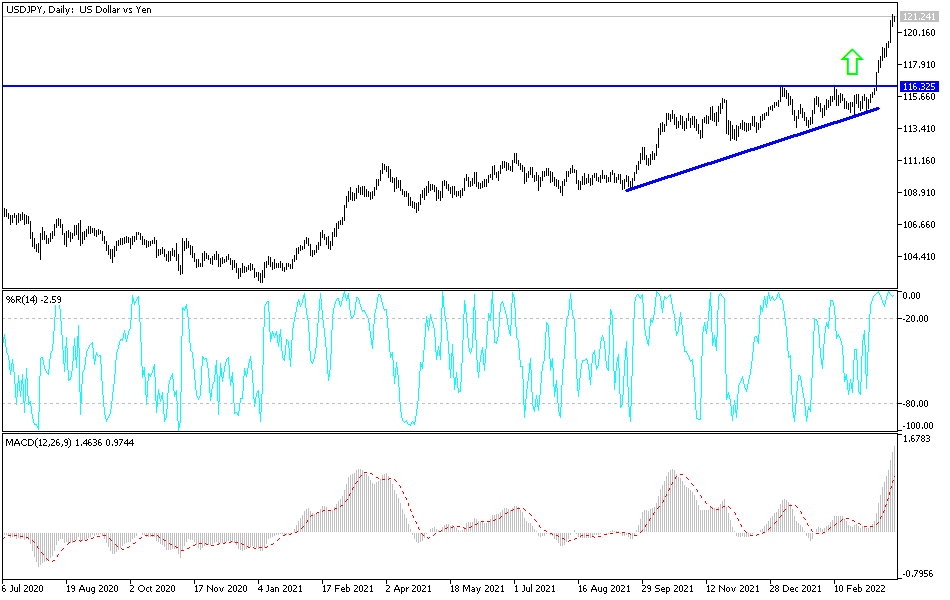

According to the technical analysis of the pair: The bulls of the USD/JPY currency pair ignored the technical indicators’ arrival towards overbought levels after the recent gains. The general trend of the currency pair is getting stronger to the upside and so far, I still see that profit taking sales could happen at any time. The closest targets are 121.20 and 122.00, respectively. It must be considered that the Japanese yen is one of the most important traditional safe havens for investors in times of uncertainty. Therefore, the aggravation of matters regarding the Russian war may restore the Japanese yen’s strength.

According to the performance on the daily chart, a break of the 118.50 support will be important to return the bears’ dominance.

Source link