Failure to Break the Trend

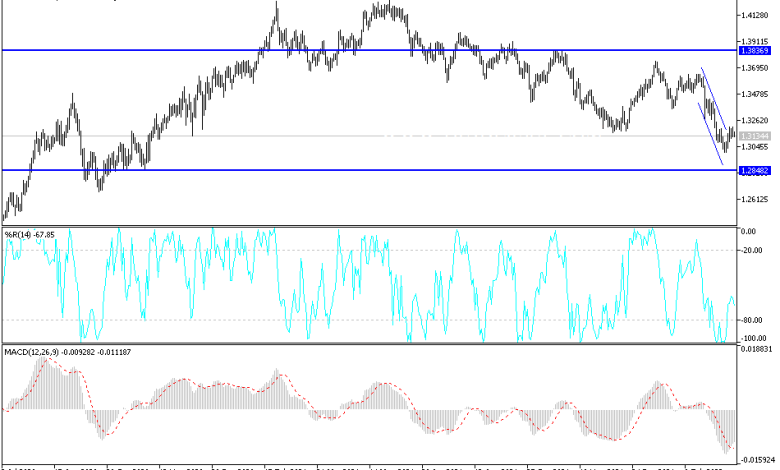

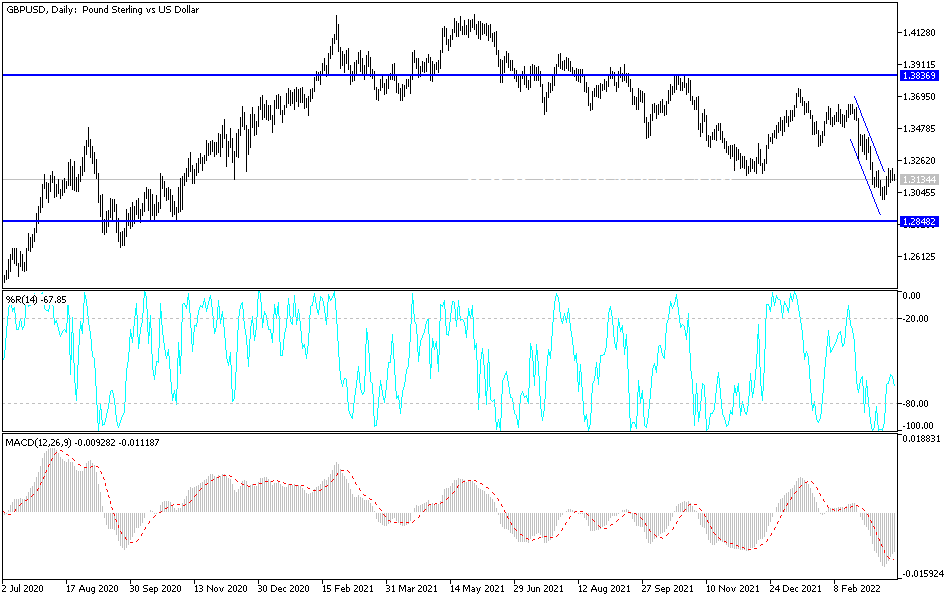

During last week’s trading the GBP/USD exchange rate has smartly rebounded from three-month lows. Its range for further recovery is likely to be limited, while the risk of additional losses remains due to the watershed change in Federal Reserve policy and a more cautious stance in the Bank of England (BoE). The gains of the sterling dollar pair last week brought it to the resistance level of 1.3210, and with the failure to gain more momentum, the currency pair was subjected to selling operations, stable on its impact, around the 1.3125 level at the time of writing the analysis.

The British pound attempted to draw a line under losses incurred in a month-long sell-off against the dollar last week as global markets rebounded strongly in price action which many analysts attributed to optimism over peace talks between Russia and Ukraine as well as government spending in China.

The GBP/USD pair rose from its lows in December to enter the new week’s trading again above the 1.31 level, despite the possibility that the sterling will weaken due to a cautious reversal in the Bank of England’s outlook for the economy, inflation, and interest rates, it may face difficulty extending this recovery over the coming days.

Most recently, the Bank of England questioned interest rate expectations when it indicated that higher energy prices and the resulting pressure on income could eventually act as a substitute for increases in bank interest rates over the coming months. Accordingly, John Manuel Herrera, an expert at Scotiabank says, “Markets moved away from pricing 50 points higher at one of the remaining 2022 meetings, and year-end prices are down about 30 basis points since Wednesday, but the British pound is expected to remain in a lagging state with more ruled out. From rate hike bets, and sharp double-digit inflation in the fall could spur markets to hold some of those bets, but a cost-of-living crisis that dampens growth and employment will prevent the Bank of England from rising excessively – so expect further declines in the rate of value. the pound.”

The Bank of England’s warning of risks on its expectations for growth, inflation and bank interest rates contrasted with the mood of Fed Chairman Jerome Powell, who said last Wednesday that the US economy is likely to remain strong enough to continue to grow at a solid pace even with the interest rate. It will rise sharply over the coming months. The Fed raised interest rates for the first time since before the coronavirus crisis, and Governor Powell acknowledged that the March dotted chart of Fed policymakers’ expectations indicates that it is possible, if not likely, to raise US interest rates to between 2.5% . and 3% next year.

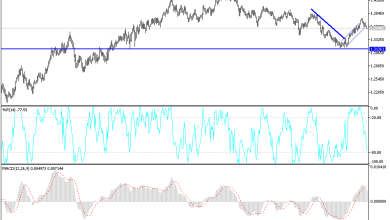

According to the technical analysis of the pair: The loss of momentum for the GBP/USD bulls may increase market expectations of a return to the 1.3000 psychological support area again. The US dollar currently has a better chance of strength, as it is an ideal safe haven with the continuation of the Russian war, in addition to the comparison of the expectations of raising interest rates during the year in its favour as well. On the upside, and according to the performance on the daily chart, the break of the resistance levels 1.3220 and 1.3335 will be important in turning the general trend of the currency pair to the upside.

Source link