GBP/USD Technical Analysis: Preparing for Buying Levels

Despite the recent sell-offs that the GBP/USD currency pair was exposed to last week, the factors of the pound’s strength in the forex market still exist. Most notably, the future of tightening the Bank of England’s policy and the weakening of concerns about the new Corona variable. Recently, the heavy selling returned in the stock markets and thus negatively affected the rise of the British pound in 2022, which lost nearly half a percent against the euro while also losing its strength against other safe haven currencies ahead of the weekend.

It’s been a bad start to the year for stock markets – especially US stock markets – so why is another drop in stocks hitting sterling now? In recent weeks, investors have been taking money off the table in anticipation of higher interest rates from central banks. For the British pound, expectations for higher rates in the Bank of England are ultimately supportive as they mean higher returns for UK monetary assets, which in turn attract international capital inflows.

The link to market concern is that the Fed may raise interest rates four times in 2022, but the higher rates from the Fed also provide cover for the Bank of England to go ahead with the rate hike. Therefore, the story of higher interest rates in the US also proves the story of higher rates in the UK.

This means that any price-related selling in the stock market is relatively supportive of the British pound.

It should also be noted that in this system, the FTSE 100 has outperformed, a marked contrast to the poor performance of the past two years – as global investors seem keen to pick out undervalued UK companies. But, during the last hours, the markets slid as concerns about future earnings in technology stocks began to return home. A 20% drop in Netflix stock after disappointing earnings appears to have spooked the markets.

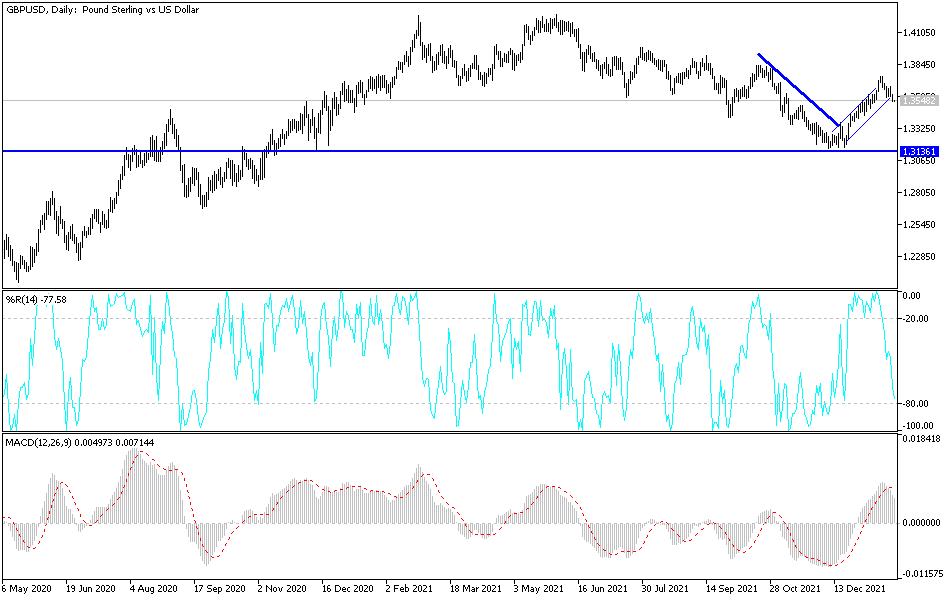

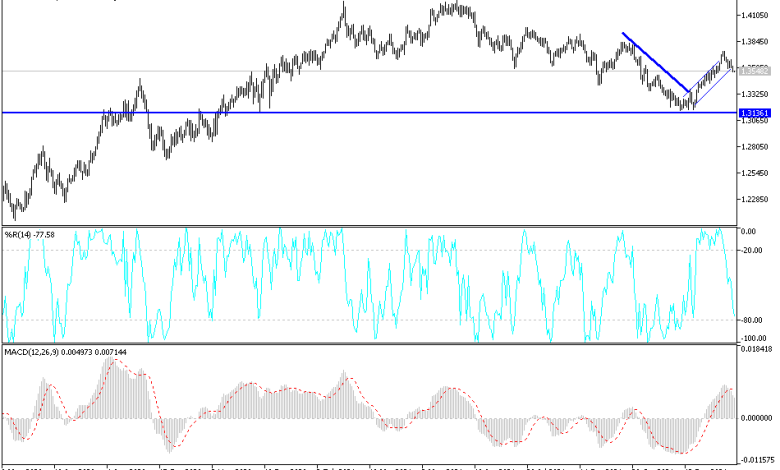

According to the technical analysis of the pair: On the daily chart below, it seems clear that there is a breakout of the bullish channel for the GBP/USD currency pair, and the strength of the bears’ control will be consolidated if it falls more, especially towards the support levels 1.3485 and 1.3390, respectively. I prefer buying the pair from it. On the other hand, in order for the currency pair to return to the path of its ascending channel, the pair must move towards the resistance levels 1.3620 and 1.3700, respectively, and the last level is important to move towards the psychological top 1.4000.

Technical indicators have changed direction to the downside and have a lot of time before they reach oversold levels.

Source link