Americans Make Huge Efforts to Keep up with Raging Prices

Retail sales amid record worst inflation in durable goods and red-hot inflation in nondurable goods.

By Wolf Richter for WOLF STREET.

February and January are the worst months of the year for retailers, after the huge holiday season binge. Large seasonal adjustments attempt to iron out the plunges in those two months from the November and December binge.

And for the past 14 months, we’ve got a new biggie in the mix: a record rage of inflation in durable goods and a huge bout of inflation in nondurable goods.

Not seasonally adjusted, retail sales, at $577 billion in February, were up a stunning 17.7% from February last year, according to the Census Bureau today. This was a huge massive gain, showing that Americans are spending hand over fist to keep up with price increases:

Seasonally adjusted, retail sales ticked up in February from January by 0.3%, to a record $658 billion, on top of the spike in January, and were up 17.6% year-over-year:

But then there’s the biggie: Raging inflation.

Retail sales are sales of goods, both durable goods (such as cars, electronics, and tools) and nondurable goods (such as food, household supplies, and gasoline). Retail sales do not include services such as healthcare, rents, and plane tickets. The retail sales here are not adjusted for inflation.

The Consumer Price Index for durable goods spiked by 18.7% in February (red line in the chart below), by far the highest in the data going back to the 1950s. A big part was the ridiculous spike in prices for used and new vehicles.

The CPI for nondurable goods spiked by 10.7%, the highest since July 2008 (purple line). The current spike in gasoline prices since late February has not yet made it into the index.

So the year-over-year jump in retail sales of 17.6% needs to be seen in light of price increases for durable goods of 18.7% and nondurable goods of 10.7%. Which means: Consumers are making heroic efforts to spend what they have and earn and can borrow to keep up with inflation, and maybe spend a little extra on top of inflation:

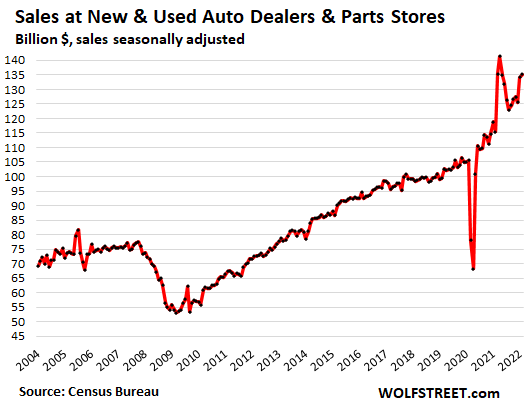

Sales at New and Used Vehicle and Parts Dealers: Spiking prices, declining unit sales.

In dollar terms, sales at new and used vehicle and parts dealers, the largest category of retailers, ticked up 0.8% seasonally adjusted in February from January, to $135 billion. Not seasonally adjusted, sales rose by 2.6% month over month to $121 billion. Compared to a year ago, sales jumped by 17.7%, a huge jump.

But used vehicle prices exploded by 41% year-over-year, according to the CPI; and new vehicle prices spiked by 12.4%. So the dollar-sales gains were all based on higher prices and a shift to higher-end and more-loaded models that the manufacturers have been prioritizing.

But the number of vehicles delivered to end users dropped. The number of used vehicles sold to retail customers in February dropped by 7% year-over-year, according to Cox Automotive. And the number of new vehicles sold dropped by 12% year-over-year, to a seasonally adjusted annual rate of 14.1 million new vehicles:

The other retail categories in order of sales volume.

Sales at ecommerce and other “nonstore retailers,” the second-largest category, jumped 13.8% year-over-year in February, to $96 billion, seasonally adjusted, down 3.7% from the record in January:

Food and Beverage Stores: sales dipped 0.5% for the month, seasonally adjusted, to $78 billion. Year-over-year, sales jumped 7.9%, while the CPI for food-at-home spiked by 8.6%:

Food services and drinking places: Sales rose 2.5% for the month seasonally adjusted, to a record $74 billion. Year-over-year, sales were up 33%:

General merchandise stores: Sales dipped 0.6% for the month to $58 billion, seasonally adjusted, and were up 10.9% year-over-year. Walmart and Costco are in this category, but not department stores.

Gas stations: Sales spiked by 5.3% for the month, to a record $57 billion, seasonally adjusted, driven by the 6.6% spike in gasoline prices. Year-over-year, sales spiked by 36%, driven by the 38% spike in gasoline prices. In other words, the sales growth at gas stations is all due to higher prices:

Building materials, garden supply and equipment stores: Sales ticked up 0.9% for the month, to a record $43 billion seasonally adjusted, up 14.8% from a year ago.

Clothing and accessory stores: Sales rose 1.1% for the month, to $26 billion, seasonally adjusted, and were up 31% year-over-year:

Miscellaneous store retailers, which include cannabis stores: Sales jumped 1.9% for the month to a record $15.5 billion (seasonally adjusted), up 25% from a year ago. This category tracks specialty stores, such as for cannabis products, beer brewing supplies, telescopes, art supplies, etc.

Department stores: sales rose 1.6% for the month, to $12 billion (seasonally adjusted) and were up 23% year-over-year. Compared to the peak in the year 2000, sales were down 39%, as Americans have abandoned that type of retailer. Innumerable department stores were closed over the past 10 years, and many regional and national chains were liquidated, with only a small number of survivors left:

Furniture and home furnishing stores: Sales fell 1.0% for the month, to $12 billion (seasonally adjusted), but were up 7.4% year-over-year:

Sporting goods, hobby, book and music stores: Sales rose 1.7% for the month, to $9.0 billion (seasonally adjusted), and were up 11.7% year-over-year:

Electronics and appliance stores: Sales dipped 0.6% for the month, to $7.3 billion, seasonally adjusted, but were up 2.6% from a year ago. Sales of consumer electronics and appliances are huge, but are spread over many types of stores, such as Costco, Walmart, and Home Depot, and a lot of the sales have wandered off to ecommerce. This category here covers only the sales at specialty brick-and-mortar stores, such as Best Buy.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Source link