Weekly Forex Forecast

Begin the new trading week with our Forex forecast that focuses on the major pairs.

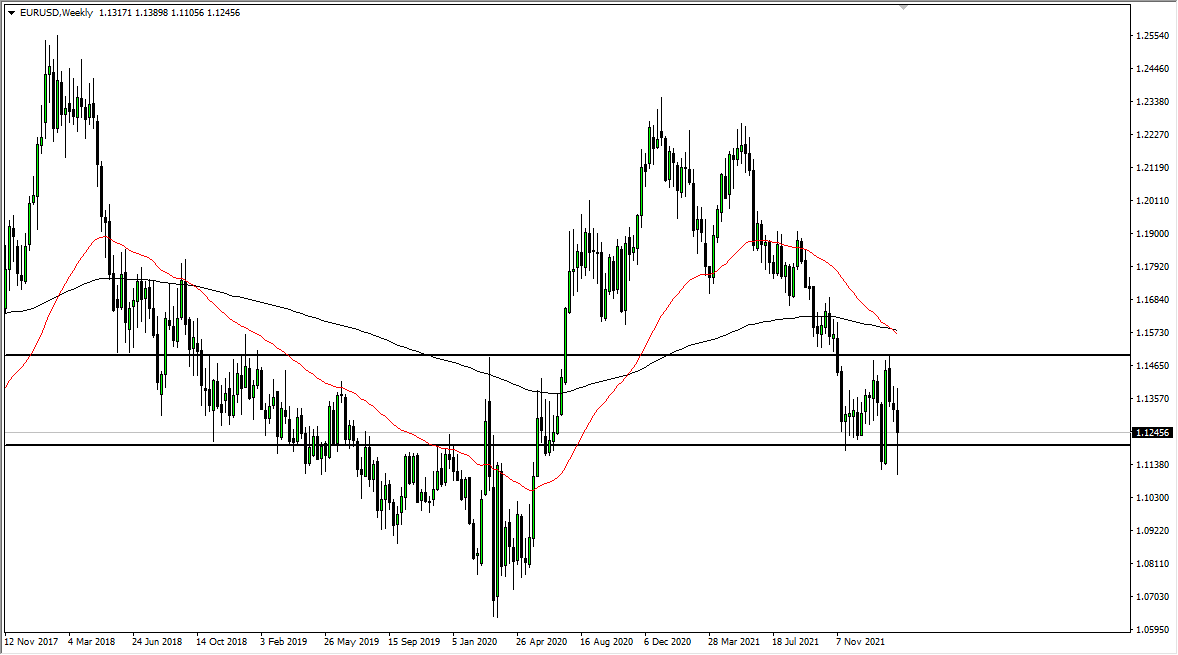

EUR/USD

The Euro has had a wild ride over the course of the month of February, and now that we are closing out the month, we seem just as confused as we were in the beginning. The past week has seen the market break down to a fresh, new low, before turning around and breaking back above the 1.12 level. At this point, the market is very likely to continue to look at the 1.12 level as an area of interest, so if we break down below the bottom of the weekly candlestick that we just close down, then it opens up the “trapdoor” to the 1.10 level underneath. I do favor the US dollar in general so fading rallies probably continues to be the way forward.

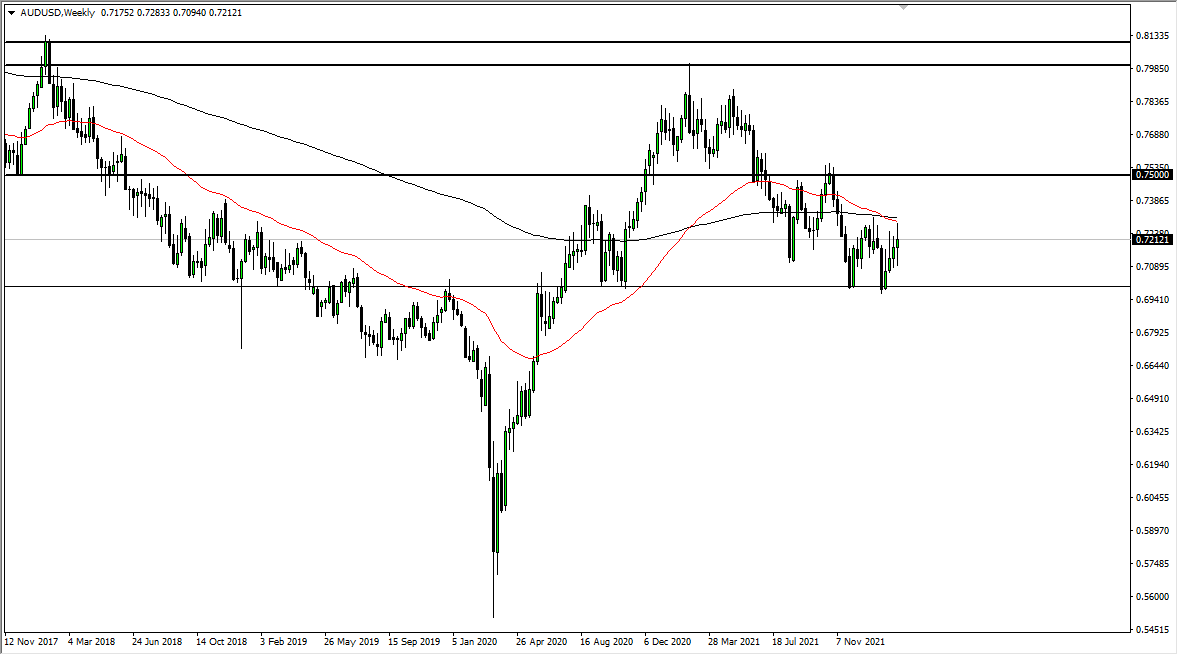

AUD/USD

The Australian dollar has seen a lot of back and forth action during the previous week, to reach towards the 0.73 level above, before pulling back to show signs of exhaustion. This is a market that will continue to be noisy, as the Australian dollar is a risk appetite based currency. The 0.73 level is the top of the current trading range, with the 0.70 level underneath being the bottom. I do believe that we are more likely than not to drift lower based upon the Federal Reserve tightening monetary policy more than anything else.

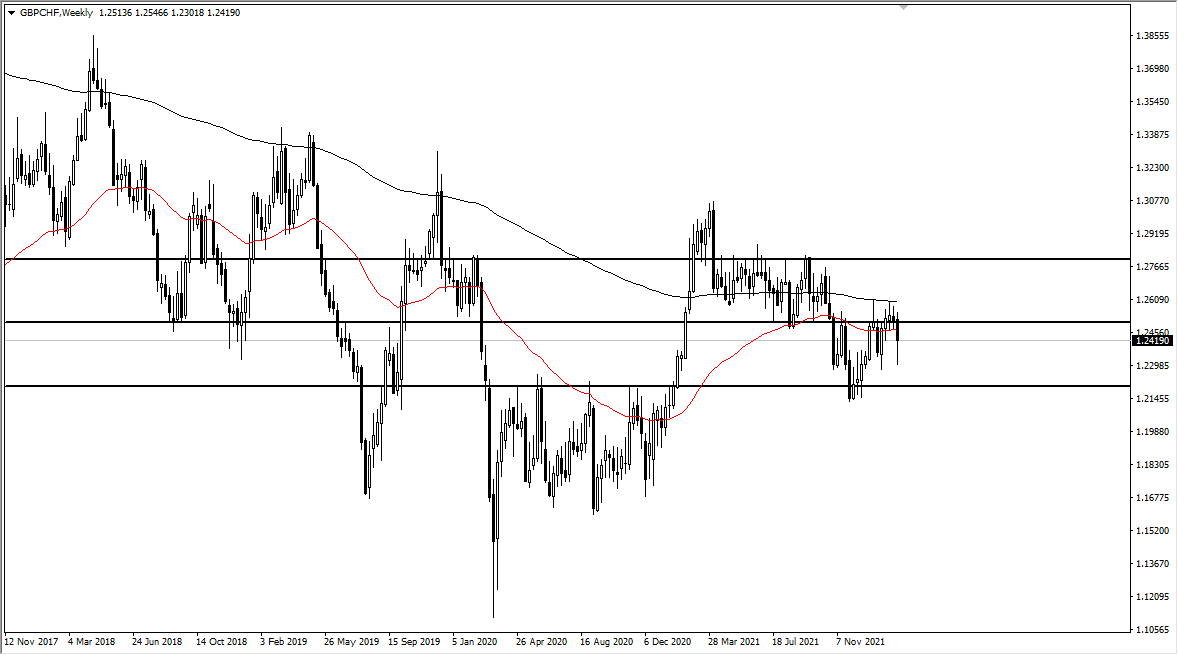

GBP/CHF

The British pound has broken down significantly during the last week, showing signs of weakness and “risk off trading.” The 1.25 level has been a bit of a magnet for price, and the previous three weeks had seen the market simply going back and forth. Now that we have busted through the little bit of support, I do think that it has done enough structural damage to the market that it is only a matter of time before we short again. Keep in mind that the Swiss franc of course is a safety currency, and there are plenty of reasons out there to think that the market is going to go looking towards safety.

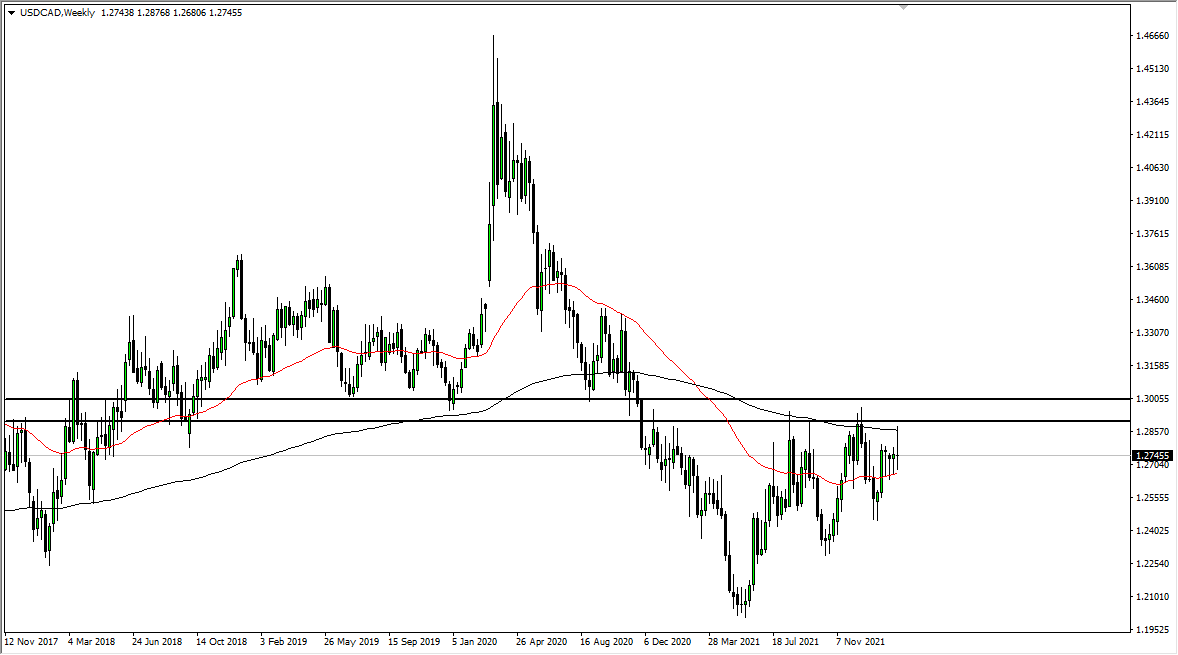

USD/CAD

The US dollar has been all over the place during the previous month as we squeeze between the 50 week EMA and the 200 week EMA. The 1.29 level above is significant resistance, extending all the way to the 1.30 level. That is a 100 points range of resistance, so if we can finally break above the 1.30 level, then the market is free to go much higher.

I would point out that short-term pullbacks continue to see buyers, and therefore it looks like we are trying to form some type of ascending triangle. Although the oil markets are ready to break higher given enough time, the reality is that the US dollar continues to attract a lot of inflows. That should continue to be the case on dips going forward.

Source link