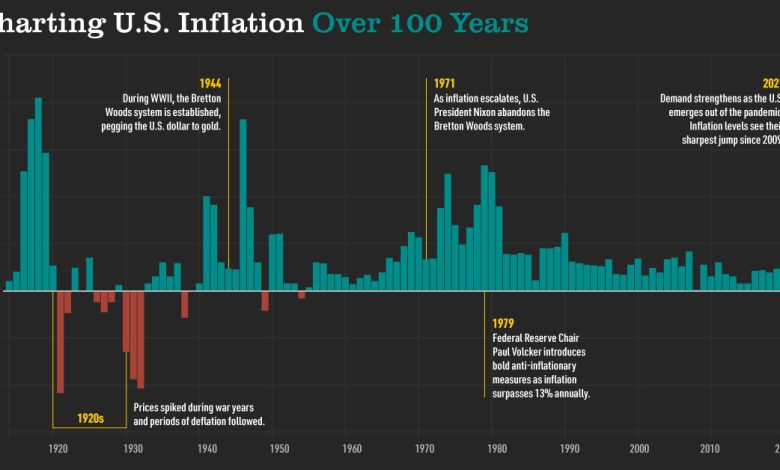

Visualizing the History of U.S Inflation Over 100 Years

This infographic is available as a poster.

Chart: Interest Rates Fall Decades After Pandemics

How have interest rates responded to pandemics?

Despite higher interest rates on the horizon, historical data shows that real interest rates fall decades after pandemics end. Real interest rates were shown to decline as much as 1.5% lower, even after an initial rise.

In this Markets in a Minute chart from New York Life Investments, we show how pandemics have impacted real interest rates across 19 pandemics since the 14th century.

Pandemics and Real Interest Rates

According to a working paper from the San Francisco Federal Reserve Bank, pandemics have lasting effects on real interest rates.

Real rates were defined as the level of returns on safe assets issued from global financial powers.

Specifically, interest rates were constructed by weighting real interest rates on long-term debt by each country’s share of GDP. Data was collected over seven centuries for pandemics with over 100,000 deaths across Europe due to available historical records.

To study how interest rates respond to major economic events over the long run, pandemics were compared to wars.

| Changes in Real Rate | 0 Years | 10 Years | 20 Years | 30 Years | 40 Years |

|---|---|---|---|---|---|

| Pandemics | -0.1% | -0.6% | -1.3% | -1.0% | -0.7% |

| Wars | -0.1% | 0.3% | 0.8% | 0.8% | 0.5% |

Based on their research, interest rates fell slightly after pandemics, but this effect increased over time. What’s more, four decades after pandemics ended, real interest remained lower than pre-pandemic levels. By contrast, interest rates increased after wars, hitting the highest point two to three decades out.

What factors may have impacted a depression in real rates after pandemics?

An abundance of capital per unit of labor was one possible factor. Higher levels of precautionary savings was another, which may be a result of rebuilding lost wealth during the pandemic. According to economic theory, increased savings and a slowing population can lead real interest rates to decline.

In other words, when there is excess capital and people are saving money, there is less demand for credit. This decreased demand, in turn, may lead to lower interest rates.

By contrast, capital is destroyed during wars, which may have caused an upward pressure on rates in the past.

Pandemics vs. Recession Savings

How do savings during pandemics compare to recessions? In April 2020, personal savings rates skyrocketed to over 33%—the highest ever recorded.

In the table below, we show the peak savings rate during the pandemic, and compare it to different recessions.

| Date | Peak Savings Rate |

|---|---|

| Apr 2020 | 33.8% |

| May 2009 | 7.9% |

| Sep 2001 | 7.0% |

| Jan 1991 | 9.3% |

| Nov 1981 | 13.2% |

| Jul 1980 | 11.2% |

| Dec 1973 | 14.8% |

| Jul 1970 | 13.5% |

| Jan 1961 | 11.1% |

Source: U.S. Bureau of Economic Analysis (Jan 2022)

At one point, savings rates during the COVID-19 pandemic were double or triple the rate of past recessions. The average U.S. personal savings rate over the last 60 years is around 9%.

Rise in Real Wages

Like interest rates, real wages showed a meaningful response to pandemics. As labor scarcity increased, real wages rose higher. Overall, pandemics corresponded with a rise in real wages that lasted for decades. For wars, real wages decreased persistently for years.

During the Black Death, for instance, a 25-40% decline in the labor supply corresponded with a 100% rise in real wages.

| Changes in Real Wages in Great Britain | 0 Years | 10 Years | 20 Years | 30 Years | 40 Years |

|---|---|---|---|---|---|

| Pandemics | 0.5% | 3.6% | 8.0% | 10.2% | 11.8% |

| Wars | -0.2% | -1.3% | -2.2% | -2.2% | 0.1% |

It’s worth noting that the study was released in June 2020, long before current wage rises began to appear.

Productivity Increases

Pandemics have also positively impacted productivity. While real GDP per capita rose 8.6% four decades after pandemics, for wars, productivity increased just 1.4%.

| Changes in Real GDP per Capita in Great Britain | 0 Years | 10 Years | 20 Years | 30 Years | 40 Years |

|---|---|---|---|---|---|

| Pandemics | 0.1% | 1.7% | 4.6% | 4.3% | 8.6% |

| Wars | 0.1% | -1.0% | -0.7% | 0.5% | 1.4% |

Why did productivity improve? As the number of workers declined, capital per worker increased, raising labor productivity. In other words, there was more capital available for the remaining workers, boosting productivity.

By contrast, wars have hurt productivity due to the destruction of physical capital such as public infrastructure.

What if COVID-19 Is Different?

Two caveats may impact how real interest rates respond to the current pandemic, according to the research.

In the past, pandemics created a significant dent in the labor force. COVID-19, in comparison, has a greater impact on an elderly demographic in terms of deaths, who are less likely to be in the workforce. As a result, the decrease in capital to labor could depress interest rates to a lesser degree.

Secondly, the fiscal response to COVID-19 is much larger than past pandemics. A major fiscal response could lead to higher debt levels, which in turn could push real interest rates higher. As the central bank prints more money, this could lead to inflation, which causes bonds to be worth less. In turn, investors begin selling bonds and yields rise.

World War II: A Modern Day Case Study

However, there is a case to be made for lower rates for longer.

In the aftermath of World War II, the Federal Reserve sustained low borrowing costs in spite of a soaring economy and high inflation. The central bank kept long-term Treasury yields at 2.5% after the war to stabilize markets and keep government debt financing low. Even amid high debt levels, the debt-to-GDP ratio declined without causing damaging effects on the economy.

Overall, if history repeats itself, there could be a low interest rate environment for a significant period of time, with sustained effects on real wages and productivity.

Thank you!

Given email address is already subscribed, thank you!

Please provide a valid email address.

Please complete the CAPTCHA.

Oops. Something went wrong. Please try again later.

Source link