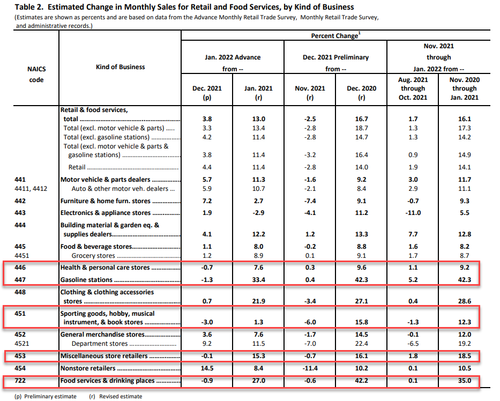

US Retail Sales Exploded Higher In January. There’s Just One Thing…

After December’s gravely disappointing drop in retail sales, analysts are convinced January will see all that pent-up demand come flying back and expected a 2.0% MoM jump (despite a collapse in consumer confidence, especially buying attitudes and financial well-being expectations). In fact the analysts under-appreciated the rebound as headline retail sales exploded a stunning 3.8% MoM

Source: Bloomberg

That is the biggest MoM surge since March 2021’s stimmy-driven surge in spending.

The rebound was mostly driven by a huge jump in non-store retailers (e.g. online, Amazon etc) and in autos…

Non-store retailers saw their second biggest MoM jump in history…

Finally, the Control Group – which is used to calculate GDP – showed a massive 4.8% MoM surge after its 3.1% MoM collapse in December

Source: Bloomberg

Remember, all the retail sales data is nominal, and thus with CPI and PPI soaring near record highs, disseminating the real demand pull from the inflation push is all but impossible in deciding whether the consumer is ‘healthy’ and spending again.

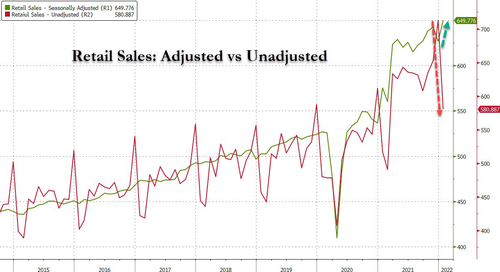

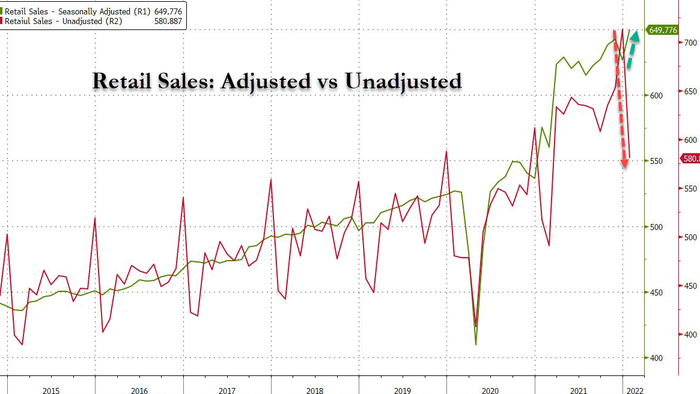

Finally, before we all go celebrating the return of the consumer, it is worth considering the absolutely stunning difference between ‘adjusted’ and non-adjusted retail sales data in January…

While ‘adjusted’ retail sales soared 3.8% MoM, the unadjusted retail sales data for January collapsed by a record 18.5% MoM.

This is the biggest seasonal adjustment on record.

Source link