FOMC Minutes Show Fed To Rush Rate-Hikes, Leaves QT Details Up In The Air

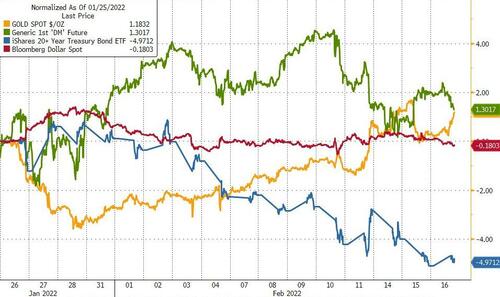

Since the Jan 26th FOMC meeting, bonds have been a bloodbath while stocks and gold are higher and the dollar flat…

Source: Bloomberg

We have also seen a dramatic rise in rate-hike odds in the period since the last FOMC meeting (helped in some part by Jim Bullard’s uber hawkish perspective), with a 60% chance of a 50bps hike in March priced-in…

Source: Bloomberg

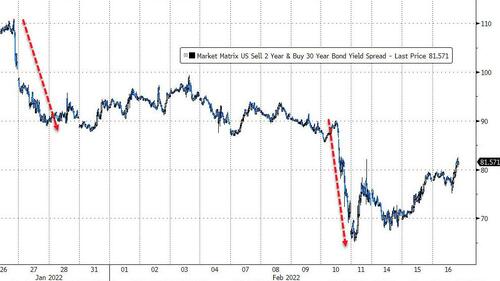

And as the liftoff and trajectory of rate-hikes soared, the yield curve has collapsed signaling growing market fears that The Fed is on a path to a policy error…

Source: Bloomberg

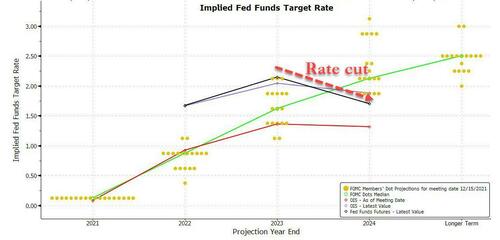

Perhaps most notable is the fact the forward curve has moved rapidly to price in rate-cuts starting in 2023…

Source: Bloomberg

Which is now very obviously pricing in a more hawkish Fed in the short-term and then a dovish collapse…

Source: Bloomberg

With all that said, today’s release of the Fed Minutes are somewhat moot, given all the post-FOMC FedSpeak, but all eyes will be on any signaling around the 50bps hike, the timing of QT, and any comments on the terminal rate (the peak rate of the hiking cycle) anyone on The Fed expects.

Here’s what they want us to see (even though this was before the big jobs print and 2 huge inflation prints) (via Newsquawk)

On Policy:

In light of elevated inflation pressures and the strong labor market, participants continued to judge that the Committee’s net asset purchases should be concluded soon

Most participants preferred to continue to reduce the Committee’s net asset purchases according to the schedule announced in December, bringing them to an end in early March.

A couple of participants stated that they favored ending the Committee’s net asset purchases sooner to send an even stronger signal that the Committee was committed to bringing down inflation.

Many participants commented that sales of agency MBS or reinvesting some portion of principal payments received from agency MBS into Treasury securities may be appropriate at some point in the future.

Participants discussed the implications of the economic outlook for the likely timing and pace for removing policy accommodation.

Compared with conditions in 2015 when the Committee last began a process of removing monetary policy accommodation., most participants suggested that a faster pace of increases in the target range for the federal funds rate than in the post-2015 period would likely be warranted, should the economy evolve generally in line with the Committee’s expectation.

Participants emphasized that the appropriate path of policy would depend on economic and financial developments and their implications for the outlook and the risks around the outlook, and they will be updating their assessments of the appropriate setting for the policy stance at each meeting.

Participants noted that the removal of policy accommodation in current circumstances depended on the timing and pace of both increases in the target range of the federal funds rate and the reduction in the size of the Federal Reserve’s balance sheet

In this context a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year

On persistent elevated inflation

In light of elevated inflation pressures and the strong labor market, participants continued to judge that the Committee’s net asset purchases should be concluded soon. Most participants preferred to continue to reduce the Committee’s net asset purchases according to the schedule announced in December, bringing them to an end in early March. A couple of participants stated that they favored ending the Committee’s net asset purchases sooner to send an even stronger signal that the Committee was committed to bringing down inflation.

On labor market conditions:

Many participants commented that they viewed labor market conditions as already at or very close to those consistent with maximum employment, citing indications of strong labor markets including the low levels of unemployment rates, elevated wage pressures, near-record levels of job openings and quits, and a broad shortage of workers across many parts of the economy. A couple of participants commented that, in their view, the economy likely had not yet reached maximum employment, noting that, even for prime-age workers, labor force participation rates were still lower than those that prevailed before the pandemic or that a reallocation of labor across sectors could lead to higher levels of employment over time.

On balance sheet composition:

Many participants commented that sales of agency MBS or reinvesting some portion of principal payments received from agency MBS into Treasury securities may be appropriate at some point in the future to enable suitable progress toward a longer-run SOMA portfolio composition consisting primarily of Treasury securities.

Participants discussed the implications of the economic outlook for the likely timing and pace for removing policy accommodation. Compared with conditions in 2015 when the Committee last began a process of removing monetary policy accommodation, participants viewed that there was a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market

On the pace of hiking:

Participants discussed the implications of the economic outlook for the likely timing and pace for removing policy accommodation. Compared with conditions in 2015 when the Committee last began a process of removing monetary policy accommodation, participants viewed that there was a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market.

They also anticipated that it would soon be appropriate to raise the target range. In discussing why beginning to remove policy accommodation could soon be warranted, participants noted that inflation continued to run well above 2 percent and generally judged the risks to the outlook for inflation as tilted to the upside. Participants also assessed that the labor market was strong, having made substantial, broad-based progress over the past year.

On pate of future policy:

Participants emphasized that the appropriate path of policy would depend on economic and financial developments and their implications for the outlook and the risks around the outlook, and they will be updating their assessments of the appropriate setting for the policy stance at each meeting.

Participants noted that the removal of policy accommodation in current circumstances depended on the timing and pace of both increases in the target range of the federal funds rate and the reduction in the size of the Federal Reserve’s balance sheet

In this context a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year

On outlook for monetary policy:

In their discussion of the outlook for monetary policy, many participants noted the influence on financial conditions of the Committee’s recent communications and viewed these communications as helpful in shifting private-sector expectations regarding the policy outlook into better alignment with the Committee’s assessment of appropriate policy. Participants continued to stress that maintaining flexibility to implement appropriate policy adjustments on the basis of risk-management considerations should be a guiding principle in conducting policy in the current highly uncertain environment. Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate. Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation. A few participants remarked that this risk could be mitigated through clear and effective communication of the Committee’s assessments of the economic outlook, the risks around the outlook, and the appropriate path for monetary policy.

On elevated asset prices:

The staff judged that asset valuation pressures remained elevated. In particular, the forward price-to-earnings ratio for the S&P 500 index stood at the upper end of its historical distribution; high-yield corporate bond spreads and the excess loan premium for leveraged loans remained at low levels; and house prices grew strongly, with price-to-rent ratios that were at elevated levels

On cryptocurrencies:

The staff noted that the market capitalization of crypto-assets had grown significantly over the past decade and had experienced considerable volatility, including sizable declines since late last year. The staff changed its assessment of vulnerabilities associated with nonfinancial leverage from notable to moderate, noting that measures of business leverage had declined to prepandemic levels.

Summary: Lack of (Hawkish) surprises.

As Newsquawk puts it, the minutes have seen little new information that markets were not aware of. The pick-up in stocks and Treasuries is likely a function of the lack of hawkish surprises, rather than outright dovishness.

Additionally, we did *not get any clarity on a 50bps rate liftoff *nor did we get much new regarding balance sheet reduction rather than its expected by “a number’ of participants “later this year”. There is some attention on the comment that the Fed Funds rate could increase at a faster pace than the post-2015 period, but given where markets are priced and the recent Fed speak projections, that’s not so surprising

On tapering, however there are a “couple” who favored ending net asset purchases sooner

The minutes also reinforced the data dependence mode from the Fed particularly around inflation where most” said “if inflation does not move down as they expect it would be appropriate to “remove policy accommodation at a faster pace than they currently anticipate

On a side note, we point out that yields at the long-end exploded higher about 5 minutes before The Minutes were released…

* * *

Read the full Fed Minutes below:

Source link