Treasury Market Liquidity Is Eroding With Fed’s Course a Gamble

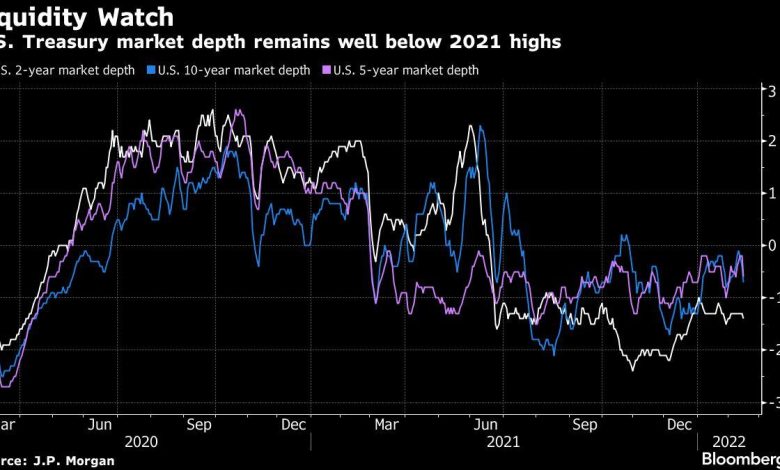

(Bloomberg) — Liquidity is eroding in the U.S. Treasury market again, as the past week’s controversy about how much and how quickly the Federal Reserve will raise interest rates this year unleashed a bout of extreme volatility in yields.

Most Read from Bloomberg

The Bloomberg U.S. Government Securities Liquidity Index — a gauge of deviations in yields from a fair-value model — is approaching last year’s highs, reached in early November. At that time, expectations for Fed hikes had begun to mount in October, causing historically large daily swings in short-dated Treasury yields in particular.

In the latest iteration, the prospect that the central bank — which normally changes its policy rate in quarter-percentage-point increments — might consider a half-point rate increase in March spurred the two-year note’s yield to rise 21 basis points on Feb. 10, its biggest increase since 2009. The same day a gauge of expected volatility in U.S. rates over the next 12 months reached the highest level since May 2010, a period of spectacular volatility in U.S. stocks.

“Any true depth of liquidity is low,” Peter Tchir, head of macro strategy at Academy Securities, said in a panel discussion on the Bloomberg TOPLive Blog Tuesday. In Treasuries, older securities “are trading very poorly, a sign of that lack of liquidity.”

Related: Rate Volatility at 2010 Mayhem Highs Lures $35 Million Sale

“As volatility has picked up, market depth has fallen,” JPMorgan Chase & Co. U.S. interest-rate strategists led by Jay Barry said in a Feb. 11 note. The “softer Treasury market liquidity acted as an accelerant in the latest moves,” they said. Market depth — derived from the sizes of the top three bids and offers on the BrokerTec trading system between 8:30 a.m. and 10:30 a.m. in New York — is depressed for all Treasury tenors, and worse for two-year notes than for the five- and 10-year.

With short positions anticipating higher yields elevated and continuing to grow, liquidity will be essential to avert a dramatic repricing lower in yield in the event of a reversal in sentiment that drives investors out of those positions.

(Adds comment in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link