‘There is danger on either side’ of rate hikes, Sevens Report founder says

Sevens Report Research Founder and President Tom Essaye joins Yahoo Finance Live to discuss the outlook for Fed rate hikes after Russia further invaded Ukraine.

Video Transcript

KARINA MITCHELL: All right, I want to bring in our next guest to discuss more market analysis as the crisis in Ukraine expands. Let’s bring in Tom Assaye, founder and president of Sevens Report Research. Tom, it’s been a really interesting 24 hours. I want to start with commodity prices. Given the surge there, oil in particular, you know, is that something that is going to be inflationary, or could it be disinflationary, depending on the duration?

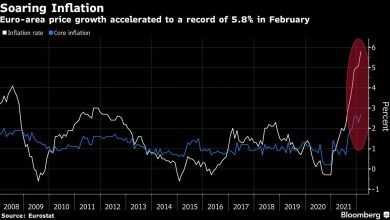

TOM ESSAYE: I think it will be inflationary. It’s just a question of how much. So this is coming at a very inopportune time because the global commodity markets were already stretched, right, from the pandemic reopening from some of the underinvestment and lack of supply chain capabilities. And now we’re throwing in a whole bunch of geopolitical risk premium on top of virtually every commodity. And, you know, we’re all focused on oil, but it’s not just oil. It’s aluminum. It’s wheat, it’s other grains. It’s kind of everything. So it will be inflationary. I think the question is, how long does this conflict last? And then, how much damage does that high inflation do to growth going forward?

KARINA MITCHELL: And so then how does the Fed react to all of this that’s going on? Does it have any choice but to hike, given the high inflation concerns, stagflation now coming into the conversation by some, and, you know, really strong labor conditions?

TOM ESSAYE: Yeah, the Fed’s reaction is that they will have no reaction, I think. You know, there’s nothing the Fed can do to help bring about peace in Russia and Ukraine. We have an inflation problem. That’s evident to everyone. We just had 7% Q4 2021 GDP, and we had very low unemployment. So the Fed will raise rates. I think they probably raise 25 in March and then probably go at that rate for the next couple of months.

Perhaps if the conflict drags on, and we see really continued elevated inflation and we start to see a slowing of growth, the Fed could hold off on some balance sheet reduction, but that’s a problem for the summer. In the meantime, the Fed will not change course. And anybody who’s hoping they’re going to be dovish, I’m afraid you’ll be disappointed.

KARINA MITCHELL: Yeah, 50 basis points, though, off the table, it seems like. But then are you worried at all of the Fed making a mistake? Because hiking into high inflation, you see energy prices, oil prices soaring past $100 a barrel and weakening growth down the road.

TOM ESSAYE: Yeah, I am quite nervous about a Fed mistake because the problem is, there’s a mistake on either side, right? If they don’t hike and this conflict drags on, then we are going to have significantly worse inflation, right? And that is going to become a problem for growth. And the only solution to that will be to hike even later when the economy can’t stand it. On the other side, if they hike too quickly, if they get too aggressive into, again, the natural slowing of growth, then maybe they crash the economy.

So there is a pretty narrow channel that they are going to have to navigate here. It has gotten more difficult in the last 24 hours. There’s no doubt about it. I am not envious of the Fed right now, but we have to hope that they chart the right course here because there is danger on either side.

ALEXIS CHRISTOFOROUS: You know, Tom, what are your– what’s your exposure to the emerging markets at the moment? Mark Mobius, who we know is a big EM investor, was talking about how China is now a safe haven, amidst all of this chaos. What are your thoughts on that?

TOM ESSAYE: You know, I tend to agree with him, although, obviously, that’s only for people who can really stomach a lot of volatility. If we look around the world and we say, hey, which government is stimulating their economy? Which government is really actively supporting economic growth? China comes to the top of the list. Right? Now they are coming out of a pretty deep valley. And they have had economic problems. They had a major property problem. But that government is very aggressively stimulating the economy. So I think that that can help China outperform.

Now we have to have geopolitical calm. We can’t be having a war in Ukraine and Russia ongoing, hopefully not spreading beyond those borders, and expect the emerging markets to trade well. So I think we have to have geopolitical [INAUDIBLE] in that environment. Yes, China can do well this year.

KARINA MITCHELL: And Tom, I want to ask you. Cyclicals really do generally very well up until the first couple of rate hikes. And then, you know, some of the gains sort of ease off. So what are the best bets now? Where should people be looking to allocate? Or should they be sitting in some cash at the moment?

TOM ESSAYE: I think that cyclicals are still a good place to go. I mean, from an asset allocation standpoint, obviously, commodities had a huge tailwind. I understand the commodity producing equities, your XLEs, your GDXs, I understand they’ve had big moves. But look, if this conflict really extends out a couple of months, they will go much, much, much higher. So don’t count them out just because they’ve rallied. Also, if you go to your industrials, if you go to your financials, I know they’re getting hit today on some concerns, but they’re generally solid. I think that’s where you can go to try and get some exposure to still strong growth. You’re absolutely right. Usually, it takes several rate hikes to cool the economy. I don’t expect it’ll be different this time.

KARINA MITCHELL: And then so where in commodities do you like? Because we’ve seen precious metals metals, like gold, soar much higher than $1,930, I think, was the last time I looked today.

TOM ESSAYE: Yeah, I think you can spread your money around. I think this is a whole commodity complex bull market. Energy, as long as there is geopolitical angst, will probably do the best, but you will also encounter the most volatility. Gold has a pretty strong tailwind because this geopolitical concern, call it, is not going away anytime soon.

Even if the hostilities stop, which hopefully they do soon, there’s still going to be a lot of uncertainty. And then finally, looking at something like a DBA, which gives you more targeted grain exposure. Between Russia and Ukraine, they export almost 30% of the world’s wheat. That is going to suffer, frankly, from this conflict, regardless of how quickly or long it goes. So I think it’s a whole commodity complex. Something like a DBC or a DBA is an easy way to go.

ALEXIS CHRISTOFOROUS: You know, another– what investors were calling digital gold, right, cryptocurrencies, in particular, Bitcoin, just getting slammed here. I’m looking at Bitcoin right now, down 5%, below $36,000. This is a real geopolitical test, I guess, for cryptocurrencies. They haven’t lived through anything like this since they came into existence. What’s your take on the crypto sector right now? And is this perhaps a buying opportunity?

TOM ESSAYE: Yeah, Alexis, great insight. I think that there will be a lot of Bitcoin owners who are quite disappointed this morning. And I think that they will realize that Bitcoin, while sort of from a theoretical standpoint, this is supposed to be an asset that should do well in this type of environment, there is a lot of speculative money that flowed into the crypto space solely for the momentum. So you don’t have a lot of people who bought this as sort of a non-hedged and non-correlated asset. They bought it because it was going up and now it is going down, and they are selling it.

And I think that this is a major test for Bitcoin. I think Bitcoin is going to fail this test. It’s part of the maturity process. It’s not mature enough yet to go through a major global conflict and really hold up value. Gold has been through this countless times over the decades and centuries. So it’s doing exactly what it’s supposed to do. Maybe one day, Bitcoin gets there, but I think it’s not mature enough yet.

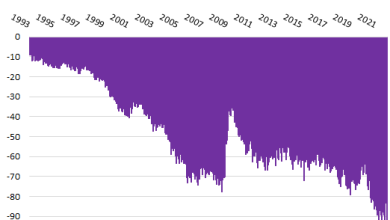

KARINA MITCHELL: And Tom, I want to ask you also really quickly. So oil spiking, right? Inflation at seven-year highs. Some say at 40-year highs at 7%. Some say it could hit 10%. How resilient is the consumer in all of this, with real wages in negative territory?

TOM ESSAYE: It’s been resilient, but that resilience is going to wane. This is the key, right? At what point does inflation get high enough that it begins to contract growth? I do not think we are there yet, but I think we are getting close. I think by the summer, if we don’t get some relief, it becomes a problem.

KARINA MITCHELL: OK–

Source link