Russia attack on Ukraine may nudge Fed to less aggressive move next month

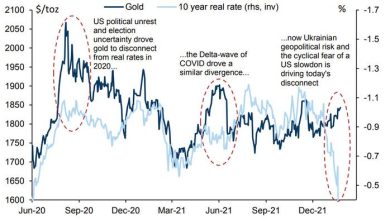

Russia’s attack on Ukraine is fueling geopolitical risk that may push the Federal Reserve away from a more aggressive interest rate increase in March.

Fed officials, who are still eager to begin the process of paring back pandemic-era easy money policies, say they are monitoring any spillover effects of the conflict onto U.S. economic activity.

“These create a lot of uncertainty and uncertainty, as we know, is a demand shock,” San Francisco Fed President Mary Daly told reporters on Feb. 23 — before Russian President Vladimir Putin announced the attack on Ukraine. “And how big the demand shock is depends on how high the uncertainty is and how long it lasts.”

High inflation in the U.S. had stoked speculation that the Fed may want to move quicker on normalizing short-term interest rates, which the central bank had been holding at near zero since the pandemic began. Earlier in February, St. Louis Fed President Jim Bullard outright said he would support a double interest rate hike (of 0.50%) in the Fed’s next meeting in mid-March.

The Fed has not raised interest rates by more than 0.25% in a single meeting since 2000.

But economists say the evolving situation in Ukraine introduces a whole new set of uncertainties to a global recovery still facing the challenge of a pandemic. Disruptions to Russian oil and gas supply are pushing energy prices higher, and Ukraine’s importance to the European economy is already raising questions about the impact to real income and growth across the entire continent.

With the picture unclear, Fed watchers say policymakers stateside are likely to hold back from a double bump in rates, as Fed officials defer to options less likely to rattle the already sensitive financial markets.

“[W]e do not expect geopolitical risk to stop the FOMC from hiking steadily by 25 [basis points] at its upcoming meetings, though we do think that geopolitical uncertainty further lowers the odds of a 50bp hike in March,” Goldman Sachs Economics Research wrote Wednesday night.

Evercore ISI similarly said the risks from Ukraine are likely to steer the Fed away from a double hike. But analysts noted that the shock of higher energy prices as a result of the disruption to Russian oil and gas supply may exacerbate the ongoing U.S. challenge of high inflation.

“At a minimum, the further boost to headline inflation from higher energy costs will make the central banks additionally sensitive to any hints of second round effects in the coming months — potentially in the U.S. for instance resulting in a 50bp move some time after March,” Evercore ISI said Thursday.

Daly said Wednesday that she currently expects to support a 0.25% move in March, although all policy options are “on the table” with additional readings on inflation and employment expected before the next meeting on March 16.

Fed funds futures, the CME Group’s betting market for Fed moves on interest rates, were pricing in an 87% chance of a 0.25% move in March instead of 0.50%.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link