Relief Rally to Continue for a While

There is a likelihood that the pair will continue the bullish momentum ahead of the upcoming decision by the European Central Bank.

Bullish View

- Buy the EUR/USD and set a take-profit at 1.1300.

- Add a stop-loss at 1.1150.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.1170 and a take-profit at 1.1100.

- Add a stop-loss at 1.1250.

The EUR/USD pair bounced back on the first day of the month as investors reflected on the latest economic data from the Eurozone. The pair is trading at 1.1215, which is about 0.80% above the lowest level in January.

PMI Data Ahead

The EUR/USD pair declined sharply last week as investors reflected on the hawkish interest rate decision by the Federal Reserve. In it, the bank warned that it will end its asset purchases program in March and then implement a series of interest rate hikes this year. During the weekend, Raphael Bostic warned that the Fed could implement this hiking cycle in tranches of 50 basis points each.

Now, focus shifts to this week’s interest rate decision by the European Central Bank (ECB). The decision will come a few days after the EU published strong economic data. On Monday, data by Eurostat showed that the bloc’s economy expanded by 0.3% in the fourth quarter after it contracted by about 2% in the previous quarter.

The Eurozone’s economic recovery was attributed to the strong performance in France, Italy, and Spain. These economies rebounded sharply even as the Covid-19 pandemic continued to spread. On the other hand, the biggest laggard was Germany.

Therefore, the EUR/USD rose as investors started to price in a situation where the ECB signals that it will start to wind down its pandemic-era economic policies. For example, it could signal that it will end its asset purchases earlier than expected and then hike interest rates in the third or fourth quarter.

Later today, the key catalyst for the EUR/USD price will be the latest manufacturing PMI data by Markit and the Institute of Supply Management (ISM). Based on the estimates numbers published almost two weeks ago, analysts expect the data to show that the manufacturing sector held steady in January.

EUR/USD Outlook

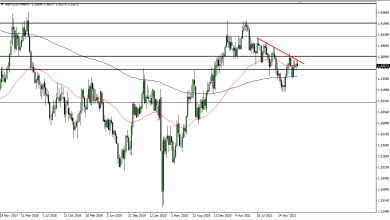

The four-hour chart shows that the EUR/USD pair has started the year well. It has erased some of the losses that it made last week. As a result, it has moved slightly above the 25-day moving average and the standard pivot point.

At the same time, the Relative Strength Index (RSI) and other oscillators have started pointing upwards. Therefore, there is a likelihood that the pair will continue the bullish momentum ahead of the upcoming decision by the European Central Bank. If this happens, the next key level to watch will be at 1.1300.

Source link