Oil closes in on $100 a barrel as European storage sites hit by cyber attacks

Brent Crude oil (BZ=F) continued its push to $100 (£74) a barrel on Friday despite a string of cyber attacks on European storage sites this week.

Oil prices were more than $92 in early trade, a rise of 1.3%, pulling up oil majors such as Shell (SHEL.L) and BP (BP.L). Both companies climbed 3% on the day to the top of the FTSE 100 just a day after Shell reported that annual profits quadrupled last year.

The climb meant that Brent was at its highest level in more than seven years, since October 2014.

As oil prices head for their seventh weekly gain, West Texas Intermediate (WTI) also hit a fresh seven-year high as it neared $91 a barrel. It is on track for a jump of more than 4% this week.

Edward Moya, senior market analyst at OANDA, said: “WTI crude surged over the $90 level after an Arctic blast made its way to Texas and disrupted some oil production in the Permian Basin.”

It came as two German fuel storage firms were hit by a ransomware software known as Black Cat this week, adding to the pressures on crude supply.

Mabanfaft and Oiltanking are believed to have been hacked by attackers linked to the Russian group that also targeted the Colonial Pipeline in the US last year.

Other sites across Europe also experienced IT issues, including SEA-Invest in Belgium, a site in Malta and Evos in the Netherlands. However, it has not been confirmed if these are related to the German attacks.

Belgian prosecutors say they are investigating the cyber-attack that’s affected SEA-Invest terminals including the company’s largest in Antwerp, called SEA-Tank.

“Some types of malware scoop up emails and contact lists and use them to automatically spam malicious attachments or links, so companies with shared connections can sometimes be hit in quick succession,” Brett Callow, threat analyst at cyber-security company Emsisoft, said.

“This is why you sometimes see sector-based or geographic-based clusters of incidents.”

Read more: Shell ups share repurchases and dividend as earnings surge

Oil has been bolstered recently by supply concerns and increasing geopolitical tensions between Russia and Ukraine, which could threaten supply to Europe.

Investors have also raised doubts over OPEC’s ability to deliver its plans to boost output. The OPEC+ group, which includes Russia, is continuing to increase supplies gradually, even as demand increases as economies recover from the COVID-19 pandemic.

It said it would aim to raise production by another 400,000 barrels a day in March, continuing with the monthly plan agreed in July to gradually replace output cuts at the start of the health crisis.

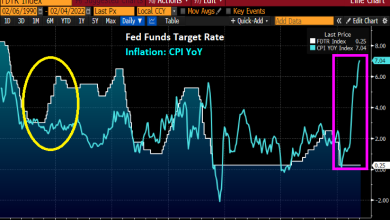

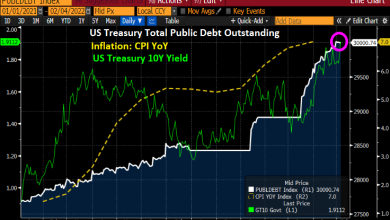

An emerging winter storm across the US has also added to the further threat of supply disruption, pushing the price to stand ahead by almost 18% in the year to date. This has intensified the energy crunch that is currently driving up inflation, squeezing households, and boosting oil producers’ earnings.

Analysts have predicted that Brent crude will reach more than $100 this year.

Watch: Shell ends 2021 on high note, hikes dividend

Source link