Natural Gas Technical Analysis: Price Continues to Decline

Our expectations still suggest a return to the rise of natural gas during its upcoming trading.

Spot natural gas prices (CFDS ON NATURAL GAS) declined during the recent trading at the intraday levels, to record daily losses until the moment of writing this report, by -1.20%. It settled at the price of $4.272 per million British thermal units, after declining during yesterday’s trading and for the fourth day on respectively, by -1.88%.

Yesterday, natural gas prices took some breaths after a series of big drops, with Nymex gas futures for March finally settling just 1.6 cents higher at $4,248. With more moderate losses in Tuesday’s trading, spot gas prices NGI’s Spot Gas National Avg down 12.0 cents to $4.615.

Much of the United States is experiencing a respite from Arctic conditions that have descended south to Texas in recent days, with arctic air retreating to Canada. However the possibility of a return of the cold wind refreshed.

There has been some inconsistency between the GFS and European models in recent runs, but both showed cold weather hitting the eastern half of the US this weekend and into early next week.

However, it may make sense that the market has been struggling to determine a fair price for natural gas, according to on-demand weather services. The company has noted that price fluctuations are often exaggerated versus changes in weather, as has been the case recently.

Along with the temperature forecast, traders are also competing with stronger production gains. This may be the reason for the immediate weakness of the month in the end. Preliminary data showed output rose the lowest 48 near 93 billion cubic feet, and production should continue to rise now that the cold has waned, and the snow has receded.

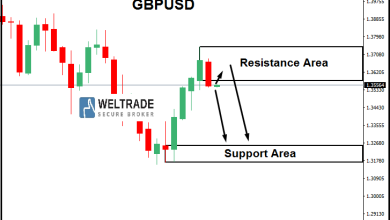

Technically, the price continues to search for a bullish bottom to take as a base that might help it gain the necessary positive momentum to recover and rise again, amid the influx of negative signs on the relative strength indicators.

This is considering the dominance of the main bullish trend over the medium term along a slope line, as shown in the attached chart for a (daily) period, with the positive pressure continuing in its trading above its simple moving average for the previous 50 days.

Therefore, our expectations still suggest a return to the rise of natural gas during its upcoming trading, provided that the support level of 4.200 remains intact, to target the first resistance levels at the price of 4.954.

Source link