More Sell-Off as Fear Rises

There is a possibility that the pair will keep dropping in the coming days.

Bearish View

- Sell the BTC/USD and set a take-profit at 36,000.

- Add a stop-loss at 40,000.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 39,000 and a take-profit at 41,000.

- Set a stop-loss at 38,000.

The BTC/USD pair continued its bearish trend during the weekend as geopolitics concerns remained. The pair declined to a low of 38,240, which was significantly lower than last week’s high of almost 45,000. The Bitcoin fear and greed index has moved to the lowest level in weeks.

Divergence with Gold

The BTC/USD pair declined even as gold prices soared. Gold, which is often seen as a safe haven, rose to the highest level in more than 6 months. As a result, the overall divergence between gold and Bitcoin has widened, considering that the latter has dropped by over 40% from its all-time high. Therefore, investors seem to be believing that gold is a better hedge against risks than Bitcoin.

Bitcoin’s price action has also mirrored the performance of the tech-heavy NASDAQ 100 index. The index, which tracks the biggest tech names in the US, has dropped by more than 16% from its highest level this year. This means that it is nearing its bearish territory.

There are two main drivers to Bitcoin’s performance in the past few months. First, there is the ongoing crisis in Europe, where there are worries that Russia will attack Ukraine. The crisis has triggered a substantial sell-off in stocks, which have a close correlation with Bitcoin.

Second, there are fears that the Federal Reserve will embrace a more hawkish monetary policy considering that the American economy remains at a good place. For example, data published last week showed that the country’s retail sales rebounded sharply in January even as inflation jumped to the highest level in over 40 years.

Therefore, analysts are positioning themselves for multiple rate hikes this year. In a statement last week, analysts at JP Morgan noted that the bank will likely implement about 7 rate hikes this year as it battles inflation. That will be the highest number of hikes in years.

BTC/USD Forecast

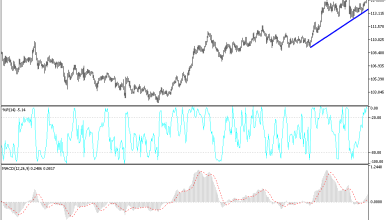

The BTC/USD pair declined sharply during the weekend as demand for Bitcoin waned. The pair dropped to a low of 38,000, which was the lowest level since February 4th. It managed to move below the key support level at 41,716, which was the lowest point on February 14th. It also dropped below the 25-day moving average.

The pair also moved between the lower and middle lines of the Bollinger Bands while the TRIX indicator has crossed the neutral level. Therefore, there is a possibility that the pair will keep dropping in the coming days.

Source link