USD Gets Crushed Against Indian Rupee

This is a market that I think is trying to carve out more of a range than anything else, and it looks like we are ready to turn things around.

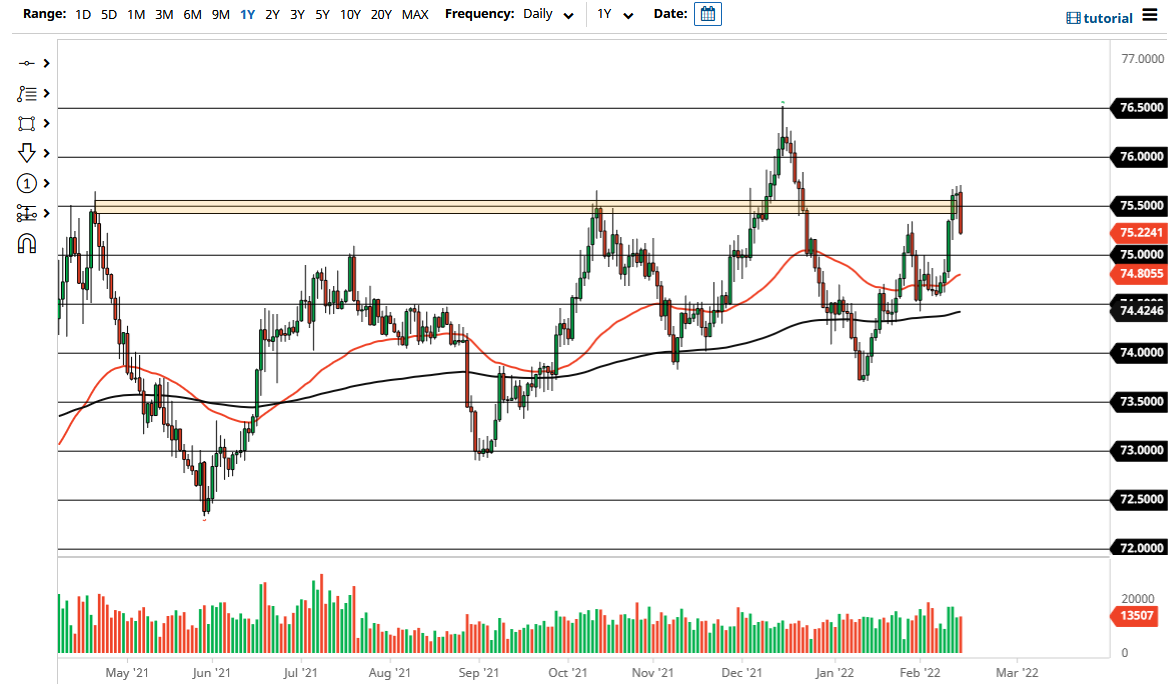

The US dollar fell rather hard against the Indian rupee on Tuesday to slice through the ₹75.50 handle. The size of the candlestick is rather large, so it does suggest that we are more than likely going to see a bit of follow-through. At this point, the question is whether or not we can break down below the ₹75 level. Obviously, that would be a very “risk on move”, as it would be negative for the greenback, which is considered to be a safety currency, and positive for an emerging market currency.

The rupee has been extremely popular lately – don’t miss these interesting opportunities!

When you look at the longer-term chart, you could make an argument for a massive head and shoulders pattern trying to start, but we are so far from that actually be in reality it is just something that you need to keep in the back of your mind. The fact that the market had closed at the very low of the trading session, which suggests that we could see a little bit of follow-through at this point. If we did break down below the ₹75 level, then we will go looking towards the 50 day EMA initially, perhaps even down to the 200 day EMA.

To the upside, if we can break above the highs of the last couple of days that would be very bullish for the US dollar, perhaps sending it towards the ₹76 level, before testing the highs at the ₹76.50 handle. Ultimately, this is a market that I think is trying to carve out more of a range than anything else, and it looks like we are ready to turn things around. That being said, if we get some type of major negative headline from geopolitics, it is very likely that we could see money flowing right back towards the US dollar. Furthermore, inflation is very bad for a lot of emerging market economies, so I do think that the downside is somewhat limited, but we could have a nice run for the next several sessions. It is not until we break above the highs of the last couple of days that I would consider buying this market, as it appears that near the ₹75.60 level, we have a lot of selling pressure. Breaking that would obviously kick off the potential for a short covering rally.

Source link