GBP/USD Technical Analysis: Testing Important Levels

Despite the recent strength of the US dollar, GBP/USD has settled above the recently recovered 1.35 level. It may try again to reclaim 1.36 over the coming days, but the Fed’s increasingly hawkish policy expectations are likely to constrain the pound. up there. Amidst aversion to risk, the GBP/USD pair fell at the beginning of this week’s trading to the 1.3495 support level, before settling around the 1.3545 level at the time of writing the analysis.

The pound held out better than many other major currencies during last Friday’s bout of strength in the US dollar, which was boosted ahead of the weekend by comments from the Federal Reserve’s James Bullard as well as by investors’ risk aversion linked to events across Ukraine.

GBP/USD was testing an important level of technical resistance around 1.36 on Friday before being affected by reports in the US and international media that an extension of the 2014 Russian incursion into the country may be likely sometime during the current week. In this regard, National Security Adviser Jake Sullivan later said, referring to Russian President Vladimir Putin during the press, “We saw that we don’t think he made any kind of final decision – or we don’t know that he made any final decision.”

Although White House officials later admitted that the attack on Ukraine is not actually certain, the alleged threat of one of them helped push up the value of the dollar, something that could have a suppressive effect on the GBP/USD rate this week.

Last week witnessed the GBP/USD price withdrawing from buyers on the decline every time it brought it back loops of weakness towards the 1.35 level. This closely coincides with the 100-day moving average for the British pound, a level around which it may continue to find support during next few days. Accordingly, warns Juan Manuel Herrera, strategist at Scotiabank, “The fact that this range-constrained period has now lasted longer than the bounce off around 1.3350 suggests a closing window to extend its gains – and the pound may actually fall below 1.35 to resume the downtrend since last June.” “Support is the number along with the 100-day moving average at 1.3505 followed by the 50-day moving average at 1.3463,” the analyst added.

While geopolitics will almost inevitably be a major focus for financial markets this week, the pound against the dollar is also likely to be sensitive to comments by Fed monetary policy officials throughout the week. It was FOMC member James Bullard who suggested last Thursday that the Fed should consider raising interest rates by a larger-than-usual 50 basis points in March after the release of official data showing inflation in the US rose to a four-high. In a decade it reached 7.5% in January, which helped the US dollar gain solid gains against the other major currencies.

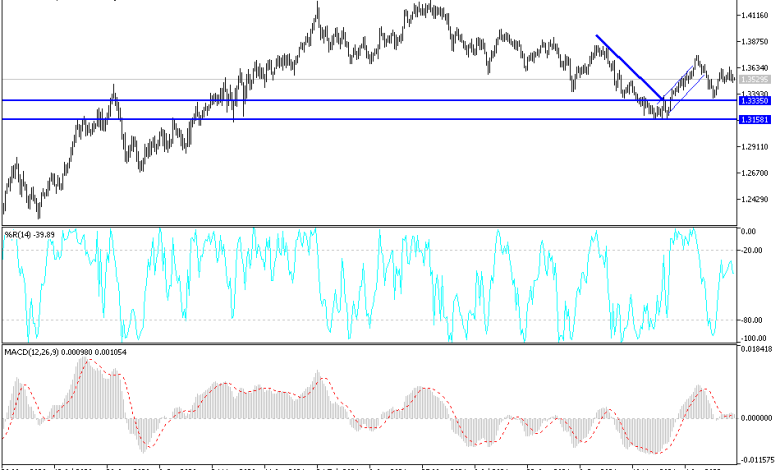

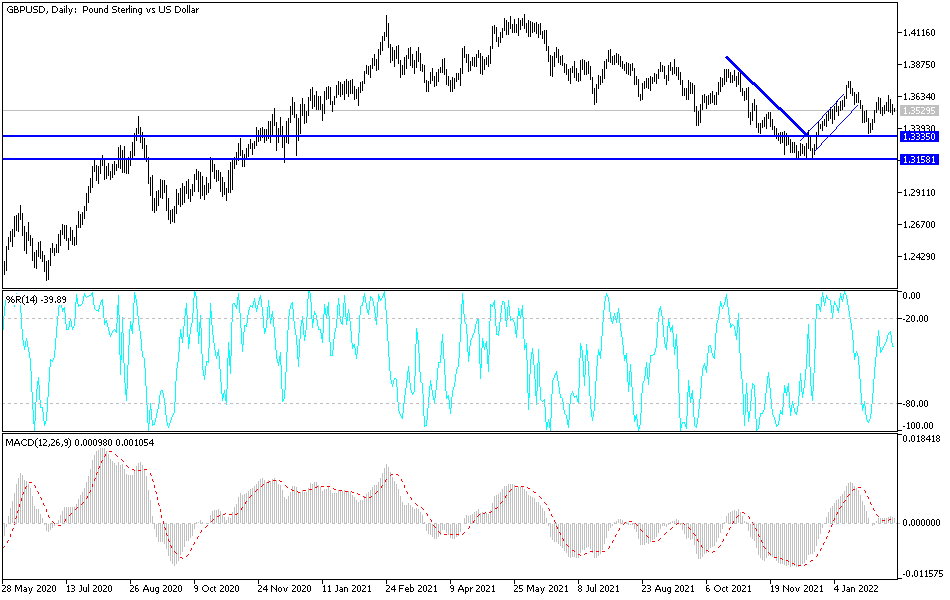

According to the technical analysis of the pair: On the daily chart below, the price of the GBP/USD currency pair is still showing resilience in the face of the US dollar’s gains from the demand as a safe haven in light of global geopolitical tensions. At the same time, this resistance may collapse if the currency pair moves towards the support levels 1.3435 and 1.3300, respectively. On the other hand, the bulls will gain momentum if the currency pair returns to the resistance level 1.3660. The currency pair will be affected today by the announcement of job and wage numbers in Britain, as well as the US producer price index reading.

Source link