Gold Markets On Edge Yet Again

You should be aware of the fact that the market is obviously very strong, so shorting gold is all but impossible at this point.

The gold markets have been all over the place during the trading session on Monday, as we continue to see a lot of geopolitical concern near the Ukraine/Russia border. Vladimir Putin is now looking likely to recognize the breakaway Ukrainian regions as state entities, and thereby has likely set forth the motion of escalating. There has been a lot of back and forth when it comes to world leaders over the last several days, and the most recent positive development was that Emmanuel Macron, Joe Biden, and Vladimir Putin are all supposedly going to meet relatively soon, so mean that the Russians do not invade Ukraine.

Beyond that, we have seen the inflation numbers continue to spike around the world, so people start to look at gold as an alternative in order to protect wealth. That has been going on before a lot of the noise in the Ukrainian border area, so this simply put a bit of a turbocharging to the gold market going forward. Unfortunately for a lot of retail traders, most of the gold moves have been due to headlines crossing the wires over the last couple of days, and most retail traders get the news far too late to jump all over it. That being said, you should be aware of the fact that the market is obviously very strong, so shorting gold is all but impossible at this point.

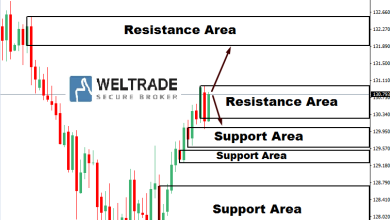

The $1880 level underneath should be rather supportive as it was resistance previously, and therefore I think it is a scenario where you look at that as a potential level that buyers would step back and if we did in fact get that pullback. To the upside, the $1920 level was a major peak going back about a year ago, so if we break above there then it would be a “fresh, new high” in the market, and that of course attract even more money. Regardless, I just do not see a scenario where you would be a seller of gold, unless of course something changes from a geopolitical standpoint. Even then, I think you could probably look at an even deeper correction as an opportunity to pick up gold “on the cheap.” As long as we have massive inflation and uncertainty, it does make a certain amount of sense that gold would attract quite a bit of interest.

Source link