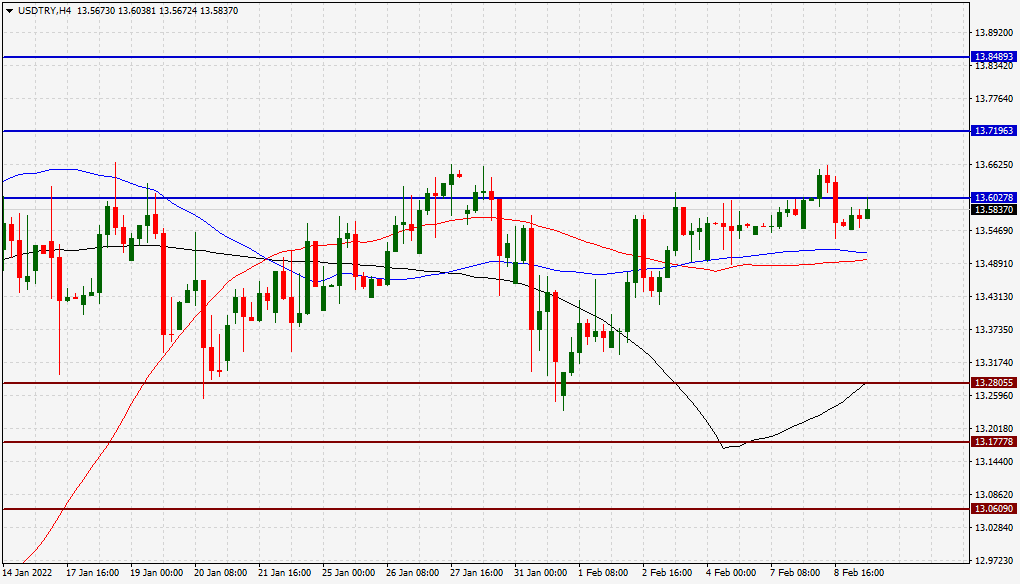

USD/TRY Forex Signal: Trading Below Resistance Levels

We expect the lira to decline, especially after it approached the mentioned resistance levels, as it targets the support levels on the other side.

Today’s USD/TRY Signal

Risk 0.50%.

Buy the order for yesterday, as half of the contracts were closed, and the stop-loss point was moved to the entry point

Best Buy Entry Points

- Entering a long position with a pending order from 13.29 levels.

- Place your stop-loss point below the 13.10 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best Selling Entry Points

- Entering a short position with a pending order from 13.71 levels.

- The best points to place the stop loss are above 13.89 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The price of the Turkish lira varied against the dollar during the early trading of Wednesday. This is despite the Turkish government’s continued attempts to expand the inclusion of citizens’ savings, especially foreign currencies, and gold, within the country’s financial system. While controlling the depreciation of the lira while adhering to the country’s president’s policy of lowering the interest rate despite the rise in inflation in the country to its highest level in nearly twenty years, since the Justice and Development Party came to power in the country. In this context, the Turkish Finance Minister said that a package of decisions will be announced aimed at introducing the citizens’ saved gold into the homes, which is estimated at 5,000 tons, equivalent to between 250 and 350 billion dollars, within the country’s financial system.

The lira is still trading above the 50, 100 and 200 moving averages, respectively, on the four-hour time frame, as well as the 60-minute time frame. The lira is also trading below the resistance levels that are concentrated at 1371 and 13.84, respectively. On the other hand, the lira is trading the highest support levels at 13.28 and 13.06. The lira is still trading within a limited price range without significant changes. We expect the lira to decline, especially after it approached the mentioned resistance levels, as it targets the support levels on the other side. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Source link