GBP/USD Technical Analysis: Rising Interest Rates

The US dollar may be set for a softer February month according to analysts, a view that could carry a return to its 2022 highs for the pound-dollar exchange rate. In a distinguished performance, as usual, the price of the GBP/USD currency pair rebounded for two days in a row, with gains to the 1.3525 resistance level, which is stable around it at the time of writing the analysis. The rebound gains came amid profit-taking sales of the dollar’s recent gains, in addition to the strong expectations of an opportunity to raise interest rates from the Bank of England this week.

With 2022 approaching, the US dollar was a huge favorite among analysts and market participants alike, as it emerged after 2021 strong, but initially fell in the first half of the month before falling off its feet. Indeed, the latter half of January was met with coordinated buying of the dollar as the long-held net US dollar has now been pared back and investors have begun to buy back into the hawkish Fed that indicated it could raise interest rates by as many as four times in 2022.

For one analyst, the US dollar was weak at the beginning of February.

Brent Donnelly, CEO of Spectra Markets, says: “For me, this is a great place to take a shot for short bucks. You have all kinds of things that suggest it’s a good tactical entry.” Donnelly also says that the end of January period was dominated by large dollar buying, but now that that is over, the market may be ready to sell the dollar.

Donnelly believes that the forex foreign exchange market could be tempted to return to the moves seen in January, and therefore the strength of the US dollar should fade. In January, the dollar rose about 1.0% against the pound and about 2% against the euro.

Donnelly also found that US data is slowing “because of the financial cliff, not because of Omicron”.

More importantly, the boost to US yields provided by last week’s Fed meeting will start to wane, Donnelly says, and so US interest rates will start converging with rates elsewhere. In a possible omen for the new month, the dollar was unfavorable on January 31 when it fell against all of its peers, allowing the euro/dollar exchange rate to recover again to 1.1275 and the pound/dollar exchange rate to rise again to 1.3520. Meanwhile, this week should be significant for the British Pound which will be subject to the Bank of England interest rate decision, scheduled for Thursday.

The British central bank is widely expected to raise interest rates by 25 basis points and announce that it intends to begin negative liquidation of its balance sheet by opting not to reinvest maturing bonds purchased under the quantitative easing program. For sterling to remain steady, the bank must move forward and meet market expectations by raising interest rates while also noting the need for rate hikes.

The downside risk for sterling comes in the form of the bank’s warning that market expectations of up to 100 basis points of gains by the end of 2022 are unjustified.

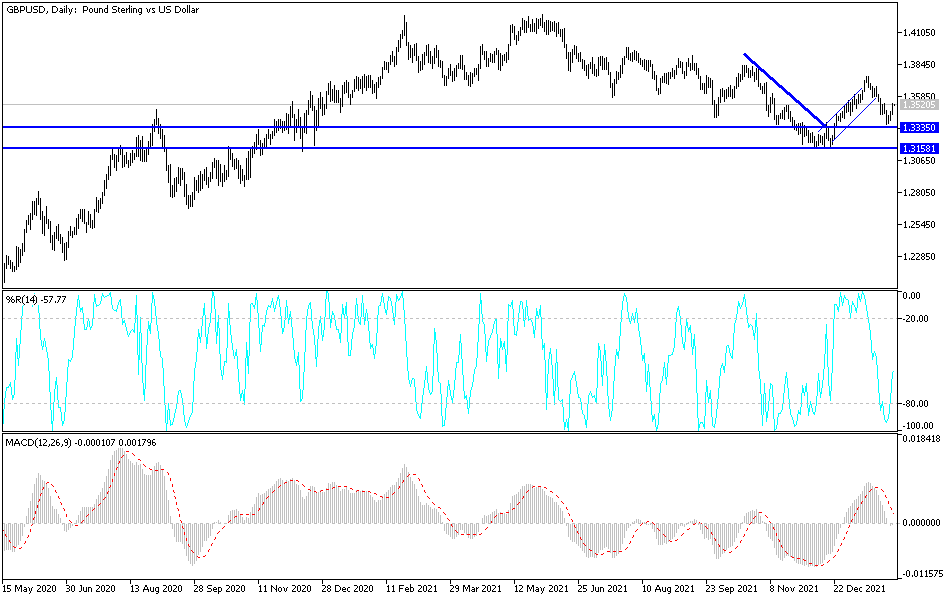

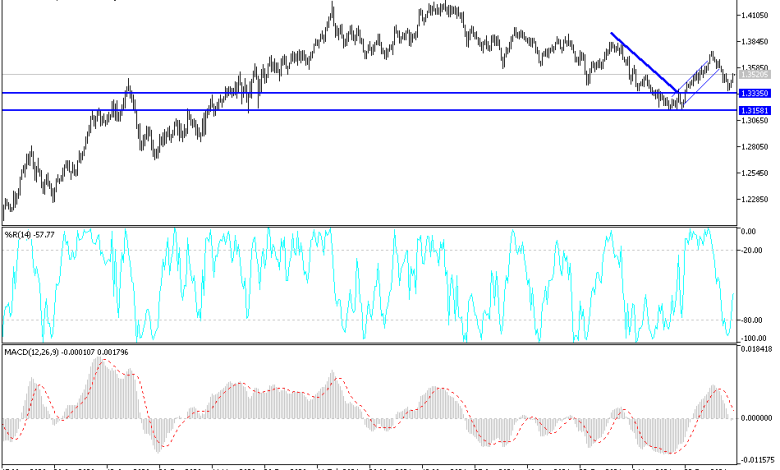

According to the technical analysis of the pair: The price of the GBP/USD currency pair is trying to form an opposite channel to the recent bearish move, and it may succeed in that if the currency pair moves towards the resistance levels 1.3600 and 1.3735. On the downside on the daily chart, the move towards the 1.3330 support level is the most important to change the general trend to a bearish, stronger, and continuous. The currency pair may remain subject to instability until the Bank of England announces its monetary policy decisions tomorrow, Thursday. The bulls may try to gain more ground. It may give up all its profits unless the bank offers what the markets price.

Source link