GBP/USD Technical Analysis: Ready to Rise

The sterling did not suffer sharp losses due to the anxiety on the Russian-Ukrainian border. The price of the GBP/USD currency pair is still stable around the 1.3560 level at the time of writing the analysis

British inflation figures today showed that the Bank of England’s plans to accelerate tightening are in order, which will support the sterling against the rest of the other major currencies.

Financial markets have come to anticipate an increased pace in interest rate hikes from the Bank of England, which has been supportive of the Pound in recent months. It could remain supportive this week even if this eventually leaves some investors frustrated at various points in the coming months. Sterling finished 2021 and started 2022 on strong foundations as markets priced higher interest rates at the Bank of England, but they’ve done the same recently for the Euro.

More than 130,000 Russian troops remain on standby on Russia’s border with Ukraine, and a senior US source told The Mirror that the Kremlin will order an attack at 3 a.m. local time on Wednesday. For his part, British Prime Minister Boris Johnson said that “the intelligence we are seeing today is still not encouraging”, as Russian field hospitals are being built near Belarus’ border with Ukraine. Johnson added that this could only be “interpreted as a willingness to invade”.

In a possible pretext for the invasion, Russian President Vladimir Putin said in an appearance alongside the German chancellor after the talks, “In our opinion, what is happening now in the Donbass is genocide.” Donbass is a region in southeastern Ukraine, part of which is occupied by two unrecognized separatist states, the Donetsk People’s Republic and the Luhansk People’s Republic.

They are unofficially supported by Moscow in their attempts to break away from Ukraine.

Besides accusations of genocide on Ukrainian soil, Putin said what happens next in Ukraine is not entirely up to Russia. Commenting on this, Susanna Streeter, Senior Investment and Markets Analyst at Hargreaves Lansdown said: “There remains very vigilance about Moscow’s agenda and investors remain very sensitive to the geopolitical situation.” Tensions are likely to remain high until there are more specific signs of de-escalation.

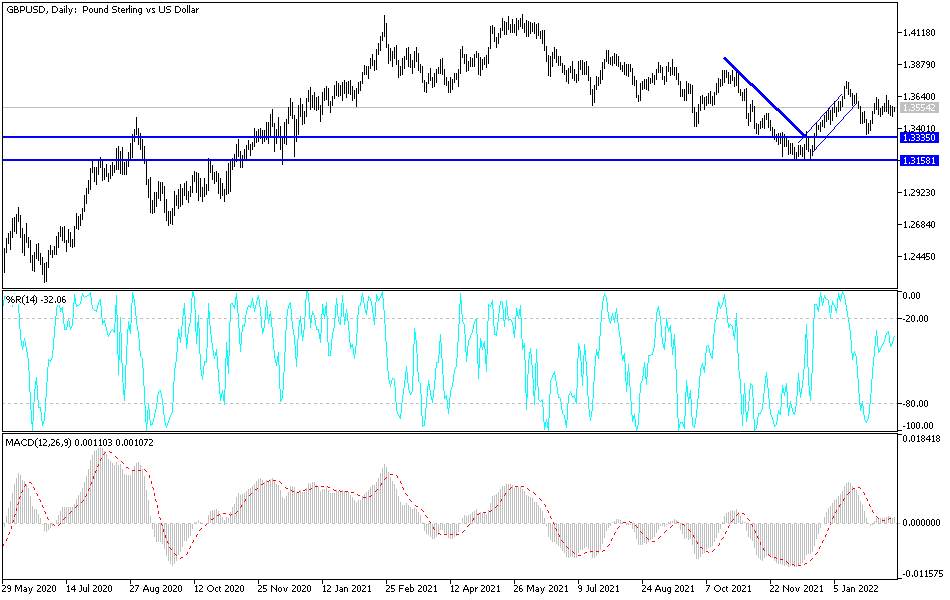

According to the technical analysis of the pair: There is no change in my technical point of view for the performance of the GBP/USD currency pair in the possibility of rebounding upwards. The bulls are still targeting the resistance levels 1.3660 and 1.3750 to further launch higher and support the upward trend. According to the performance on the daily chart, bulls’ attempts may fail, and the pair’s direction will change to a bearish move towards the 1.3350 support level after the announcement of the British inflation figures. The currency pair will be affected by the announcement of the US retail sales figures, ending with the announcement of the minutes of the last meeting of the Federal Reserve.

Source link