GBP/USD Technical Analysis: Neutral Performance

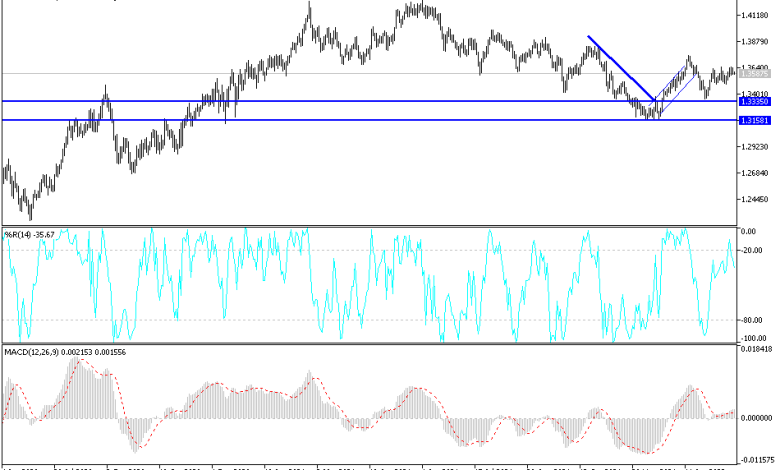

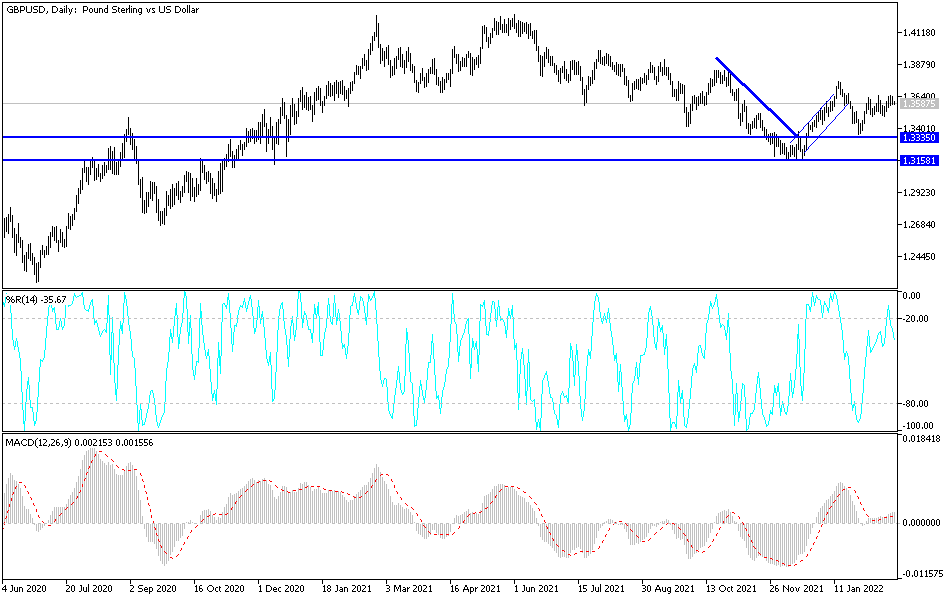

The GBP/USD exchange rate consolidated its recovery from its lows in late January last week. However, the presence of a group of upper resistances near 1.37 may limit the upside of the pound over the coming days while the situation along the Russian-Ukrainian border remains dangerous. The GBP/USD pair entered the week’s trading, stabilizing around the 1.3638 level, before settling around the 1.3585 level at the time of writing the analysis.

The currency pair’s gains were halted after ceasefire violations and related events in eastern Ukraine, which raised market concern about the risks of conflict in Europe and triggered a reversal for riskier currencies. The evacuation of residents from the breakaway provinces of eastern Ukraine, to Russia, was a clear indication of the risk of escalating conflict which is likely to remain at the top of the concerns of at least some market participants in the coming days, although the recent streak of bullish sterling has had surprises in the data. The UK economy is a dominant influence while its potential implications for Bank of England (BoE) policy will be in focus again this week.

Commenting on future predictions. “We are waiting for speeches and appearances in Parliament next week from the BoE Governor and the Bank’s Chief Economist to report on the prospects for the March meeting – as we continue to believe it is unlikely that the Bank will raise rates by 50 basis points,” says Juan Manuel Herrera, Scotiabank strategist. The analyst added, “Sterling rose to an eight-day high before some selling pressure emerged around the middle number area but the technical trends over the past four days point to further gains ahead of a test of 1.37 once it breaks solidly above mid 1.36.”

The first date in the UK calendar this week is the release of IHS Markit surveys of key economic sectors on Monday which could provide an additional indication that the UK economy has weathered the Omicron variant of the coronavirus in a resilient manner, although one of the highlights of the week was the Parliamentary appearance of the BoE Governor Andrew Bailey and colleagues Wednesday afternoon.

Wednesday’s testimony before the House of Commons Treasury Select Committee will explain BoE policy makers’ answer to questions about its February monetary policy report, recent inflation developments and interest rate expectations, which will be of great interest to the pound after the MPC came in. We came close to raising the bank rate by 0.50% to 0.75% this month before settling on a smaller increase to 0.50%.

“We continue to believe that the near-term strength of CPI inflation will convince the Bank of England Monetary Policy Committee to raise the bank rate to 0.75% in March and then to 1.00% in May,” said Samuel Tombs, chief UK economist at Pantheon Macro Economics. . One or two members may vote to raise rates by 50 basis points in March, but we think most of them would agree with Chief Economist Howe Bell, who brought up the issue in a speech last week for scaling.

According to the technical analysis of the pair: So far, the price of the GBP/USD currency pair shows resilience as investors seek to buy safe havens, but this resilience may not last long if military action takes place in Europe. The current selling operations may extend to the support levels 1.3545, 1.3480 and 1.3390, respectively. Pullbacks will remain an opportunity to buy the GBP/USD. On the other hand, according to the performance on the daily chart, the resistance level of 1.3720 is important for the bulls to take control again.

Source link