GBP/USD Technical Analysis: Anticipating an Important Week

The British pound settled above a key level against the US dollar after UK retail sales for January beat analysts’ expectations. The bulls strongly dominated the performance of the GBP/USD pair throughout the last week’s trading, with gains to the 1.3642 resistance level, its highest in three weeks. Before closing the week’s trading, it was stable around the level of 1.3592. According to official figures, UK retail sales increased 1.9% month-on-month in January, the Office for National Statistics said, topping the consensus forecast of 1.0% and surpassing the -4.0% reading in December.

Retail sales rose 9.1% year-over-year in January, beating expectations of 8.7% and December’s reading of -1.7%. Commenting on this and the reaction, Robert Howard, an analyst at Reuters, said: “Cable remained above $1.3600 after better-than-expected UK retail sales in January.”

Francesco Bisol, FX analyst at ING says: “As expected, UK retail sales rebounded strongly in January, as the recession caused by Omicron dissipated. This is another indication of how the UK economy has started the year with some good momentum, which is eventually keeping GBP/USD breaking above 1.3600 likely on the back of the recent positive data flow and strong expectations of a BoE rate hike. The Pound also appears to be relatively less exposed to negative swings in geopolitical sentiment than other European currencies.

It was the strongest monthly increase in retail sales since April 2021, when restrictions were lifted, following a decline in December that the Office for National Statistics said was due to earlier than usual Christmas trading. Retailers have also struggled amid a drop in retail footfall in December, due to concerns about the coronavirus Omicron variant. The rebound in activity in January comes as the British economy faces significant inflationary pressures, with the Office for National Statistics reporting the highest inflation reading in 30 years in January.

The Bank of England raised interest rates in February in an attempt to cool inflation expectations and financial market prices are showing that another rate hike is almost certain to come down in March. In fact, more than 125 basis points were priced in to raise prices in the UK for the remainder of 2022.

Susanna Streeter, senior investment and markets analyst at Hargreaves Lansdowne said, “The January sales rally shows that an increase in Omicron cases is underway, but retailers have not yet made up for all of December’s losses. And at some point shutdown savings, rapid price hikes on supermarket shelves and energy and gasoline bills, combined, with looming tax increases, will most likely dampen consumer spending.”

The prospect of a BoE rate hike has supported sterling over the course of 2022, but questions remain regarding the outlook. Economists expect higher inflation to weigh on consumer spending and sentiment over the coming months, creating headwinds for the economic recovery.

It remains to be seen if the British pound can outperform in a slowing economy with rising interest rates.

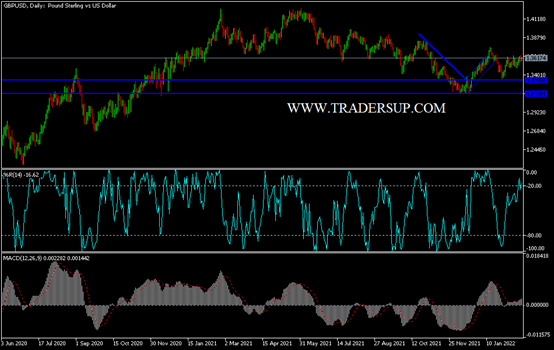

According to the technical analysis of the pair: The expectations of raising interest rates from the Bank of England and recently the announcement of a complete lifting of the epidemic restrictions still support the continuation of the gains of the GBP/USD currency pair. Stability above the resistance 1.3600 supports the bulls’ dominance for a while, and the most important levels for the bulls are currently 1.3660 and 1.3720 and 1.3800, respectively. On the other hand, attempts to retreat will remain an opportunity to buy the pair, and selling operations may not cross at any time the support levels 1.3520 and 1.3400, respectively. This week, the British pound will hear the inflation report from the Bank of England and there will be several occasions for the statements of the Governor of the Bank of England.

Source link