Even the Fed’s Lowball Inflation Measure Goes WOOSH: Fodder for 50-Basis-Point Rate Hike in March

The most reckless Fed ever is still just watching – and fueling – the consequences of 23 months of policy errors as the Inflation Monster gets bigger and bigger.

By Wolf Richter for WOLF STREET.

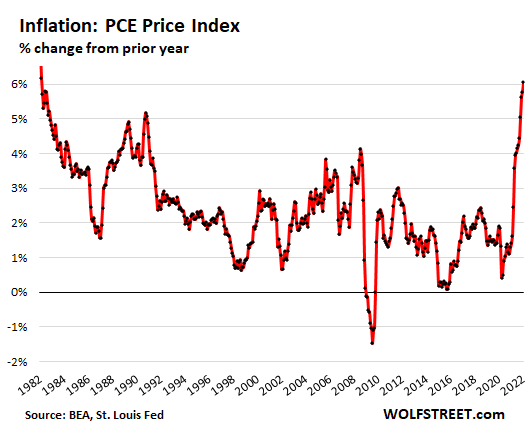

The Fed’s official yardstick for inflation, the “core PCE” price index, which excludes food and energy and is the lowest lowball inflation measure the US government produces and which understates actual inflation more than any other inflation measure, spiked by another 0.5% in January from December, and by 5.2% year-over-year, the worst inflation spike since April 1983, according to the Bureau of Economic Analysis today.

The Fed’s official and inexplicable inflation target is 2%, as measured by this lowest lowball inflation measure. And now even this lowball measure is 2.6 times the Fed’s target:

But back in 1982 and 1983, inflation was on the way down; now inflation is spiking to high heaven. Back in 1982 and 1983, the Fed’s policy rates were over 10%; now they’re near 0%.

Several Fed governors have put a 50-basis-point rate hike on the table for the March meeting. Yesterday it was Federal Reserve Board Governor Christopher Waller who said that “a strong case can be made for a 50-basis-point hike in March” if we get hot readings for today’s core PCE index, and the jobs report and CPI in early March. The first of the three conditions has now been met with panache.

“In this state of the world, front-loading a 50-point hike would help convey the Committee’s determination to address high inflation, about which there should be no question,” he said in his speech.

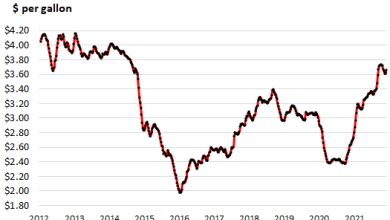

The overall PCE price index, which includes food and energy, spiked by 0.6% in January from December, and by 6.1% year-over-year, the worst reading since February 1982.

Here is Fed chair Jerome Powell’s reaction after he saw today’s data, documenting the consequences of his reckless monetary policies, as imagined by cartoonist Marco Ricolli for WOLF STREET:

This not-so-mind-boggling inflation monster was created by $4.8 trillion in money-printing in 23 months — I mean, duh! — which continues though at a slower pace and is slated to end in early March, and by the most insane interest-rate repression ever in face of spiking inflation, which is slated to be softened somewhat – too little, too late – on March 16 with the liftoff rate hike.

The Fed, the most reckless Fed ever, has brushed off this surging inflation for over a year, and has continued to print money and repress short-term interest rates to zero for over a year despite this surging inflation, with the goal to pump up asset prices further to make the already wealthy that hold these assets even wealthier. And now people who are working for a living are paying the price as the purchasing power of their labor plunges.

In the process, the Fed has created the biggest wealth disparity ever in the shortest amount of time ever, based on the Fed’s own wealth distribution data that I’m now tracking with my “Wealth Effect Monitor” & “Wealth Disparity Monitor” for the Fed’s Money-Printer Economy:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Source link