Euro at Risk if ECB, Fed Policy Speculation Overshadows Ukraine Crisis

EURO, RUSSIA, UKRAINE, ECB, FED, INFLATION, EUR/USD OUTLOOK – TALKING POINTS:

- Euro steady in familiar range as markets weigh ongoing Ukraine crisis threat

- Fed vs. ECB policy outlook might retake center stage, weighing on EUR/USD

- Pivotal support eyed below 1.12 figure, dense resistance runs up into 1.1552

The Euro still looks unimpressed even as Western powers deliver the first round of collective sanctions punishing Russia for recognizing the independence of two breakaway regions in eastern Ukraine and dispatching troops to enforce it. Tellingly, a Bloomberg index tracking energy commodity prices has likewise stalled.

This seems to imply that markets do not envision severe Westward contagion from the instability at the Russia/Ukraine border. This may be as traders liken this episode to the 2008 Russo-Georgian War. If the parallel holds, setting Donetsk and Luhansk as pliant buffer zones may be the extent of Moscow’s ambition.

From investors’ perspective, such a scenario may imply a significant downshift in the risk that the situation poses for the global economy and the broader financial markets, at least for now. With that in mind, the Euro might switch gears to focus on inflation and the evolving monetary policy landscape once again.

EURO AT RISK IF ECB, FED POLICY BETS RETAKE CENTER STAGE

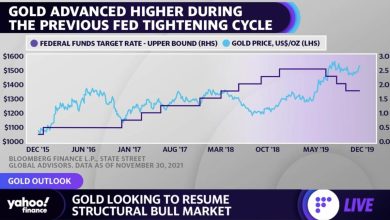

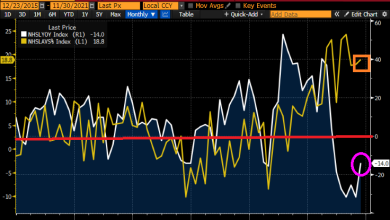

That seems to put the single currency at a disadvantage against the Greenback. The markets seem to expect the Fed to transition to a meaningfully tighter policy stance over the medium term than that of the ECB. Five-year real interest rates in the US enjoy the highest premium in two years over German equivalents.

The near-term perspective seems similarly USD-supportive. At its rosiest setting before the Ukraine crisis, the priced-in 2022 ECB policy outlook implied about 50 basis points in hikes, bringing the target Deposit Rate back to zero from -0.50% currently. The Fed Funds rate is seen rising by 150bps into positive territory.

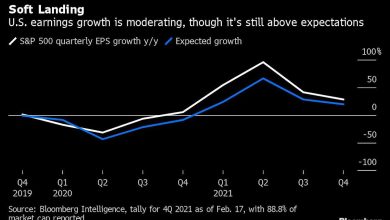

The next major inflection point in this narrative is likely to be Friday’s release of US PCE data, the Fed’s favored inflation gauge. It is expected to show that core price growth accelerated to a 40-year high of 5.2 percent on-year. By contrast, today’s revised Eurozone CPI print is expected to put core inflation at 2.3 percent.

If the Ukraine narrative moderates, such outcomes may encourage EUR/USD lower ahead of the back-to-back ECB and Fed policy announcements in mid-March. Pushing through immediate support levels at 1.1272 and 1.1222 may set the stage for a retest of former resistance from March 2020, anchored at 1.1140.

Immediate topside barriers come in at 1.1414 and 1.1495. Making a move through these and securing a foothold back above the recently broken support shelf capped at 1.1552 – with confirmation on a daily closing basis – seems like a pre-requisite for lasting upside follow-through however.

EUR/USD daily chart created withTradingView

EUR/USD TRADING RESOURCES

— Written by Ilya Spivak, Head of Greater Asia at DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link