EUR/USD Technical Analysis: Russian Tensions Affect Euro

The EUR/USD exchange rate suffered a major setback last week. Although it may try to stabilize above the 1.13 level in the coming days, there are several risks that are likely to limit the scope of its recovery in the short term. With the beginning of this week’s trading, it fell to the support level of 1.1280 before settling around the level of 1.1315 at the time of writing the analysis, waiting for anything new. The Euro incurred some of the steepest losses ever in the G10 currencies ahead of the weekend when early declines in the euro-dollar rate appeared to have been exacerbated late Friday. The Russian military incursion into Ukraine in 2014 will start from the middle of this week.

In short, markets are waking up late to the geopolitical risks posed by Russian military action against Ukraine. We now have an alleged potential start date, with all the usual caveats – Wednesday, February 16. Russia continues to loudly deny that it has such intentions, and correctly points out that the United States is not a good party when it comes to the causes of war. Then again, Moscow has just refused to comply with an official request by the Organization for Security and Cooperation in Europe (OSCE) to explain transparently what its military is doing across Ukraine’s borders.

White House officials have since admitted that the attack on Ukraine isn’t actually certain, but the alleged threat from one of them helped lift the dollar’s value and appears to be weighing heavily on the euro in particular during the final hours of trading on Friday.

This may be due to some eurozone countries sharing their borders with Ukraine or Russia-allied Belarus, although geopolitics has not affected the euro only in recent days as it has in the policy of the Federal Reserve (Fed) and the European Central Bank (ECB). This was also stressful for the currency pair.

The euro’s recovery against the dollar was reversed in early February late Thursday and throughout Friday trading after St. Louis Fed President James Bullard suggested that the FOMC should consider raising US interest rates by 50 more than usual.

However, last Friday’s declines may be a result of a comment from the European Central Bank’s chief economist Philip Lane who reiterated in Friday’s blog that eurozone inflation is likely to fall toward the bank’s identical 2 percent target this year even without any increase. Interest rates, which may have disappointed some parts of the market given the excitement generated by the European Central Bank’s policy decision in February.

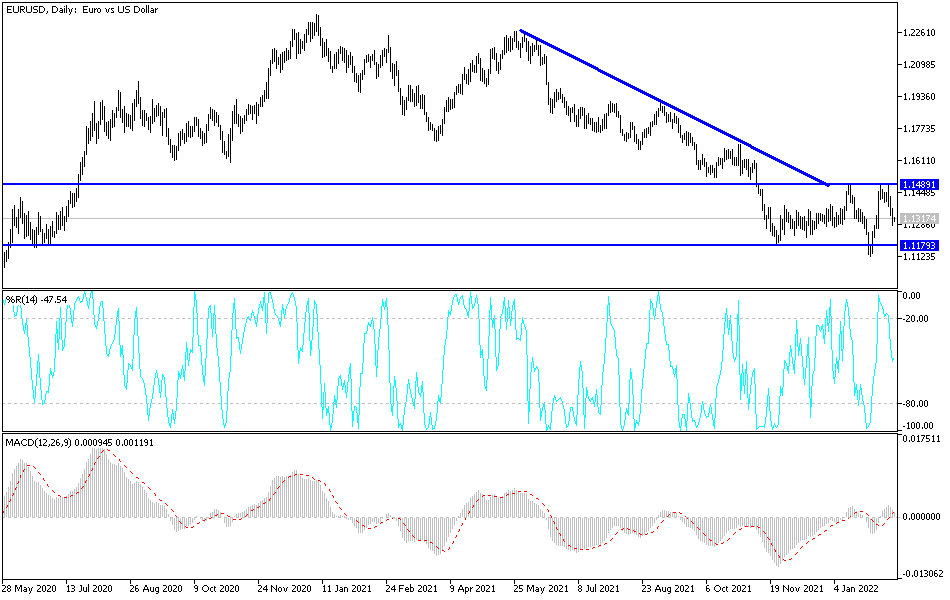

According to the technical analysis of the pair: in the current situation, the performance of the EUR/USD pair will focus on geopolitical tensions more than on the economic performance. On the upside, the resistance levels 1.1485 & 1.1565 will remain important for the bulls to return to control.

The currency pair will be affected today by the extent to which investors take risks or not, as well as the reaction from the announcement of the German ZEW index and the US PPI.

Source link