EUR/USD Technical Analysis: Russian Invasion Increases Loss

Expanding the scope of Russian military operations means that the invasion of Ukraine is very likely, and thus the suffering of the euro has increased in the Forex market. The price of the currency pair EUR/USD is stabilizing towards the 1.1208 support level before settling around the 1.1244 level at the time of writing the analysis. Investors and markets are focusing primarily on geopolitical updates rather than the reaction to economic data results. Currently, the headlines are filled with developments related to the Russian-Ukrainian conflict, in particular the possibility of further attacks between the two countries.

Russian President Putin has acknowledged Moscow’s pro-Moscow stance for the breakaway regions, sending more soldiers or “peacekeepers” to the border earlier this week. Germany has already imposed some sanctions on the country while the United States is preparing to announce more.

The main concern now appears to be a looming energy crisis, as Russia is a major supplier of natural gas to Western Europe and crude oil to the rest of the world. Attacks could disrupt production while sanctions could also restrict global supply, which could limit the flow of goods around the world and lead to stronger inflation.

And reacted with anxiety. The decline of the Russian ruble extended to its lowest level since 2016 after Russian President Vladimir Putin said he had ordered a “special military operation” to protect residents of the breakaway region of Donbas. The Russian currency fell about 3.5% to 84.1 per dollar in internal trading Thursday, according to data compiled by Bloomberg. US President Joe Biden called the move an “unprovoked attack by Russian military forces” and vowed more US action.

Commenting on this, Jeffrey Haley, chief market analyst at Oanda, wrote in a note Thursday: “Markets are setting prices for an impending invasion and an end to spoilage/disinformation and false flags, and I can’t disagree.” The internal moves reversed previous declines in the Russian currency abroad, where the ruble fell more than 4%. As such, it is the worst performing emerging market currency in February so far after the escalation in geopolitical tensions in Ukraine.

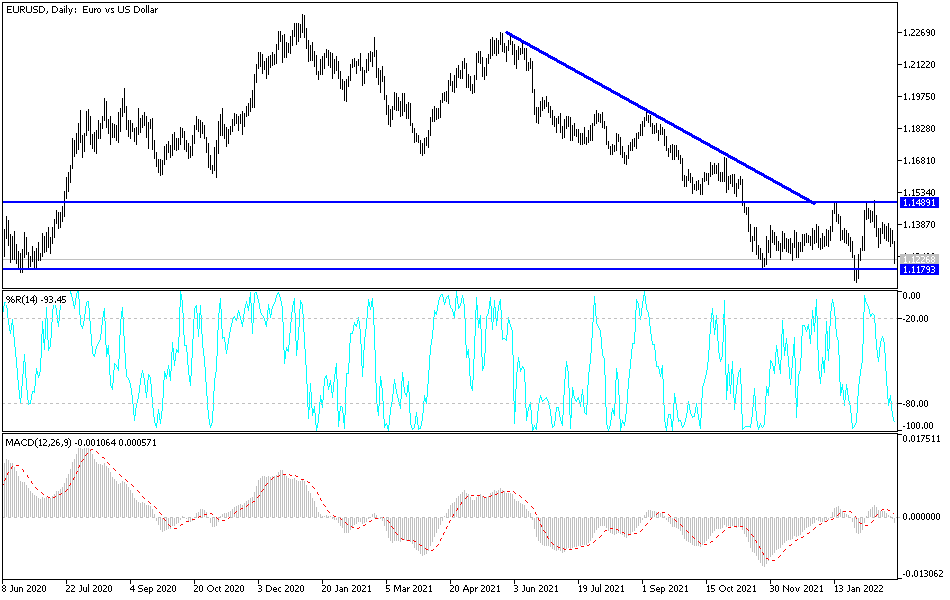

According to the pair’s technical analysis: The price of the EUR/USD currency pair formed lower highs and found support around the 1.1300 mark, creating a descending triangle on its hourly time frame. The price is testing support and it may be due to fall back to the ground. So far the 100 SMA is still below the 200 SMA to confirm that the general trend is still bearish and that the top of the triangle is more likely to keep gains in control rather than break them. These moving averages also line up with the resistance of the triangle to add to their strength as a ceiling.

The Stochastic is pointing down to confirm the bearish pressure effect. The RSI is also moving lower, without even reaching overbought territory, indicating that sellers are eager to take over. Stronger selling pressure may trigger a break below triangle support and sell offs as high as the chart pattern or 100 pips. The most prominent drop stations for the EUR/USD pair are now 1.1180, then the psychological support 1.1000.

Source link