EUR/USD Technical Analysis: New Attempts to Rise

Today’s trading started off positive for EUR/USD as the pair jumped to the resistance level of 1.1247. It is bouncing back from the 1.1122 support level that it recorded last week, its lowest since July 2020 due to the strong expectations of the future of tightening the Fed’s policy. The pair gains amid profit-taking after the dollar’s recent strong gains, and the euro itself will be on high alert with the European Central Bank announcing the update of its monetary policy.

Despite this performance there are expectations that the EUR/USD will fall over the coming weeks, according to a group of analysts who are citing the latest policy update from the Federal Reserve (Fed) to target a key support level located around 1.1002. So says Valentin Marinov, FX analyst at Credit Agricole CIB, who described the single currency as an “attractive sell-off” and “while the FOMC is in a hurry to move forward on the curve, the board appears comfortable to stay.” behind the curve. As a result, the EUR/USD spread fell to new lows after the January Fed meeting and before the European Central Bank meeting this week.”

While the Fed’s official statement only indicated that a hike in US interest rates may be necessary soon, Chairman Jerome Powell strongly suggested at his subsequent press conference that a hike could be announced at the next meeting in March. Fed Governor Powell also provided a strong indication that US interest rates could rise further after that, and faster than in the following period of December 2015, which was when the bank first raised rates in the previous monetary tightening cycle.

The Fed had waited a full year after December 2015 before raising the interest rate for a second, and since then proceeded to raise rates roughly once a quarter until the top of the US federal funds rate target range reached 2.5% in December 2018.

With the economy and labor market stronger than they were in 2015 – and US inflation at 7% as of December 2021 – Governor Powell seems to have indicated that the Fed could raise interest rates every quarter and said nothing to rule it out.

Until the Fed decides how to start this, the flexibility of the US dollar remains in place, says Mazen Issa, senior FX analyst at TD Securities. “We believe EURUSD will trade in a 1.10/12 trading range for the time being (in line with our expectations). We see the risk of a slide below this range as the real interest rate hike led by the US remains intact. The euro’s downtrend is fading, but that could come as early as the middle of the year.”

Swap market rates had already signaled prior to the bank’s latest indication that investors were expecting the Fed to raise US interest rates three times in 2022, although the implied probability of four rate steps has since risen to more than 100% while the dollar rose almost all over the world.

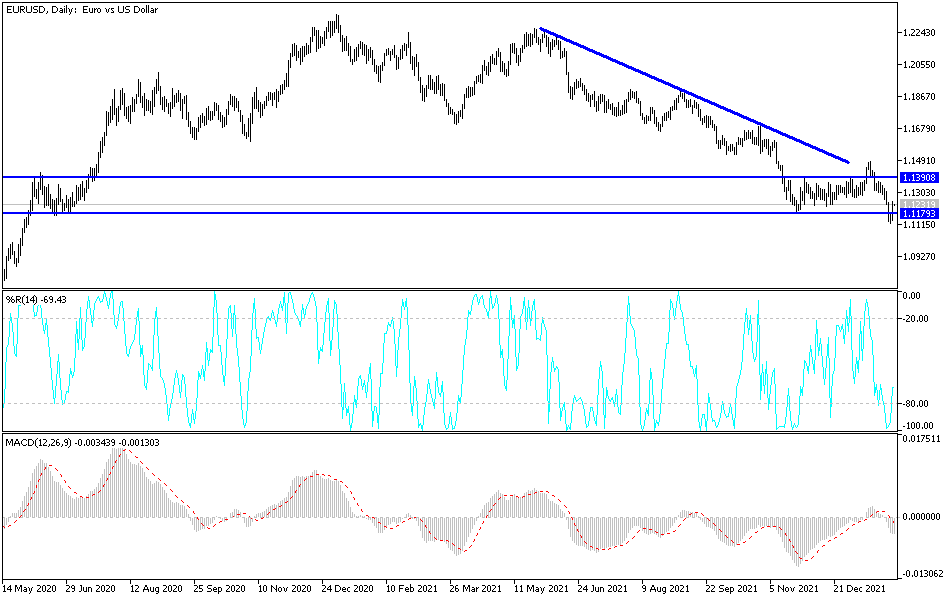

According to the technical analysis of the pair: Despite the recent rebound attempts, the price of the EUR/USD currency pair is still moving strongly within a bearish channel. It is stable below the 1.13000 support, according to the performance on the daily chart below motivating the bears to launch further downwards. As I mentioned before, the pair’s move towards the support 1.1085 will support expectations towards the psychological support 1.1000. No real reversal of the bearish trend will occur without breaching the resistance levels 1.1485 and 1.1660 over the same time.

The Euro will be affected today by the announcement of the manufacturing PMI readings for the Eurozone economies. The US dollar will be affected by the announcement of the ISM manufacturing PMI reading and the number of job opportunities available.

Source link