EUR/USD Technical Analysis: Bullish Attempts are Weak

The relative calm of fears of Russia’s invasion of Ukraine contributed to the recovery of the price of the EUR/USD to the resistance level 1.1395. The gains stopped and returned to the 1.1322 support today, Thursday, amid assurances from the US Federal Reserve that it will accelerate the pace of raising US interest rates if inflation continues. The US is in record highs, around its highest in 40 years.

ECB Executive Board member Isabelle Schnabel stated, “Recent data from the eurozone shows that the risk of responding too late to the fastest inflation in the history of the currency bloc has risen. Speaking in an interview with the Financial Times, Schnabel listed three recent changes in the economic outlook – the Covid wave. -19 is less severe than the omicron variant, strong labor market and robust producer price growth likely to be felt by lag.

“All of this indicates that inflation is becoming increasingly likely to stabilize around our 2% target over the medium term,” Schnabel added. And “that means we have to start thinking about the gradual normalization of our politics.” While the European Central Bank charted its exit from pandemic stimulus in December, successive bullish inflation surprises in recent months have pushed the headline figure above 5%. Bank Governor Christine Lagarde took a noticeably hawkish tone when policy makers last met this month.

That has prompted investors and economists to expect a rate hike – the first in more than a decade – early this year, with some European Central Bank officials publicly supporting such a move. Other policy makers are warning that a Bank of England and Federal Reserve tightening monetary policy more quickly would risk derailing the region’s economic recovery. Schnabel pointed to the eurozone’s record low unemployment rate and indications from companies struggling to fill job vacancies, saying it now appears “increasingly unlikely” that inflation will fall below 2% by the end of the year, as previously forecast.

“The risk of acting too late has increased, and therefore we need a careful reassessment of inflation expectations,” she said.

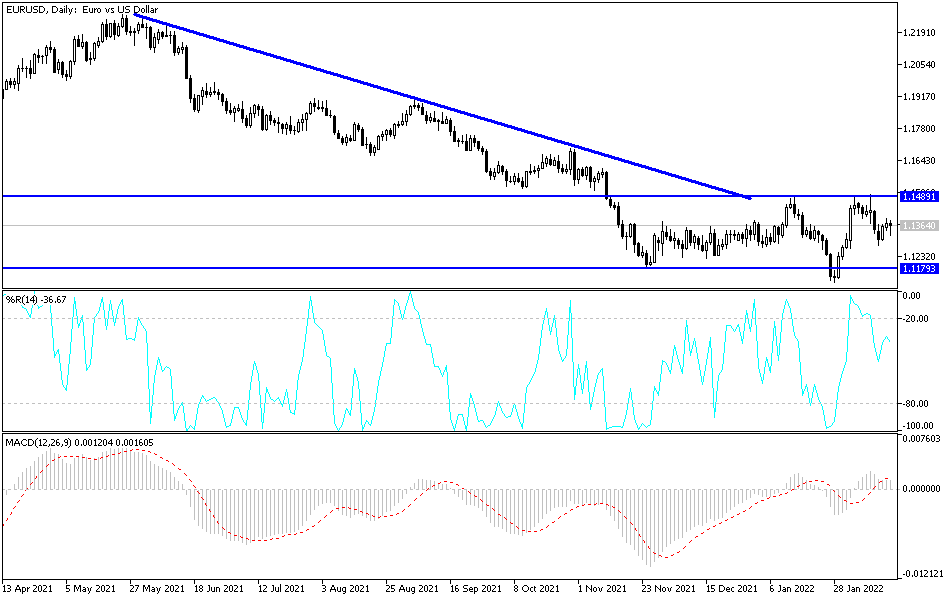

According to the technical analysis of the pair: According to the performance on the daily chart, the attempts to rebound upwards for the EUR/USD currency pair are still weak. The bulls will not succeed in controlling the performance without breaching the resistance levels 1.1485 and 1.1565. The bears can control the stronger, as long as the closest psychological support 1.1300, which adds to the disappointment of the euro’s recovery. As I mentioned before, the divergence in economic performance and the future of monetary policy tightening will ultimately remain in favor of the strength of the US dollar.

In addition to this, the continuing concern about a Russian invasion of Ukraine, may increase the suffering of the recovery of the eurozone economy if it occurs. Today, the focus will be on the announcement of the US housing market figures, along with the weekly jobless claims and the reading of the Philadelphia Industrial Index.

Source link