EUR/USD Technical Analysis: Beware of Profit Taking

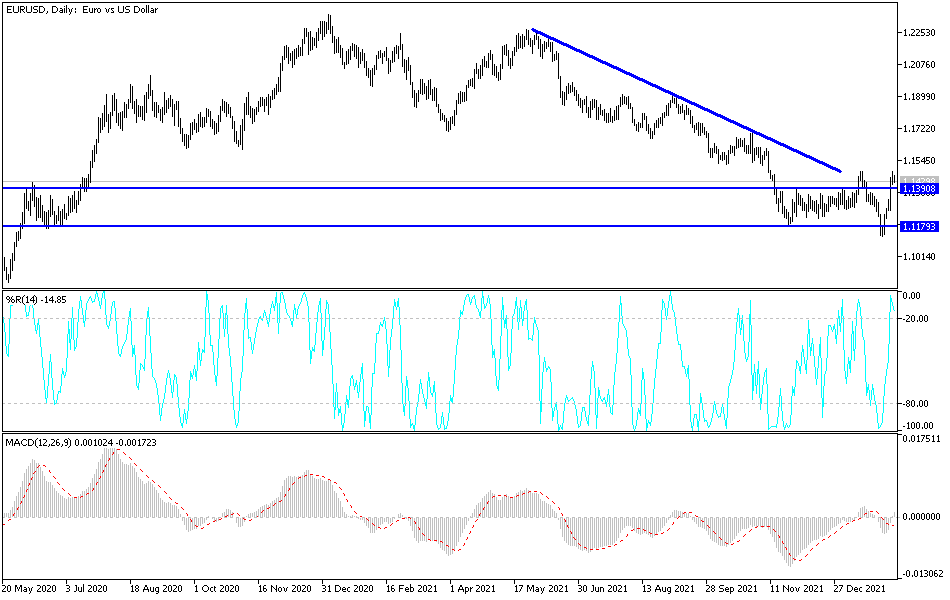

EUR/USD was on track for a fifth straight gain in the last session of last week’s trading and could now have room to reach three-month highs around the 1.15 resistance. According to some strategists, who also see the Euro, would find support around the 1.13 level in the short term. The gains of the euro-dollar last week reached the resistance 1.1483 and closed trading stable around the 1.1450 level.

Ahead of those gains, the euro-dollar moved towards its lowest levels towards the 1.1121 support. Its strong sudden gains came after the European Central Bank warned of the situation of increasing uncertainty and upside risks to inflation expectations. Thursday’s comments from European Central Bank Governor Christine Lagarde seem to have been taken by the market as a prelude to a possible shift in the ECB’s policy stance, which has put pressure on investors and traders who have been betting against the single European currency and made the market look forward to a policy decision in March.

Many analysts are of the view that the EUR/USD rate is now likely to establish itself in an approximate range of 1.13 to 1.15 as market attention turns to the policy decision in March in which the European Central Bank is expected to announce its next three-year set.

This will be crucial to market participants’ attempts to deduce the ECB’s monetary policy outlook as the ECB’s strategy specifies that its forecasts will need to envisage inflation at or above the symmetric 2% target either in the middle or at the end of the forecast horizon. Before the board of directors could consider raising the bank’s interest rates.

Such forecasts, if made in March or any time thereafter, would suggest that more immediate actions are in the pipeline as they require a swift end to the ECB’s asset purchase program. This is the original quantitative easing program for government bond purchases that was first announced in January 2015 and that the European Central Bank announced in December a temporary increase in the volume of its monthly purchases to run between March 2022 and October 2022.

As a result, the European Central Bank is likely to raise its inflation forecast significantly when updating its forecasts due in March. The Commerzbank team announced a change in their eurozone interest rate expectations on Friday, and they now envisage announcing two 0.25% increases this year, which would bring the ECB’s negative deposit rate of 0.50% back to zero.

According to the technical analysis of the pair: The gains of the currency pair EUR/USD this week are enough to change the general trend of the pair to the upside. It has breached important levels to form the bullish channel that was formed recently on the daily chart. Its recent gains are pending the announcement of US inflation figures later this week, bearing in mind that the pair may be exposed to profit-taking operations, especially if investors return to balance the discrepancy between economic performance and the future of monetary policy tightening between the eurozone and the United States.

On the downside, the support levels 1.1360 and 1.1280 are important for bears to control and end the current bullish outlook.

Source link