EUR/USD Technical Analysis: Bears in Control

During yesterday’s trading, the price of the EUR/USD currency pair attempted to recover, but the gains did not exceed the 1.1367 resistance level. Then it settled around the 1.1330 level at the time of writing the analysis. A recovery from the 1.1288 support level was recorded at the beginning of the trading session. Euro exchange rates and stock markets recovered yesterday, but volatile market conditions seem warranted amid chronic uncertainty over Russia’s next moves in Ukraine.

The euro and global stocks had fallen sharply before then after the overnight news that Russia would send troops into the disputed areas of eastern Ukraine, but the recovery took shape as investors bet that the worst may now be over. Global stock markets turned a deep negative start to the upside sharply while the Ukraine-influenced euro reversed losses against the dollar, the British pound and a host of other currencies.

According to analysts, the market reaction indicates that there is limited fear of contagion to Eastern Europe in general, and global risk assets of course do not like current developments, but are likely to ignore them unless there is an all-out war. The focus today should be on how various Western capitals respond to Russia’s decision to recognize the breakaway regions of eastern Ukraine and Russian President Vladimir Putin’s assertion that he does not recognize the integrity of the Ukrainian state.

Ukraine’s ambassador to the UK, Vadim Prystaiko, told BBC Newsnight: “I’ve been listening to Putin for about an hour, a historic discussion with himself. And I must tell you that when a nuclear state describes your nation as a historical mistake that must be fixed, you have to worry about what he has in mind.”

The United Kingdom, the United States and the European Union are due to announce sanctions on Russia, but the media reports that the measures are likely to be limited as Western capitals maintain an arsenal of weapons in the event of an all-out war. The current market response to buying the euro and stocks suggests that investors are more optimistic about the outlook; Perhaps suggesting a view that Putin is doing so at the moment.

Kit Juckes, head of forex research at Société Générale says, “The main question now is how far President Putin wants to go to Ukraine. To the rebel-held areas of Donetsk and Luhansk, and to the wider Donetsk/Luhansk region, or even further?”. He added, “It is clear that bypassing the current conflict zone will lead to an escalation of the situation with the Russian forces clashing with the Ukrainian forces, but beyond the anger, sanctions and the potential humanitarian catastrophe, what are the repercussions that may ensue?” inquires.

According to the analyst, the euro’s recent recovery may not last because higher energy prices will eventually affect eurozone growth, more than anywhere else.

In the near term, the situation remains volatile, and it is almost impossible to predict Putin’s next moves. “If the Ukrainian crisis worsens, the euro will correct again,” says Asmara Jamalieh, an economist at Intesa Sanpaolo. Regarding the euro’s medium-term outlook, analysts note that there now appears to be a slim chance of a “hard turn from the European Central Bank”.

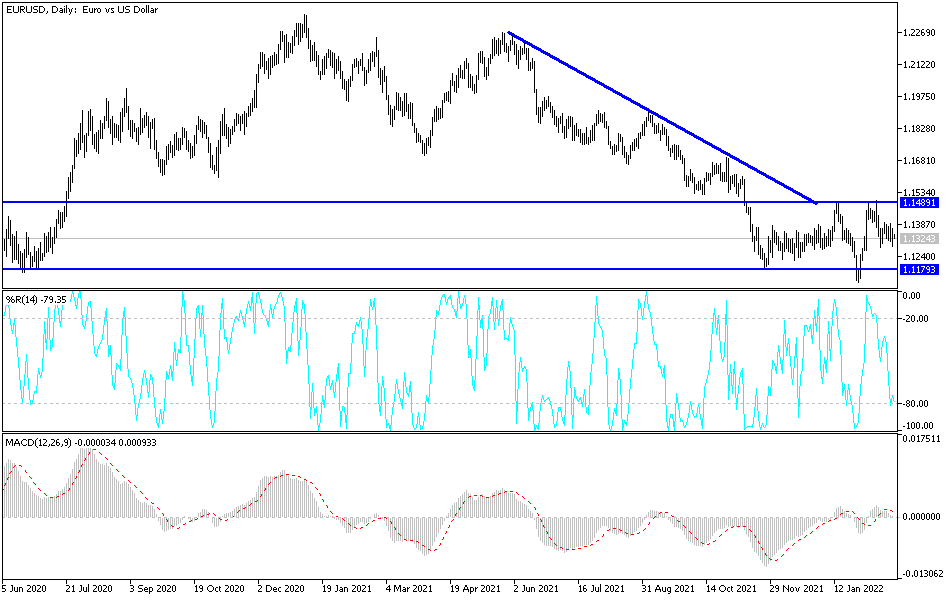

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD. The general trend is still bearish as long as the pair is close to the 1.1300 support and is ready to break below it. It may push the bears towards the support levels 1.1265 and 1.1180 and then to the psychological support 1.1000 and this could happen quickly in the event of a sudden Russian military move to invade. On the upside and according to the performance on the daily chart, the resistance levels 1.1490 and 1.1550 will remain important areas for the bulls to launch higher.

I still prefer to sell EURUSD from every bullish level. Today, the Eurozone consumer prices will be announced. There are no significant US economic data.

Source link