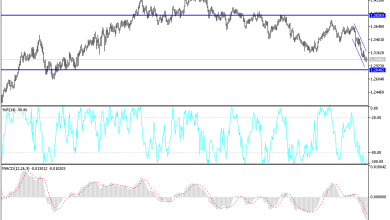

EUR/USD Forecast: Euro Reaches Slightly Higher

At the end of the day, interest rate differentials still favor the downside, so I still like the idea of fading rallies on signs of exhaustion.

The euro rallied just a bit on Wednesday to show signs of life again, but there is a significant amount of supply above that I think comes into the picture. This is especially true when we get above the 1.14 handle, as we had formed a nice double top just above recently.

Beyond all of that, you also have the interest rate differential that will continue to favor the Americans, as the Federal Reserve is almost certainly going to become much more aggressive than the European Central Bank will be anytime soon. Hot retail sales out of the United States caused a little bit of noise in the market during the day, as traders started to think about the idea of the Federal Reserve becoming even more aggressive. Whether or not that actually shows itself to be true is a completely different question, but at this point I think the Fed is likely to be the main driver of this pair.

There could be a little bit of euro buying during the session due to the fact that the Russians seemingly are willing to discuss the situation at the Ukrainian border. By avoiding conflict, that would be good for the European Union, so perhaps a little bit of money came back into the picture due to that. At the end of the day, interest rate differentials still favor the downside, so I still like the idea of fading rallies on signs of exhaustion. In the meantime, I think you will have to be somewhat cautious with your position size simply due to the fact that the markets are moving on the latest rumor or headline. In this type of situation, it is almost impossible to keep up with news reading algorithms.

Source link