EUR/GBP Weekly Outlook – Action Forex

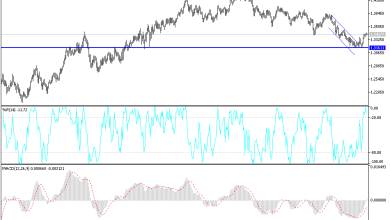

EUR/GBP’s fall from 0.8476 continued last week after brief recovery. Initial bias stays on the downside this week for retesting 0.8282 low. Sustained break of 0.8276 key long term support will carry larger bearish implication. On the upside, above 0.8401 minor resistance will turn bias back to the upside for 0.8476 resistance. Break there will resume the rebound from 0.8282.

In the bigger picture, price actions from 0.9499 (2020 high) are still seen a corrective pattern that should be contained by 0.8276 long term support (2019 low). Sustained trading above 38.2% retracement of 0.9499 to 0.8282 at 0.8747 will affirm this bullish case. However, sustained break of 0.8276 will argue that the long term trend has reversed. Deeper decline would be seen to 61.8% retracement of 0.6935 to 0.9499 at 0.7917.

In the long term picture, outlook will stay bullish as long as 0.8276 support holds. Break of 0.9499 is in favor at a later stage, to resume the up trend from 0.6935 (2015 low). However, sustained break of 0.8276 will indicate long term trend reversal, and target 61.8% retracement of 0.6935 to 0.9499 at 0.7917, and possibly below.

Source link