Dollar Finds Buyers Against Loonie

I think that we will eventually try to make a break higher to go looking towards the 1.28 handle.

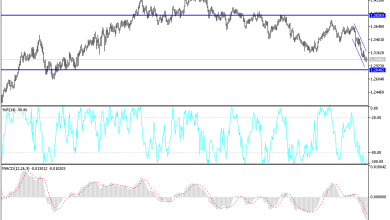

The US dollar fell initially during the trading session on Thursday to dip below the 50 day EMA. However, later in the day we started to see significant buying, and we have now parked at the 1.27 level yet again. This area is very familiar, as we continue to test it. That being said, there are a few things that happen during the trading session that could have a major influence on what happens here.

The CPI numbers came out hotter than anticipated, and therefore we initially started to see the US dollar strengthened against almost everything. This is because the yields in America started to spike, which has money flowing into the greenback. We have course all that here but then shortly later, the market has turned right back around to see the US dollar getting sold off. However, later in the day St. Louis Federal Reserve Gov. James Bullard stated that he wanted to see 50 basis points at the next Federal Reserve meeting, and he is a voting member. As a result, we started to see the US dollar strengthen again.

At this point, it looks as if the 50 day EMA is trying to offer a bit of support, and for my money I think that we will eventually try to make a break higher to go looking towards the 1.28 handle. Breaking above that level would be very bullish, perhaps opening up towards the 1.30 level above. All things been equal, this is a market that I think continues to see choppy behavior but that is not uncommon for this pair due to the fact that the two are so highly correlated with each other in the sense that they are each other’s biggest trading partner.

Speaking of trading partners, a lot of the commerce between the two countries is at a standstill currently, simply due to the truckers protesting. As this continues to unfold, that could have a detrimental effect on the Canadian economy, while causing a minor problem for the Americans. Quite frankly, although Canada has a very robust commodity-based economy, the reality is that the majority of the damage economically will be north of the border, as Canada has to import so many things from the United States. While this has not necessarily been factored in quite yet, this is a narrative that could grab the headlines.

Source link