Bond market signals fear Fed’s bid to calm inflation will backfire – Financial Times

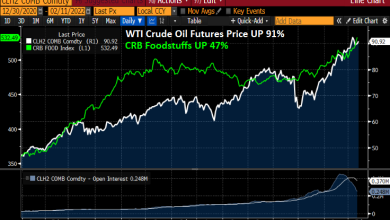

Bond markets are signaling growing concern that the US central bank will derail the post-pandemic recovery by overreacting to high inflation sweeping through the world’s largest economy.

Short-term U.S. government bonds have fallen sharply this year, in a selloff that accelerated after data released last week showed consumer prices jumped in January at the fastest clip in four decades . The fall in prices pushed the yield on two-year Treasury bills, which are highly sensitive to monetary policy expectations, up to 1.6% on Monday from 0.5% three months ago.

Yields on debt maturing in many years – generally a barometer of investors’ assessment of the prospects for economic growth – also rose, but to a lesser extent than those in the short term.

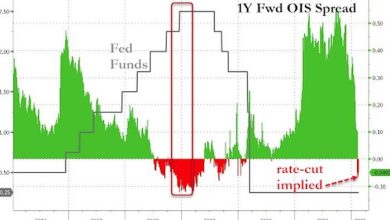

The result has been a dramatic “flattening” of the yield curve, as the gap between short and long-term yields is known to narrow. The move comes as traders now expect the Federal Reserve to raise interest rates by around seven-quarters of a percentage point this year in its bid to rein in inflation. However, the flattening of the curve indicates that investors expect this policy to backfire by slowing the economy too aggressively.

“The United States is now heading more definitely towards a late-cycle environment where Fed expectations are being reassessed for the ‘wrong’ reasons,” said George Saravelos, global head of currency research at Deutsche Bank. Supply constraints in the economy are fueling inflation, “forcing the central bank to slow growth”, he added.

The spread between two- and 10-year yields narrowed to 0.4 percentage points on Monday, its narrowest point on a closing basis since April 2020, after narrowing sharply following data on the US inflation last week. The difference between these two returns was about 1.2 percentage points a year ago.

Parts of the yield curve have even started to invert, which is usually a bad sign for investors’ economic outlook. For example, seven-year yields rose above 10-year yields on Monday. This highlights the difficult balance the Fed must strike between raising interest rates to control inflation, but not going so far as to impede economic recovery. A fuller inversion of the curve – such as 10-year yields falling below short-term interest rates – has been a reliable predictor of recession in the past.

“It’s a very difficult situation for the Fed,” said Edward Al-Hussainy, rates strategist at Columbia Threadneedle. “[They] may have to live with an inverted curve for some time to eliminate inflation risk.

Although a flattening of the yield curve is usually a sign of a slowing economy, there is no evidence of this yet. Earlier this month, the United States reported better-than-expected job growth in January and unexpectedly revised up employment numbers for December and November. And the US economy grew last year at the fastest annual rate since 1984.

Some investors say that even though the Fed – and other central banks – erred in being too tolerant of inflation, they risk making it worse by tightening too quickly while catching up. Markets are now pricing in a strong likelihood that the Fed will raise interest rates by an unusually high half a percentage point in March.

“We believe that a [0.5 percentage point] a hike could do more harm than good, as it could be seen by markets as a tacit admission of policy error, forcing policymakers to apply the brakes much more abruptly and increasing the risk of a recession in the quarters to come. said Mark Dowding, chief investment officer. Director at BlueBay Asset Management.

The current dilemma is not unique to the Fed. In the UK, where the Bank of England has already raised interest rates twice, the flattening of the yield curve has been even more dramatic. Traders expect six more BoE rate hikes this year, despite weaker growth prospects than in the US.

The spread between the two- and 10-year yields is just 0.09 percentage points, while the yield curve is inverted in several places. Three-year bond yields, at 1.48%, are higher than 50-year bond yields.

Ultimately, some analysts say, central bankers may have to choose between reining in inflation and keeping the recovery on track.

“If the Fed can fight inflation in the short term but it drags us into a recession, its credibility is maintained and the United States does not enter this stagflationary world,” said George Goncalves, chief strategy officer. US rates at MUFG.

“In this case, the prospects for real growth in the distant future should be better. That’s the most optimistic I can have at this point.

Source link